If you’re new to AdjustedCostBase.ca, this guide will help explain how to get started with step-by-step instructions. AdjustedCostBase.ca is a tool that allows Canadian investors to calculate adjusted cost base, a necessary step in determining capital gains. It’s designed to be easy to use and you can register for an account instantly and for free.

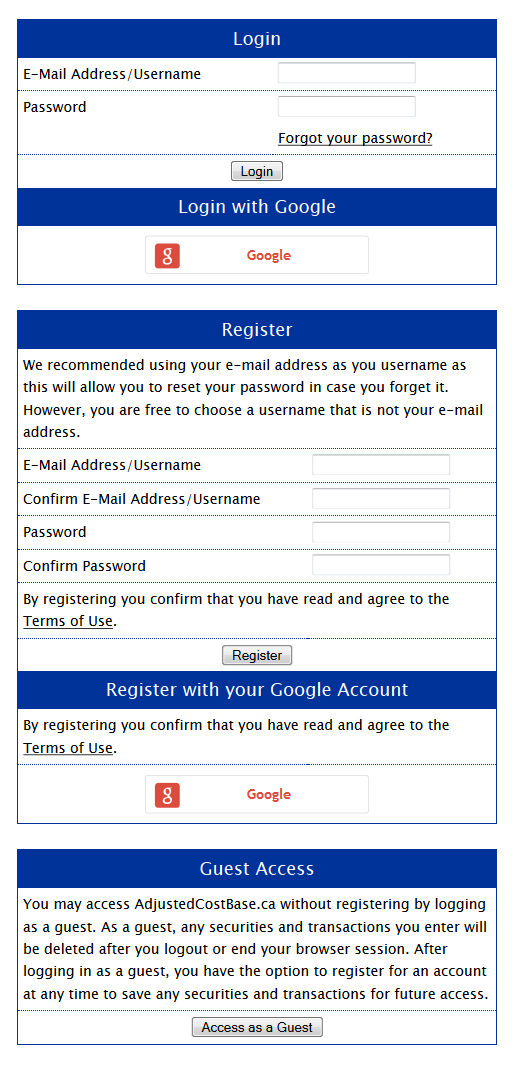

When you visit the AdjustedCostBase.ca home page you’ll see several different options for registration and logging in:

Standard Registration

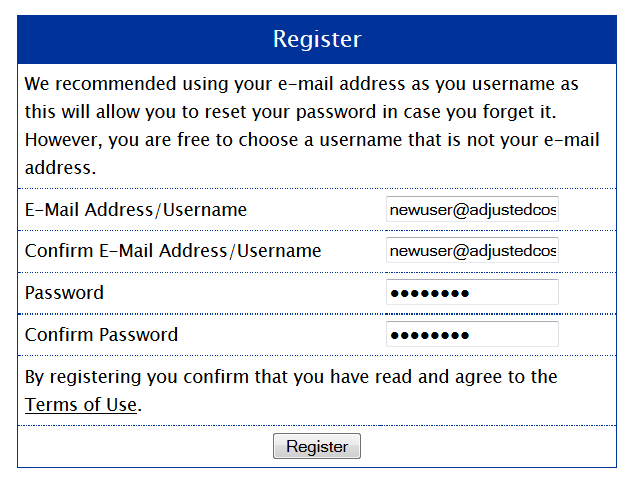

The standard registration option involves inputting an e-mail address/username and a password:

You’ll need to enter both your e-mail address/username and password twice for confirmation. Before registering, please be sure to read the terms of use.

You’re not required to enter any other personal information at all in order to register. In fact, you can choose a username that’s not your e-mail address. However, it’s strongly encouraged that you use your e-mail address as your username. Doing so will allow you to reset your password in case you forget it. If you select a username that’s not your e-mail address, unfortunately there won’t be any way to reset your password.

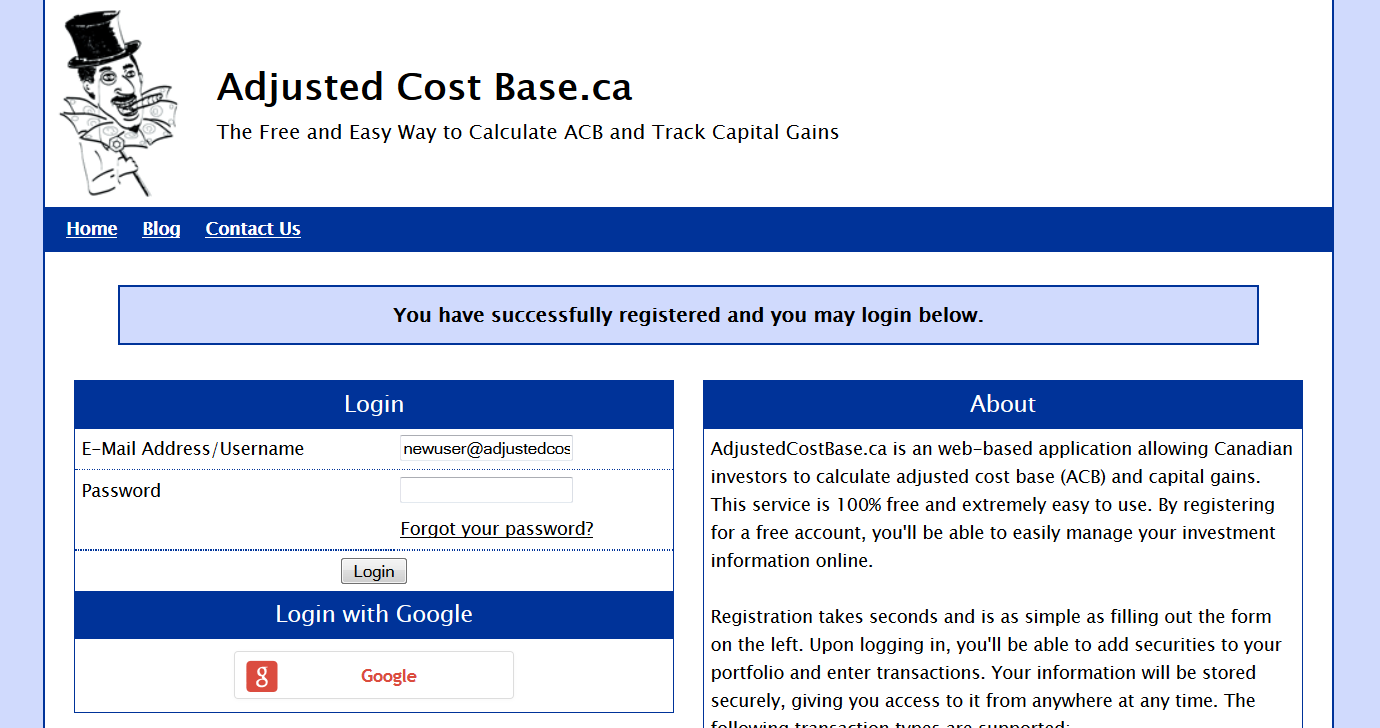

Hit the “Register” button to complete your registration. If all goes well you’ll be brought back to the AdjustedCostBase.ca home page and you’ll see a status message indicating that your registration was successful. If you registered using your e-mail address, you’ll also receive a confirmation e-mail.

Standard Login

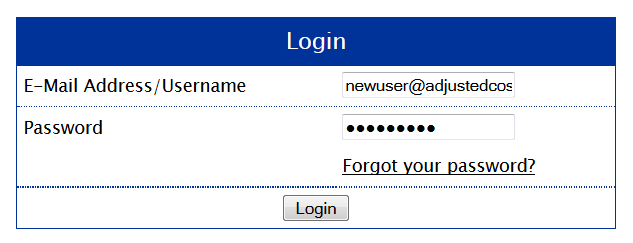

Once you’ve registered using the standard registration procedure described above you’ll be able to login using your username and password:

After logging in you’ll be brought to your account where you can start adding securities and transactions:

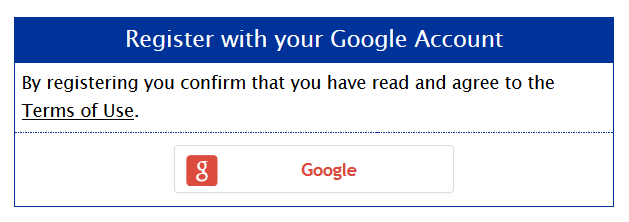

Registration with your Google Account

In addition to the standard registration process, AdjustedCostBase.ca also allows you to register using your Google account. The choice between the registrations options is yours, but registering using your Google account provides the following advantages:

- You won’t need to remember yet another username and password combination.

- Logging into AdjustedCostBase.ca will be a single-click process if you’re already logged into Google.

Ensure that you’ve read and agree to the AdjustedCostBase.ca terms of use before registering. To register using your Google account, simply click on the Google button under “Register with your Google Account”:

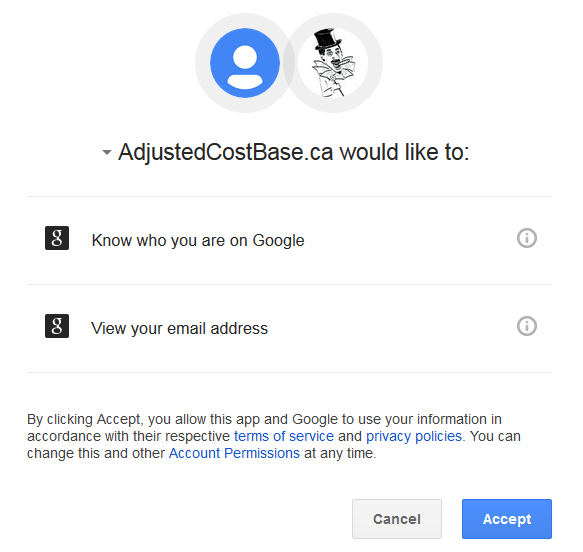

At this point you’ll be redirected to Google’s login server. You’ll be prompted to login to Google if you’re not already logged in. Next, Google will ask you whether you wish to grant access to AdjustedCostBase.ca to view your e-mail address:

Note that AdjustedCostBase.ca is requesting permission to view your e-mail address only. We will not be able to access any other pieces of information, nor will we be able to post anything to your account.

To complete the registration process, click on “Accept” and you’ll be redirected back to AdjustedCostBase.ca and a new AdjustedCostBase.ca account will be created for you.

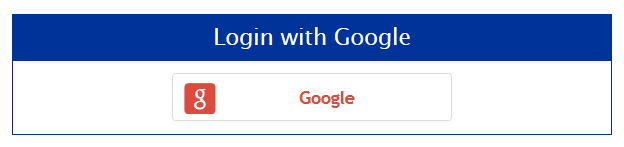

Logging In Using your Google Account

If you’ve registered on AdjustedCostBase.ca using your Google account you’ll be able to easily login using Google any time. To do so, simple click on the Google button under “Login with Google”:

If you’re already logged into Google, a single click of this button will redirect you to Google’s authentication server, redirect you back to AdjustedCostBase.ca and bring you directly into your AdjustedCostBase.ca account. If you aren’t already logged into Google you’ll be prompted to do so before being redirected back to your AdjustedCostBase.ca account.

Even if you’ve used the standard registration process to create an AdjustedCostBase.ca, you may still be able to login using your Google account, as long you’ve registered using your e-mail address and that e-mail address is associated with your Google account. Note, however, that you’ll need to grant permission for AdjustedCostBase.ca to view your e-mail address (as described above) during the first time you authenticate yourself through your Google account.

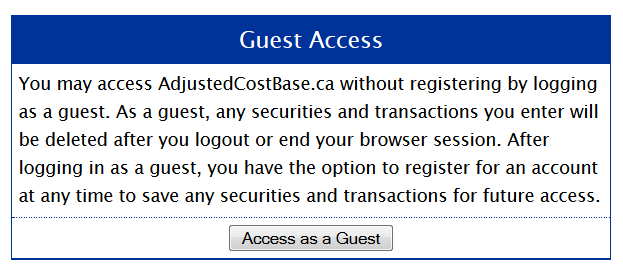

Guest Access

AdjustedCostBase.ca also allows you to access the service as a guest. This access method does not require you to register or enter any login credentials. But access to your guest account will only last the length of your browser session – any securities and transactions you entered will not be saved for future access. For more information please see the following:

Using a Guest Account on AdjustedCostBase.ca

Using AdjustedCostBase.ca – Adding Securities and Transactions

After you’ve successfully created your AdjustedCostBase.ca account, the next step is to add your securities and transactions. Your account will be initially empty, so you’ll need to add all the relevant information from your transaction records in order to calculate the adjusted cost base for the securities you own.

Before adding a transaction, you’ll need to first add a security (since each transaction must to associated with a security). To do so, select the “Add Security” link in the top menu:

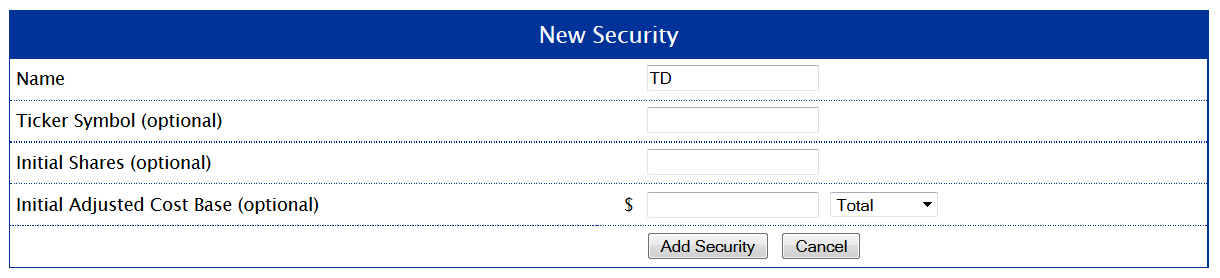

You’ll be brought to a form that allows you to add a new security. The only required field is the security’s name (e.g., “TD” in this example):

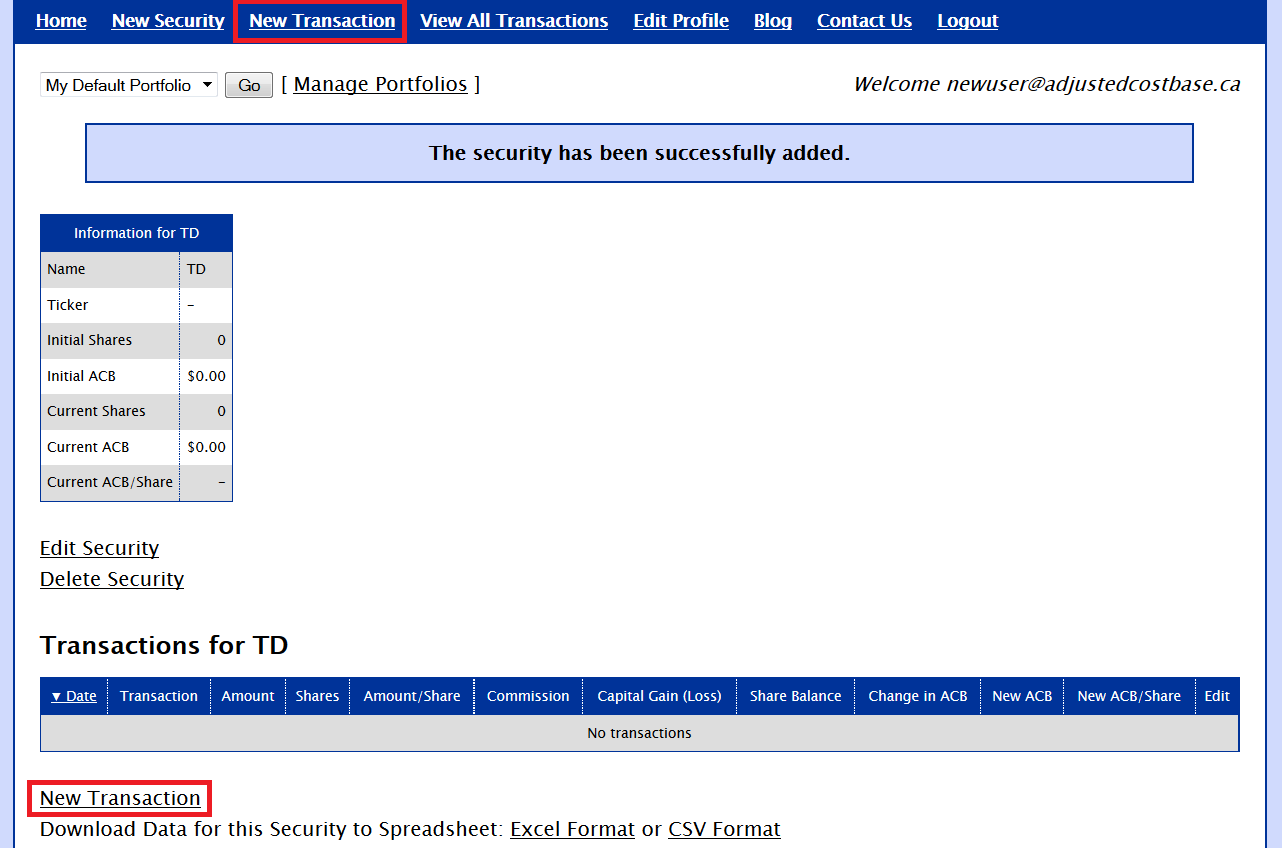

After hitting the “Add Security” button you’ll be brought the security’s page which will display all the information related to the security:

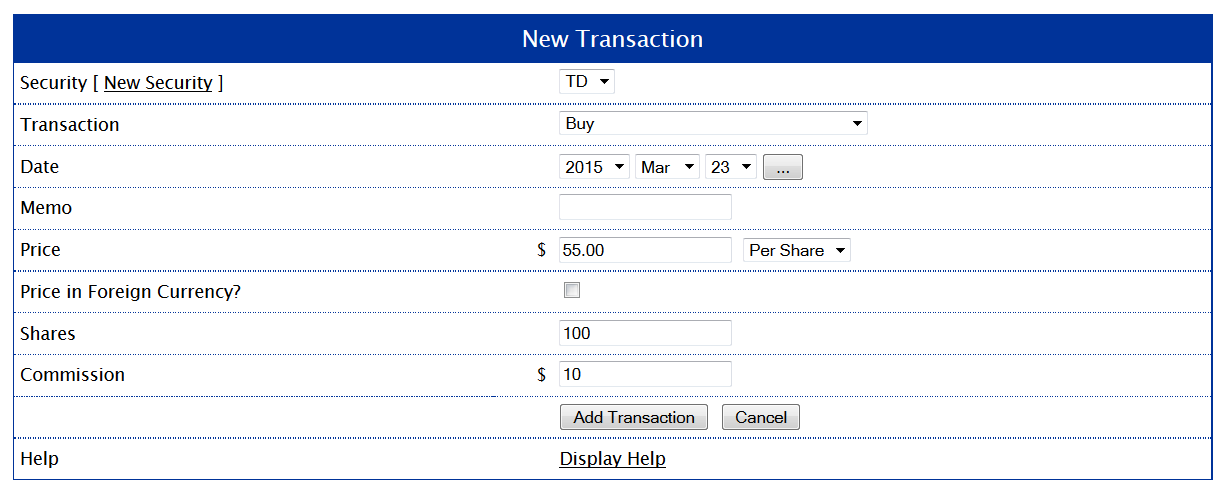

Now we can add the first transaction for this security. Select one of the “New Transaction” links (highlighted above) and you’ll be brought to a form allowing you to add a new transaction:

In the example above, we’ve entered the following details for the transaction for TD:

- Transaction Type: Buy

- Date: March 23, 2015

- Price: $55.00 per share

- Shares: 100

- Commission: $10.00

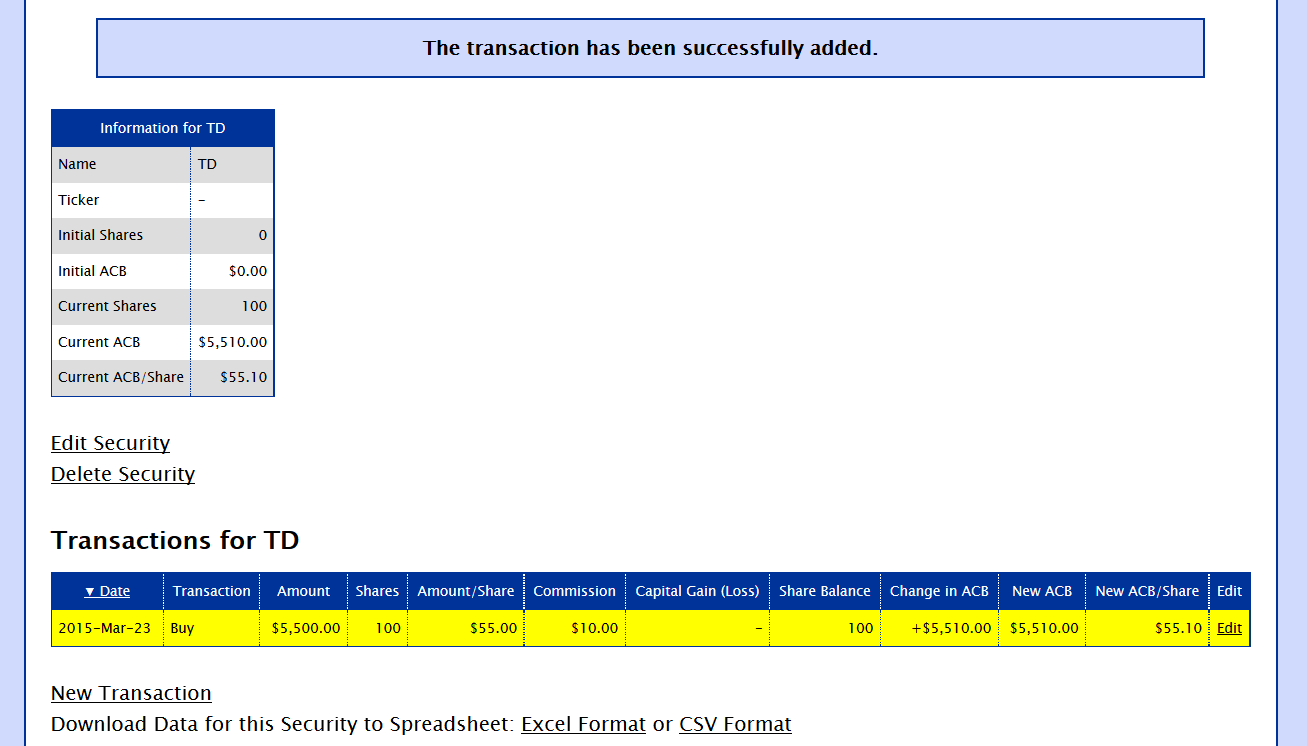

After hitting “Add Transaction” you’ll be brought back to the security’s page:

And now you’re on your way. You can now repeat the process to continue adding all your securities and transactions.

To learn more about calculating adjusted cost base and reporting capital gains you can check out the rest of this blog. Here are some good starting points:

- How to Calculate Adjusted Cost Base (ACB) and Capital Gains

- Return of Capital and How it Affects Adjusted Cost Base

- Calculating Adjusted Cost Base with Reinvested Distributions / Dividend Reinvestment Plans (DRIPs)

- Can You Rely on Your Brokerage for Calculating Adjusted Cost Base and Capital Gains?

- What Is the Superficial Loss Rule?

I am working in a new company and was given, 100 shares. In Feb, 15 was vested. I chose “Sell to cover” to pay taxes upfront and 6 were sold for taxes. That leaves me 9 shares.

In getting started here, should I add transaction as Buy 15, Sell 6? Should “Sell to cover” be added here (your drop down list doesn’t have it).

Or should my first transaction be just Buy 9?

Thank you.

Dennis

Hello;

I am new to ETFs and this whole Adjusted Cost Base thing is something I didn’t expect and is making me re-consider the whole couch-potato thing.

I am considering using your website to help with ACB calculations but I am concerned about security and I’d like to know how user names and passwords are stored, who has access to that information and what steps are being taken to thwart would-be hackers.

Al,

Connections to AdjustedCostBase.ca are always encrypted via SSL. Passwords are stored in a hashed and salted manner.

Also, aside from username/e-mail addresses and passwords, no further personal information is collected. The registration form you see on home page is complete – no further personal information is collected during the registration process.

You may also choose a username that’s not your e-mail address, however, you will not be able to recover your login credentials in that case if you ever forget them.

If you register using your Google account then no password related data will be stored on our server.

This year is the first year that I have had to calculate the ACB for tax purposes, so please forgive my unfamiliarity and lack of enlightenment concerning the process.

On your blog titled, “How to Calculate Adjusted Cost Base (ACB) and Capital Gains”, it states:

“These guide instructions assume you’re trading on capital account, not on income account.”

Not knowing the difference between trading on capital and income accounts, I am wondering if using your ACB program is the right approach? Online definitions of the two accounts have only confused me.

I have three investment account with a Broker, a Margin account and two registers accounts, a RIF and a TFSA. I have shares invested in all three account. My investments are in the following ETFs:

VAB – Vanguard Canadian Aggregate Bond Index ETF

VCN – Vanguard FTSE Canada All Cap Index ETF

VUN – Vanguard U. S. Total Market Index ETF

XEC – iShares MSCI Core Emerging Markets IMI

XEF – iShares Core MSCI EAFE IMI Index ETF

Question:

Can I use your program to calculate the ACB of my investment transactions?

Sincerely,

Ed Rasmussen

Ed,

Normally an individual’s investments would be considered to be on capital account. Income account would apply if your trading patterns resemble the operation of a business.

The rules for determining whether trading is on capital account or income account are somewhat subjective. But some of the conditions the CRA may use to determine that trading is on income account include the following:

– When the trading is characteristic of a professional trader

– Frequent trading or short holding periods

– Extensive knowledge and time spent researching the markets

– Substantial use of debt to finance the purchases

– Use of special information not available to the public

Getting restarted in advance of year end re one brokerage used THIS 2020 tax year and adding second brokerage 2021 and want to get started in advance of year end bookkeeping for ACB and GL’s as well as some fundamentals:

1. What do i need to clear out as start a new year: e.g. do i need to or is it advisable to clear out all stocks from 2020 that have the # of shares and the ACB both now at 0? and i have not repurchased withing 30 days of last year end which would be January 31. Any other adjustments? How will yr end sprdsht differentiate the two years – will it do this automatically?

2. Is it absolutely necessary to enter all purchases vs. only entering purchases on stocks that have a sale in 2021? What are the implications? thks

Ronaldo,

Nothing needs to be cleared out at the beginning of a new tax year. Your ACB will carry over.

You do not need to report any capital gains for a particular stock until you sell, so you can defer inputting transactions until then. However, it may still be a good idea to input your transactions on an ongoing basis to avoid to burden of having to update everything at once.

In clearing out i was partially thinking of my total usage of data as i have a hi turnover rate in the brokerage i am adding and several portfolios on THIS system and just generally clearing out stuff that does not need to be there in terms of neater housekeeping so I do not have to keep seeing them. Is there any harm in clearing out the ones ive described ie 0 shares in those stocks? or any advantage to leaving them in that i do not see?

I do like the idea of entering as i go along or somewhere between monthly or quarterly with respect to at least my sales for another reason as well ie i do not forget how to use certain aspects of the system compared to leaving things for a year.

What about the ? of how the system differentiates the previous years at year end spreadsheet time? thks again

Ronaldo,

It is up to you if you would like to delete data from past years, but you might want to keep it as a backup of your records in case there are inquiries from the CRA. You would also need to ensure that the current share balance is zero before proceeding. Please also note that securities are shared between your portfolios, so if you delete a security then transactions associated with that security will be deleted in each of your portfolios.

When viewing your transactions (either for a particular security or for all securities) you can choose to filter by year. Any dispositions occurring in that year will be attributable to that tax year.

First off, thank you so much for this amazing site. As my portfolio grows, I will definitively get the premium version.

Now I am new to this, so forgive me if this is a dumb question. if I a hold a security, say from January to May, and sell it on June 15, I am assuming that that I input the Return of Capital until May, or the last record date prior to selling. Is this correct? Thank you again.

Season,

You’ll only need to apply Return of Capital for periods of the year where you own units (based on the record date of each distribution). So if you units all shares with a settlement date on June 15 and don’t repurchase any units for the remainder of the year, you would not need to input Return of Capital associated with any distributions that have record dates after that date.

Hi, is there a way to set up different portfolios with different securities whereby the securities are assigned only to a particular portfolio instead of shared to all portfolios? Example, I would like to keep my RRSP portfolio separated from my Cash portfolio since distributions or capital gains are not taxable in the RRSP account until redeemed. Thank you!

Sylvia,

Any security you add will be visible from all your portfolios, and there is no way to change that behaviour.

Note that you don’t need to track anything for your RRSP or other registered accounts as you don’t need to report capital gains in that case.