An in-kind contribution to a registered account is where shares are transferred directly into the account, as opposed to cash. When making an in-kind contribution to a registered account (such as an RRSP or TFSA), it’s possible for a capital gain to be realized, even if the shares are transferred directly. Even though you haven’t actually sold the shares on the market, Canadian tax rules dictate that a deemed disposition at fair market value has occurred, which can result in capital gain taxes.

If the fair market value is greater than the adjusted cost base of the security, a capital gain will occur. From a tax perspective, making an in-kind contribution to a registered account is equivalent to:

- Selling the shares in your non-registered account.

- Transferring the cash proceeds into your registered account.

- Repurchasing the shares in your registered account.

However, in this scenario, if the deemed disposition results in the shares being sold at a loss, a capital loss cannot be claimed for tax purposes due to the superficial loss rule. The superficial loss applies here because both of its conditions are met: a) the shares are repurchased within the 61-day period centred around the sale date, and b) shares are still owned at the end of the period.

Unlike when the superficial loss rule applies to strictly non-registered transactions where the denied capital loss is added to the ACB (effectively deferring the capital loss), in cases where shares a transferred in-kind to a registered account at a loss, the capital loss is denied permanently. This is because the denied capital loss is added to the ACB where the repurchase transaction occurs. When the repurchase occurs in a registered account, you could look at as if the ACB has increased in the registered account. But ACB has no meaning inside a registered account because capital gains are not taxable there.

Fair Market Value

For the fair market value, you can use the total value of the contribution reported by your brokerage. Your brokerage will usually provide you with a statement that details the total amount of the contribution, which should be based on the market value of the security on the date of the contribution. Alternatively, you can look up the market price on the date of the contribution and use that as the fair market value.

Tracking ACB for In-Kind Contributions on AdjustedCostBase.ca

AdjustedCostBase.ca can be used to assist you with calculating capital gains resulting from in-kind contributions. To illustrate how this works, two examples of in-kind contributions are provided (one that corresponds to a gain, and another corresponding to a loss).

Example #1 — In-Kind Contribution of Shares that Have Risen in Value

You own 100 shares of BCE with a total ACB $2,500 or $25/share. You make an in-kind contribution to your TFSA of 60 shares when the fair market value is $50/share.

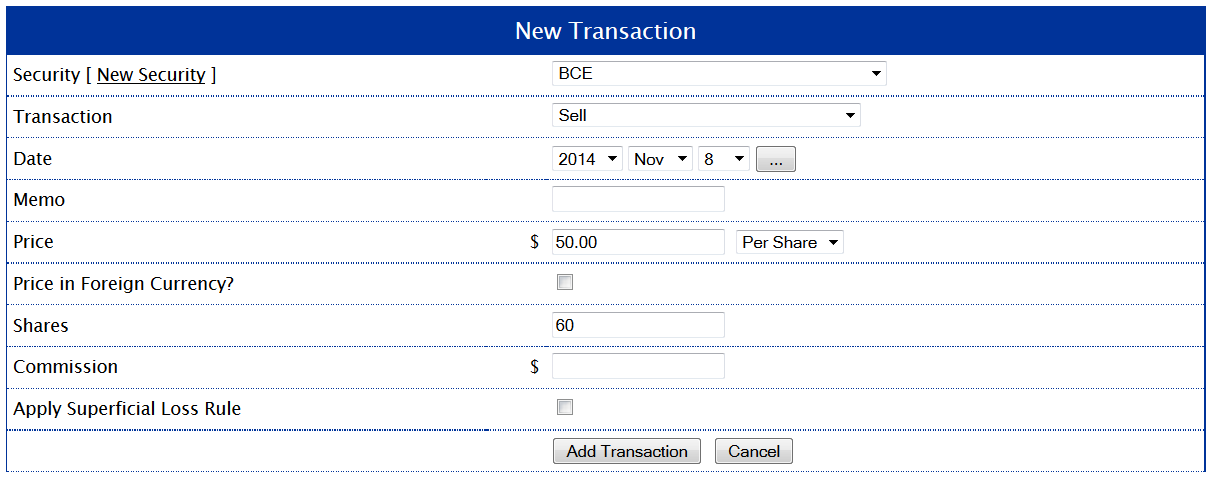

The in-kind contribution results in a deemed disposition of 60 shares. Even though you haven’t actually sold the shares on the market, a deemed sale occurs for tax purposes at the prevailing market price. On AdjustedCostBase.ca, you should enter this as a “Sell” transaction as follows:

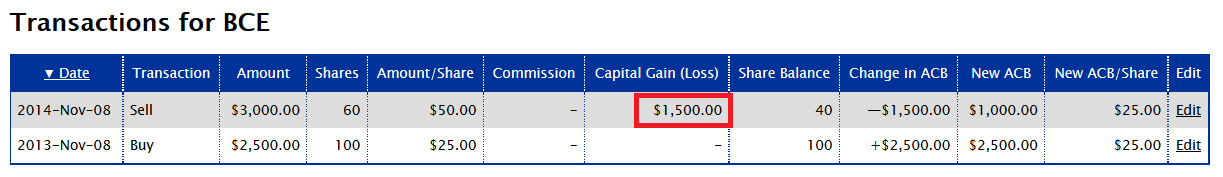

This will result in a capital gain of $1,500:

This will result in a capital gain of $1,500:

The capital gain is taxable for the year when the in-kind contribution occurred (2014 in this case).

Example #2 — In-Kind Contribution of Shares that Have Fallen in Value

You own 100 shares of BCE with a total ACB $2,500 or $25/share. You make an in-kind contribution to your TFSA of 60 shares when the market value is $20/share.

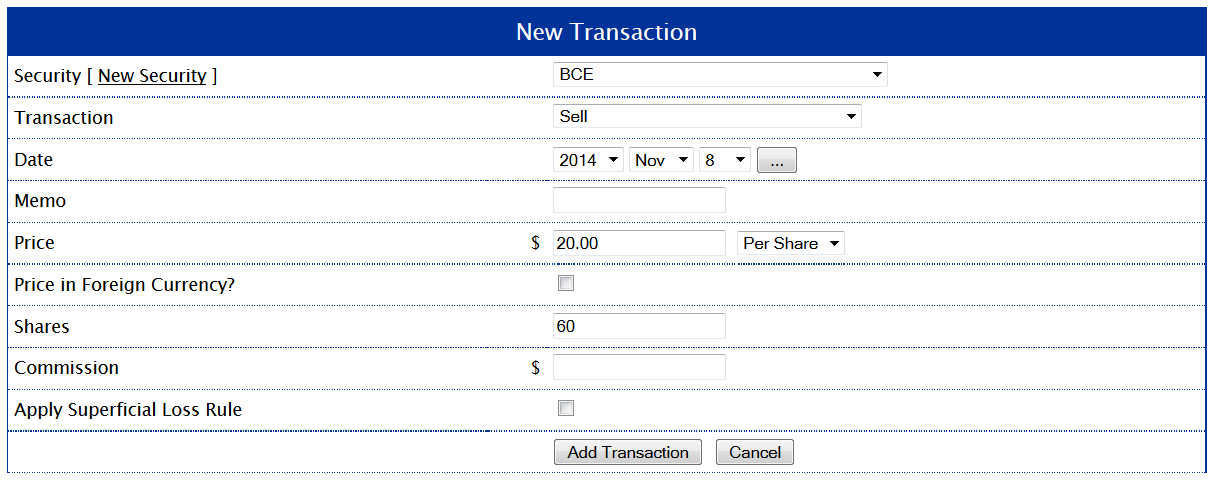

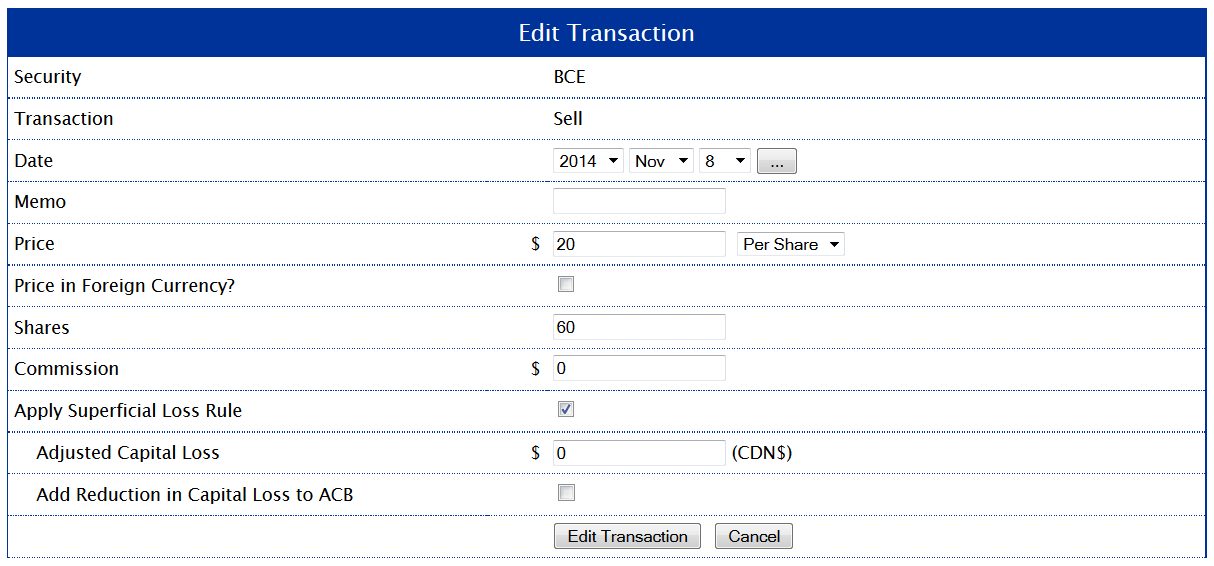

Once again, the in-kind contribution results in a deemed disposition of 60 shares. On AdjustedCostBase.ca, you should enter this as a “Sell” transaction as follows, taking into account the fair market value of $20 per share:

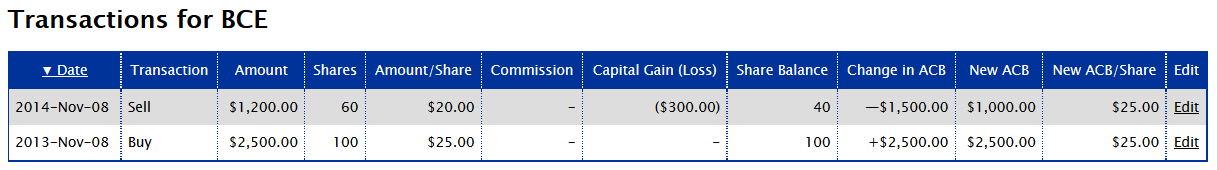

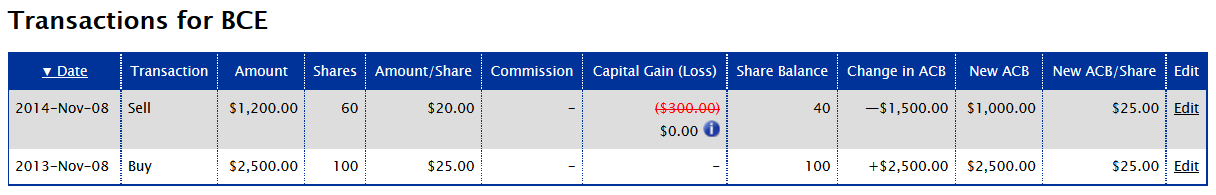

After adding the “Sell” transaction for the deemed disposition, you should see a capital loss of $300 in the transaction list for BCE:

This capital loss, however, is a superficial loss, and is permanently denied. You cannot claim the capital loss of $300. AdjustedCostBase.ca does not warn you that this is a superficial loss because it has no way of knowing that the sale corresponds to an in-kind contribution to a registered account. It’s up to you to recognize this. To correct the transaction so that the superficial loss is denied, edit the transaction by clicking on the appropriate “Edit” link. Then check off “Apply Superficial Loss Rule”, set the “Adjusted Capital Loss” to $0 (since the capital loss is fully denied by the superficial loss rule) and make sure that “Add Reduction in Capital Loss to ACB” is unchecked (since the capital loss is permanently denied and does not get added back to the ACB for your non-registered account). The form should look like the following:

After updating the transaction to apply the superficial loss rule, the capital loss is reduced from $300 to $0:

Also, the total ACB remains $1,000 (the reduction in capital loss should not be added to the ACB since the loss is permanently denied).

Should I Avoid In-Kind Contributions of Shares that Have Dropped in Value?

This is really a matter of perspective and depends on your individual circumstances. It’s often suggested that you should never make an in-kind contribution when the shares have dropped in value. The rationale behind this is that the superficial loss rule will permanently deny the capital loss and you’ll never be able to apply the capital loss to offset capital gains. But this is really a “glass half empty” point of view. If you believe that the shares will rise in value and/or generate income in the future (which you probably do if you’re holding onto the shares) then the drop in share value presents a wonderful opportunity in terms of contributing to your registered account. Since registered accounts such as RRSP’s and TFSA’s have limited contribution room, the drop in share value allows you to transfer more shares into the registered account than you otherwise would have been able to if the shares had not decreased in value. If and when the share value recovers, the capital gains and dividends will be sheltered from taxes while the funds remain inside the registered account. In the end, the benefit of being able to transfer more shares into your registered account may outweigh the drawback of the capital loss being permanently denied. Also, if you don’t have any capital gains available to be offset by a capital loss, the capital loss is of little value to you.

There are ways to circumvent the superficial loss rule in cases like this. Instead of doing an in-kind contribution, you could sell the shares in your non-registered account, transfer the proceeds into your registered account, and wait at least 31 days before repurchasing the shares in your registered account. As long as you wait long enough, you’ll be permitted to claim a capital loss on the sale of the shares in your non-registered account.

What happens if you transfer stock shares to another person and things are not held in a registered account?

Is that also deemed to be a deemed disposition and the receiver would have to note down the value of the shares on the day they received them and use that moving forward to calculate their ACB?

Thanks,

Iganc

Ignac,

In general when you transfer ownership of shares to someone else, a deemed disposition will occur based on the fair market value, resulting in a capital gain or loss. The other person’s ACB for the shares will be based on the current market value as well (if they already own the same type of shares then the market value will be added to their ACB).

An exception to this is when you transfer the shares to your spouse or common law partner. In such a case, by default, you’re deemed to have disposed of the shares at a price equal to your ACB, resulting in no capital gain, and your spouse acquires the shares with the same ACB. Alternatively, if you sell (as opposed to gift) the shares to your spouse, you have a choice of filing an election to have the transaction treated the same way as above.

In other cases, attribution rules may apply. For example, if you’ve gifted the shares to a child, the dividend and interest income will be attributed back to you until they reach the age of 18.

For further information please see the following on the CRA’s web site:

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/rprtng-ncm/lns101-170/127/trnsfrs/menu-eng.html

What about the opposite case. If I sell at a loss inside the RRSP and purchase within 30 days the same shares outside the RRSP. Does the superficial loss rule allow me to add the loss to the ACB of the shares outside the RRSP and claim the loss there when they are disposed of?

Malcolm,

A loss inside an RRSP account cannot be claimed as a capital loss. Therefore the superficial loss rule does not apply. Also, the loss cannot be re-added to the ACB of the repurchased shares.

That’s what I thought. Can the same be said about trusts? (I know nothing about trusts, just that RRSP is being equated to trusts as far as I know.)

I’m amazed how complicated ACB and the taxes surrounding it are, thank you so much for this website.

I am not sure if this question should be posted here or in the foreign currency post.

Regarding the following scenario:

– 2017.2.20 purchase 100 shares of Costco in USD @ USD150 pre share

– 2017.3.30 transfer these shares into TFSA, market price $160 per share

– 2017.8.28 sell shares @ $190 per share in TFSA and received funds in USD, still keeping USD in TFSA

-2017.10.2 transfer those USD out of TFSA into regular checking account

– 2017.11.20: convert USD into CAD

My understanding on ACB for USD cash and COST:

-2017.2.20: deemed sale of USD, and purchase of COST

-2017.3.30: deemed sale of COST, capital gain is $10 per share, what about USD cash?

-2017.8.28: nothing

-2017.10.2: deemed purchase of USD? new ACB for USD? use the market rate?

-2017.11.20: sale of USD

Thanks.

Hunter,

Yes that’s correct. For the transfer to your TFSA on 2017.3.30 there is no corresponding transaction for USD cash – only a deemed sale of COST. For the transfer of USD cash from your TFSA into a non-registered account on 2017.10.2, it’s equivalent to a purchase of USD cash at the fair market value.

Thanks for your response and this website, I have learned a lot.

Could you please clarify this “2017.3.30 there is corresponding transaction for USD cash – only a deemed sale of COST”:

So:

– deemed sale for COST

– deemed purchase of USD cash? —> this part is difficult to understand. ie, it increases the ACB of USD.

Hunter,

That should have read “there is NO corresponding transaction for USD cash” and I have corrected this above. Sorry for the confusion.

Hi, thanks for the helpful post! What happens when you don’t transfer all shares into a TFSA? Assuming the superficial loss rule applies, are you then able to add the superficial loss to the ACB of the remaining shares in the non-registered account?

For example:

Jan. 1 – Buy 100 shares of XYZ in non-registered account

Jan. 15 – Transfer 50 shares of XYZ in-kind to TFSA [superficial loss applies on deemed disposition]

Jan. 31 – Buy 50 shares of XYZ in non-registered account

Thanks!

Ben,

In that case, the loss on the shares transferred into your TFSA would be permanently denied, and cannot be added to the ACB of the shares in your non-registered account.

Hi I have a question on this part:

“An exception to this is when you transfer the shares to your spouse or common law partner. In such a case, by default, you’re deemed to have disposed of the shares at a price equal to your ACB, resulting in no capital gain, and your spouse acquires the shares with the same ACB. Alternatively, if you sell (as opposed to gift) the shares to your spouse, you have a choice of filing an election to have the transaction treated the same way as above.”

What is I transfer the shares to my spousal RRSP(first transfer to a joint account, then to the spousal RRSP account), will it be deemed as sale and I have to report capital gain/loss?

Thanks.

David,

Transferring shares in-kind from your non-registered account into a spousal RRSP would result in a deemed disposition. Any gains would be taxable, but losses would be denied according to the superficial loss rule.

Hello! I realize this is an old article, but I am hoping you are still answering questions.

I was wondering about the tax treatment if I have transferred company shares from a non-registered account to a TFSA twice in one year – once was at a loss and once was at a small gain. This is in a company share plan. The investment company sent me one T5008 for both transactions, offsetting the loss against the gain (I have a loss on the total deemed disposition). But since this was actually two transactions, should I be claiming the capital gain that occurred on one of the deemed dispositions?

Thank you,

Leslie

Leslie,

All capital gains and losses for a particular tax year should be reported on Schedule 3. If the net amount ends up being a gain then it should be included on that year’s return (capital losses must be applied against any capital gains for the year). If you wind up with a net capital loss then you have a choice: you may use it to reduce your capital gains for any of the 3 preceding years or carry it forward to apply to any future year.

Hello, if I transfer shares from my TFSA to my non-registered account in December (to regain TFSA room for the following year), would I need to record these transfers as BUY transactions at fair market value of the transfer date?

Particularly, I transferred several shares & ETFs from my TFSA to regular account (in both USD & CAD) in the last week of December. Could you advise on how to handle the exchange rate issue as well (i.e. should I be using the exchange rate on the transfer date & convert fair USD market value into CAD for the BUY transactions?) Thanks!

Henry,

Yes, transferring shares in-kind from a registered account to a non-registered account is equivalent to a purchase at fair market value in the non-registered account. The values would need to be converted into Canadian dollars based on the exchange rate at the time of the transfer. On AdjustedCostBase.ca you can either input the amount after converting it into Canadian dollars, or input it in US dollars along with an exchange rate.

I have a question about in kind transfer out of TFSA to a non-registered account. The transactions are like this:

1. Multiple buy and sell of USD Stock A in non-registered account.

2. Transfer of 2 shares of same USD Stock A to TFSA on 6th Jan resulting in deemed sale.

3. Transfer of 1 share of same USD Stock A from TFSA to non-registered account on 12th Jan.

Does the last transaction get treated as a buy transaction impacting the ACB?

The capital gain for transaction 2 is for sell of 2 shares or 1 share?

Abhijit,

For the purposes of calculating ACB transaction 2 corresponds to selling 2 shares and transaction 3 corresponds to buying 1 share. If a capital loss occurs due to transaction 2 then it will be permanently denied according to the superficial loss rule.

Got it thanks, that’s really helpful. And in case of capital gain in transaction 2, the gain will be the total gain for selling 2 shares and not 1 share, correct?

Abhijit,

Yes, that’s correct.

In the examples of making an in-kind transfer to/from a registered account, how would you calculate the FMV of the security that was transferred? Is it the opening/closing/highest/lowest/average price of the security on the day the transfer occured?

Thanks,

Eric

Eric,

You should use the same value that your brokerage uses when valuating the transferred assets. This value gets reported to the CRA for the purposes of tracking your RRSP and TFSA contribution room. It should normally correspond to something reasonable such as the previous closing price (some brokerages may provide you with a choice between the day’s high and low).

What happens if you purchase 100 shares in your tfsa then purchase 100 shares in non-registered and then the shares fall in value so you sell 100 shares in non-registered? Is it denied as 100 shares in tfsa get the acb updated but doesn’t matter since in tax sheltered account?

So what happens if I also buy back 100 shares in non-registered account within the 30 days following the sale. This would also contribute to the loss right? So which acb would get updated? The one in the tfsa or non-registered?

Hello

I am not sure Leslie question (Feb 5 2020) was fully answered

She was mentioning about two deemed disposition (transfer to TFSA) for the same security, one at gain and one at loss and whether they could offset each other?

Would you only report the gain from the at-gain disposition and ignore all at loss disposition in your Schedule 3 or are you still able to offset all the disposition from the same security into a single gain/loss?

Regards

Adrien

Adrien,

The loss would be denied and cannot be used to offset the gain.

If I’ve transferred shares (in kind) from an RRSP to a non-registered account, I’m adding a buy transaction for those shares for my ACB, at the market value specified by the brokerage for that transaction. Although there was no “commission” charged on this transaction, there was a $50 deregistration fee applied. Can this fee be considered an expense to acquire the shares, and should I enter this fee in the ACB commission field for this transaction?

Thanks!

Mike,

I would not recommend including the RRSP de-registration fee in the deemed cost of the shares, as this fee would be more closely associated with your registered account.

I have a stock, call it USDStockA, that dropped so hard in value it loss qualification to be in registered accounts and was transferred into an unregistered account. Should the in-kind transfer of the stock retain it’s original ACB or am I automatically denied the loss?

MN,

You would be deemed to acquire the shares for an amount equal to the fair market value at the time of the transfer. The ACB would therefore be based on this fair market value. The fair market value would be reportable as income. Depending on the timing and whether time passed between when the shares became non-qualified and were transferred out, there may be a penalty for holding non-qualified property in an RRSP.

thanks for the quick reply. it’s a TFSA. what’s the proof supposed to be? my broker said the transfer would be done automatically within 21 days following a notice I received in April but I had to hound them to get it done and they just did it in July. they had also assured me that my ACB would stay there same.

MN,

There is some leeway on penalties based on the timing of owning non-qualified investments in a TFSA:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account/tax-payable-on-tfsas/refund-taxes-paid.html

You cannot claim a capital loss based on the decrease in value during the time the shares were in your TFSA. The ACB would be established based on the fair market value at the time when the shares are transferred out.