Although rare, the situation can occur where you receive a ROC (return of capital) distribution that exceeds your adjusted cost base. Since ROC normally has the affect of reducing ACB, the question arises: should your ACB be reduced to a negative value in such a case?

The short answer is no, your ACB cannot go below zero, according to Canada Revenue Agency rules.

In such a case where ROC exceeds adjusted cost base, the ACB is reduced to $0. Furthermore, the amount by which the ROC exceeds the ACB is immediately taxable as a capital gain in the year of the distribution. Once the ACB has been reduced to $0, any further ROC distributions are entirely taxable as capital gains immediately.

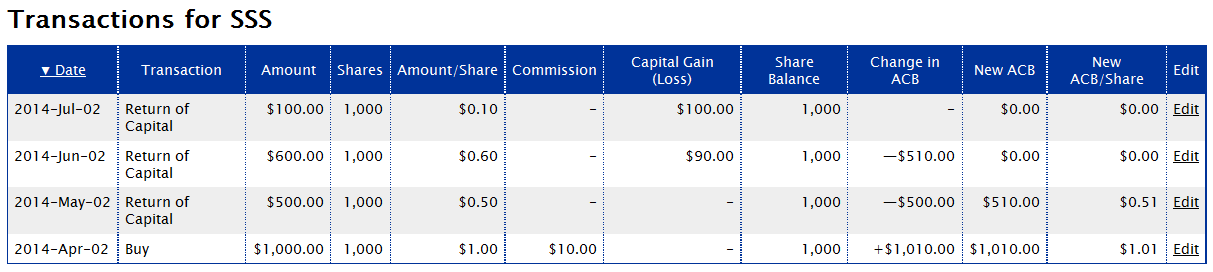

The AdjustedCostBase.ca calculator takes this rule into consideration. The following example demonstrates this:

Adjusted cost base is reduced to zero, resulting in all further return of capital distributions to be immediately taxable as capital gains.

The transactions are as follows:

- The first transaction in April is a purchase of $1,000 of the security with a $10 commission, resulting in an initial ACB of $1,010.

- Next, in May, a $500 ROC distribution occurs, reducing the ACB to $510.

- Then in June, a $600 ROC distribution occurs. In this case, the ACB is reduced to $0 since $600 exceeds the ACB of $510. Furthermore, a capital gain of $90 ($600 less $510) is immediately applicable and must be reported for the 2014 tax year.

- Finally in July, a further ROC distribution occurs. Since the ACB has already been reduced to zero, the entire distribution of $100 is taxable as a capital gain in 2014.

Hello, I am confused on how to deal with monthly distributions on a REIT that are reinvested. Using your spreadsheet I entered the additional monthly shares as dividends reinvested and the ACB did not change. If I enter the dollar amount of the distribution as a return of capital, there is no place for me to enter the additional shares.

Can you please advise. This spreadsheet is good but difficult to understand. It would be better if you added some explanations.

Thanks

Bonnie Denis

Hi Bonnie,

To read about more information on reinvested distributions, please see the following page:

http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-reinvested-distributions-dividend-reinvestment-plans-drips/

Note that in the case where a distribution has a return of capital component and is reinvested, you must enter two transactions on AdjustedCostBase.ca: one for the return of capital and another for the purchase of the new shares.

My limited partnership end this year and the adjusted cost base as at December 31, 2014 is a negative value. May I know whether I need to pay more tax or less tax with this entry?

Thanks

Do you have a CRA document showing that rule (ACB cannot be negative)?

Jimmy,

I believe this is discussed in section 40(3) of the Income Tax Act:

http://laws-lois.justice.gc.ca/eng/acts/I-3.3/page-47.html

If you have after many years 280 shares of a company with now a ACB of zero because of many ROC. If you now purchase 90 more shares at $55.61 per share and a $43.00 commission how do you get the right new ACB.

Sharon1,

The same rules for calculating ACB would apply once it’s been reduced to zero due to ROC. In this case the new ACB would be:

$0.00 + (90 shares x $55.61/share) + $43.00 = $5,047.90

Thank you so much. Just checking that my price ACB per share would now be $5047.90/ 370 shares (280 +90) giving me $13.64.

Sharon1,

Yes, you got it.

I had purchased Royal Mutual Funds Inc RBC US Mid Cap Value Equity.

I have now transferred into my RBC direct investment account.

I have transferred out the units. I bought the same Mutual Fund version a class D with lower managerment fee I was told it will not trigger a Capital Gains. How do I enter the transfer transcation with this Software? Return of Capital or Sale?

Anthony,

An exchange of shares or units that does not trigger a capital gain and the ACB is carried over can be inputted into AdjustedCostBase.ca as follows:

1. A sell transaction for all the units of the previous fund for an amount equal to the total ACB just before the exchange occurs (this should result in a capital gain of $0).

2. A buy transactions for the new fund for the same amount as above.

The Net Asset Value is not same price.

Thank you for your comments

Anthony,

I’m not sure I understand your follow-up, but please note that net asset value is not used to determine ACB.

I read this article with interest.

Do you have any Idea of how one is to claim the capital gain when filing the tax return?

I can not find anywhere to enter a capital gain which has no disposition of property.

Ed,

An entry for each disposition should go on Schedule 3 (the total capital gains for shares and fund units will go in box 132). Totals for capital gains distributions from your T-slips go in lines 174 and 176 on Schedule 3.

Thank you.

I found the following on CRA’s website:

“If the ACB of the trust units is reduced below zero during the tax year, the negative amount is deemed to be a capital gain in the year. The ACB of the trust units is deemed to be zero. Enter the amount of the capital gain on line 132 of your Schedule 3. Place a zero on line 131 since there is no actual sale of units.”

T4037(E) Rev. 18

Scroll down to Chapter 3 Special Rules, Adjusted Cost Base, Identical Properties,

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4037/capital-gains-2016.html?emaillink#P652_62619

Ed, Thank you for the link to the CRA site, and the concise answer to this question. We have this exact scenario, and knowing that it is capital gains and how to enter it on the forms is very helpful!

What is the impact if the return of capital is greater than the ACB and the shareholder has held the shares for less than 24 months? Assuming they are shares in a CCPC?

Michael,

Are you referring to the capital gains exemption for a qualified small business corporation? I believe this exemption is intended for cases where shares are disposed of, which is not the case when return of capital exceeds ACB, but I would suggested inquiring with a tax professional.

What is the ACB of a GIC not sold in the secondary market, where the purchase is $10000 and at maturity it settles for $10000 after 4 years and the interest is $250 for that 4 year period? Thanks

David,

There should not be any capital gain or loss on a GIC held until maturity as the proceeds of disposition are the same as the cost. The ACB would be $10,000 in your example and the proceeds of disposition would also be $10,000, yielding a capital gain of $0. The interest payments would be taxable as interest income and would not impact the capital gain.

Just looking for clarification on when ACB gets to zero and your point #4:

“Finally in July, a further ROC distribution occurs. Since the ACB has already been reduced to zero, the entire distribution of $100 is taxable as a capital gain in 2014.

Do you mean that the $100 is taxable under the usual capital gains rules? IE, only 50% of that $100 is taxable at one’s marginal rate? Or is it actually the full $100 taxed at the marginal rate?

Thank you!

MG,

Only a portion of the amount would be taxable based on the capital gains inclusion rate. So yes, only $50 of the $100 amount would be taxable with a 50% capital gains inclusion rate.

What about stocks trading?

eg:

2021.2.2 buy XYZ 100 shares @ $10/share

2021.5.8 sell XYZ 80 shares @ 20/share

Now the ACB is negative -$600 for the remaining 20 shares?

What if I continue to hold it and the price increases to $30/share? Also if I buy more at $25/share or $30 or $40 per share?

Thanks.

Hunter, in your example your adjusted cost base on the remaining shares after the sale is still $10 a share. You have a capital gain of $800. Your ACB will not change with the market price of the shares.

If you buy more shares at a diff. price then you will have to recalculate the ACB.

Hi Ed,

Thanks. That makes sense. Not sure why I posted the question like that.