TC Energy Corporation (TSX: TRP) completed a spin-off of South Bow Corporation (TSX: SOBO) on the record date of October 1, 2024. TC Energy shareholders received 0.2 shares of South Bow for each shares of TC Energy held on the record date.

TC Energy published a Management Information Circular document highlighting the tax treatment of the transaction for Canadian shareholders. The details are provided on page 33:

In general, a Resident Shareholder who holds TC Energy shares, and any New TC Energy Common Shares and South Bow Common Shares received pursuant to the Arrangement, as capital property will not realize a capital gain or capital loss for purposes of the Tax Act as a

result of the transactions in the Arrangement. The aggregate adjusted cost base of the TC Energy shares for a Resident Shareholder will generally be allocated among the New TC Energy Common Shares and the South Bow Common Shares based upon the relative fair market values of such shares at the time of the Arrangement. Following the Effective Date, TC Energy and South Bow will advise shareholders, either by news release or on their websites, of their estimate of the appropriate proportionate allocation.

TC Energy has also published the following on their web site:

Resident shareholders should not realize a capital gain or capital loss as a result of the distribution. The adjusted cost base in TC Energy shares prior to the distribution is allocated based on the fair market values of TC Energy and South Bow immediately after the distribution. The allocation has been determined to be 91% to TC Energy common shares and 9% to South Bow common shares.

Canadian TC Energy shareholders will therefore not realize any immediate capital gain or loss as a result of the South Bow spin-off. Rather, 9% of the ACB of TC Energy shares immediately prior to the spin-off should be reallocated to the new South Bow shares received.

How was the 91% / 9% ratio calculated?

This ratio was likely calculated based on the closing market prices of TC Energy and South Bow on October 1, 2024. The closing price of TRP on October 1, 2024 was $59.49 and the closing price of SOBO on October 1, 2024 was $29.07. Since TRP shareholders were due to receive 0.2 shares of SOBO for each share of TRP owned, the total fair market value per share of TRP corresponds to: $59.49 + 0.2 x $29.07 = $65.30. The ratio allocated to the new SOBO shares could be calculated as: 0.2 x $29.07 / $65.30 = 8.9%.

Example

Let’s assume the following:

- A Canadian shareholder purchased 100 shares of TRP for $47.50 per shares with a commission of $10.00, settling on January 4, 2024.

- On October 1, 2024, the shareholder received 20 shares of SOBO (100 shares x 0.2) as a result of the spin-off.

- No other purchases or sales before the spin-off.

The ACB of the TRP shares following the purchase on January 4, 2024 can be calculated as follows:

Initial ACB of TRP shares = 100 shares x $47.50/share + $10.00 = $4,760.00 (or $47.60/share)

As a result of the spin-off, 9% of the ACB of the the TRP shares immediately prior to the spin-off should be allocated towards the newly acquired SOBO shares.

The ACB of the TRP shares therefore decreases by: $4,760.00 x 9% = $428.40.

ACB of TRP shares following the spinoff = $4,760.00 - ($4,760.00 x 9%) = $4,331.60 (or $43.32/share)

The initial ACB of the 20 newly acquired SOBO shares would be $428.40 in total (or $21.42/share).

Recording the Transaction on AdjustedCostBase.ca

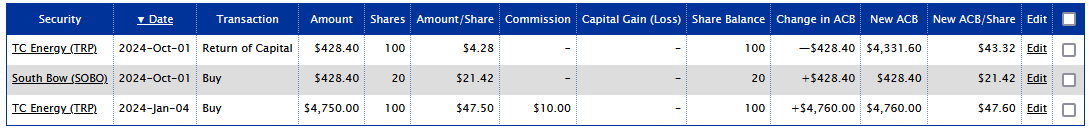

This example can be recorded on AdjustedCostBase.ca as follows:

- A “Buy” transaction on January 4, 2024 for 100 shares of TRP for an amount of $47.50/share and a commission of $10.00 (corresponding to the initial purchase).

- A “Return of Capital” transaction on October 1, 2024 for a total amount of $428.40.

- A “Buy” transaction on October 1, 2024 for SOBO for 20 shares for a total amount of $428.40 and a commission of $0.00.

This appears as follows on AdjustedCostBase.ca:

Cash In Lieu for Fractional Shares

If you received cash in lieu of fraction shares of South Bow, you may treat this as return of capital. The CRA‘s administrative practices allow you to reduce the ACB of the shares received by the cash received in lieu of fractional shares, provided that amount is less than $200.

In this case, the ACB of the TRP shares should be reduced by the full 9%. However, the cash amount should be deducted from the total purchase amount of the SOBO shares.

How is the CIL cash in $ cash in lieu calculated then?

what values or prices are you using to calculate the $CIL paid out

I am stuck on calculation…

Whitford,

The amount of cash received in lieu of fractional shares is not something you should need to calculate – just check your brokerage’s transactions history.

Thank you! This was very helpful.

I found this article on TC Energy/Southbow very helpful and clear. Could you do a similar article on the A&W Royalties Income Fund and the A&W Food Services merger in Oct. 2024?

Sally,

Thank you for the suggestion. Information on the tax treatment of the A&W Revenue Royalties Income Fund / A&W Food Services of Canada Inc. reorganization can be found here:

https://www.adjustedcostbase.ca/blog/taxation-of-the-aw-revenue-royalties-income-fund-aw-food-services-of-canada-inc-reorganization/

Hello,

I received a T5008 this tax year 2024 due to the South Bow Corp spinoff. I have to enter this into Turbotax, but I don’t know what to place in the selection box, “Type of income”…I must choose either “investment” or “capitol gain”. What is correct?

FYI, for this T5008, Box 17 , “Identification of Securities” the name given to insert is “South Bow Corp Temp”

Steve,

This choice is presented in an incredibly confusing way on TurboTax, but what they seem to be referring to is whether the gain should be reported on capital account or income account. For most investors, the gain or loss on the disposition of shares should be reported on capital account, corresponding to the “Capital gains” selection.

Please note, however, that it is best to calculate your capital gains yourself, rather than relying fully on T5008 slips. There are many reasons why the figures reported may be inaccurate:

https://www.adjustedcostbase.ca/blog/can-you-rely-on-your-brokerage-for-calculating-adjusted-cost-base-and-capital-gains/

In the case of the TC Energy / South Bow spin-off, there should be no resulting capital gain or loss, as described above. If the amount shown in box 21 (Proceeds of Settlement) is not equal to the amount shown in Box 20 (Cost of Book Value) – resulting in a non-zero capital gain or loss – then there is a good chance that the spin-off is being incorrectly reported on your T5008 slip.

Hi,

I received a T5008 from TC Energy and have a few questions. There is a value in box 21, but box 20 is empty. What do I enter there in my tax software? It won’t allow me to leave it empty. Is it my ACB? Same value as box 21 or zero?

Also, if we are not supposed to have any capital gains, why are they sending a tax form?

Thanks

Ben,

The proceeds of disposition amount reported in Box 21 on a T5008 slip can generally be relied upon (and yes, sometimes it may be reported in a foreign currency), and the slips can be useful for making sure you’ve accounted for all your dispositions. But the onus is on you to accurately calculate your ACB. There is no guarantee or expectation that the book value amount on a T5008 slip is accurate. There are many other reasons why the cost amount reported on a T5008 slip may be inaccurate:

https://www.adjustedcostbase.ca/blog/can-you-rely-on-your-brokerage-for-calculating-adjusted-cost-base-and-capital-gains/

In this instance, it seems that your brokerage has not accounted for the spin-off correctly. I would suggest that you not report the T5008 slip, as there should not be any deemed disposition in this case.

The “cost or book value” in Box 20 of a T5008 is not mandatory, and brokerages may choose to omit it. If you were to leave the amount in Box 20 blank when completing your tax return (in cases where tax software allows this) or set it to zero, you would end up overstating your capital gains.

Hi,

Thanks so much for the response.

I am worried that if I don’t report the T5008 that it may trigger an audit by CRA? My brokerage is Computershare. Wouldn’t they be the experts on this stuff?

I guess my options are to leave it at zero or calculate by ACB?

Ben,

There isn’t any expectation that the amount in Box 20 is accurate. The CRA web site states the following:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/tax-slips/understand-your-tax-slips/t5-slips/t5008-statement-securities-transactions-slip-information-individuals.html

“The amount in box 20 may or may not reflect your adjusted cost base (ACB) for the purpose of determining the gain or loss from the disposition of the security. You are required to make the adjustments, as needed, to the amount indicated in box 20, at the time of determining and reporting your gain or loss from the disposition.”

and brokerages often include similar disclaimers when reporting cost values. In general, it is not possible for a brokerage to accurately calculate ACB as they do not necessarily have have all the required information.

I would not suggest setting the cost value to zero as this will result in you reporting a non-existent capital gain and overpaying taxes. If anything, you could set the value in Box 20 to be equal to the value in Box 21, which would result in a capital gain of $0.

I too received a T5008 for this transaction from the transfer agent. Looking into it further, it is actually for the sale of fractional shares of South Bow Corp shares after they were allocated from holdings for TC Energy. Traditionally after a spin-off/merger, any fractional shares are automatically sold for you by the transfer agent and a cheque is issued.

In my mind, since it is an obvious sale/disposition, shouldn’t this be accounted for as a capital gain? The confusion is likely arising from the guidance that there are no capital gains/losses. This guidance is likely just for TC Energy, not for the sale of South Bow Corp fractional shares.

Note that the T5008 only includes the gross payment amount from the sale. On my cheque statement there is an additional amount taken off that was labeled as “Back-Up Withholding”.

I have decided to report this as a capital gain, with cost basis of $0, and added a foreign income tax credit (United States) of the amount specified as “Back-Up Withholding”. No conversion of this amount is needed since it is already in Canadian dollars.

ELiving,

You may choose to treat the cash received in lieu of fractional shares as either a disposition, or, as long as the cash received is less than $200, you may reduce the ACB of the shares received (South Bow in this case) by this same amount:

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/it115r2/archived-fractional-interest-shares.html

If you choose to report a capital gain or loss for the cash received in lieu of South Bow fractional shares, the ACB should be calculated as described above (not $0).

Good point, I’ve adjusted the ACB as of October 1, 2024 for both my TC Energy and South Bow Corp holdings accordingly (91% to TC Energy and 9% to South Bow).

I agree that it makes most sense to treat the CIL for the South Bow fractional shares as return of capital (ROC). However, it seems the U.S. IRS views this as a disposition(?) Like others responding above, I hold these shares with transfer agent Computershare and received a T5008 as others have described (box 20 blank, box 21 with a value, $26.55 in my case). But I also received a 1099 statement giving the exact amount of share fraction, date of disposition, amount in USD ($19.35) and stating that $4.65 USD was “Federal Tax Withheld”. Does that mean I can claim a foreign tax credit for this amount? Why doesn’t the T5008 show that foreign taxes were paid?