In a non-registered account, the income from a dividend or distribution can be in the form of interest income, dividend income, foreign income, capital gains, or return of capital. With the exception of return of capital, this income is usually immediately taxable in the year of the distribution. Often mutual fund investors elect to have distributions automatically reinvested back into the fund. Similarly, stock owners can enroll in a Dividend ReInvestment Plan (DRIP).

When a distribution is reinvested in additional shares/units, it’s still immediately taxable in the exact same way as it would be if you had received cash. But additional care must be taken to ensure that the Adjusted Cost Base (ACB) is calculated correctly. If you neglect to factor the reinvestment into your ACB calculations, you’ll end up paying more than you need to in capital gains taxes when the shares are eventually sold.

When a reinvested distribution occurs, it’s best to think of it as 2 separate transactions:

- You receive a cash distribution

- You purchase additional shares/units using the cash

Although the cash may never physically pass through your hands or even get deposited into your account, a reinvested distribution is seen as two distinct transactions from a tax standpoint.

For calculating ACB, the reinvestment of the distribution is equivalent to a buy transaction. The total ACB increases by the amount reinvested as follows:

New ACB = (Previous ACB) + (Total Reinvestment)

= (Previous ACB) + ((Additional Shares Received) x (Cost Per Share of Additional Shares Received))

A reinvested distribution typically doesn’t involve any brokerage commission or any other transactions costs. But if you do incur these costs they should be added into the ACB.

Example 1: Let’s assume that you own 1,060 units of XYZ Canadian Equity Fund with a total ACB of $22,684.00 and receive a distribution of $321.16, which is entirely reinvested in 12.95 additional units of the fund. The ACB would become:

New ACB = $22,684.00 + $321.16

= $23,005.16

Now, a total of (1,060.00 + 12.95 = 1072.95) units are owned.

It’s important to recognize that in addition to the ACB adjustment, the distribution is taxable in the year of the distribution. The taxation of the distribution will depend on whether it’s in the form of interest income, eligible dividend income, non-eligible dividend income, foreign income, capital gains, etc. The tax breakdown should be included on the annual T3 and T5 slips sent by your financial institution, or you can look up this information yourself. The ACB adjustment, however, will likely not be provided for you.

If all or a portion of the distribution is in the form of return of capital, an additional adjustment to ACB must be made. Suppose that 25% of the $321.16 distribution is return of capital. In this case, the ACB must be adjusted (decreased) based on this amount:

New ACB = $23,005.16 — ($321.16 x 25%)

= $22,924.87

Note that if you’re using a value for return of capital per share, this amount should be multiplied by the number of shares owned before the reinvested distribution (1,060 shares).

Sometimes when you elect to have distributions reinvested, you only receive whole shares, and the remainder is distributed in cash. This is often the case with a synthetic DRIP at a brokerage. In this case, only the reinvested portion is added to find the new ACB.

Example 2: Let’s alter the above example such that the $321.16 distribution is reinvested in 12 additional units and you receive $23.56 in cash. The price per unit would therefore be (($321.16 — $23.56) / 12 = $24.80) and the reinvested amount would be ($321.16 — $23.56 = $297.60). In this case the ACB becomes:

New ACB = $22,684.00 + ($321.16 — $23.56)

= $22,981.60

Let’s assume again that 25% of the $321.16 distribution is return of capital. In this case, the ACB must still be adjusted (decreased) based on the amount:

New ACB = $22,981.60 — ($321.16 x 25%)

= $22,901.31

Note that the effect of the return of capital is the same regardless of whether the distribution is received as cash, fully reinvested, or partially reinvested.

When you’re enrolled in a dividend reinvestment plan, extra work is required to accurately track ACB. This can become a tedious chore, especially when distributions occur monthly. Many investors choose not to participate in DRIPs simply because of the headaches involved with the ACB calculations.

Using AdjustedCostBase.ca can alleviate the pain in tracking ACB caused by frequent and persistent reinvested distributions. AdjustedCostBase.ca is a free web application that allows you to enter transactions, and the ACB and capital gains are calculated for you. This saves a lot of time, and allows you to base your decision to enroll in a DRIP on your investing needs rather than your desire to avoid the extra work.

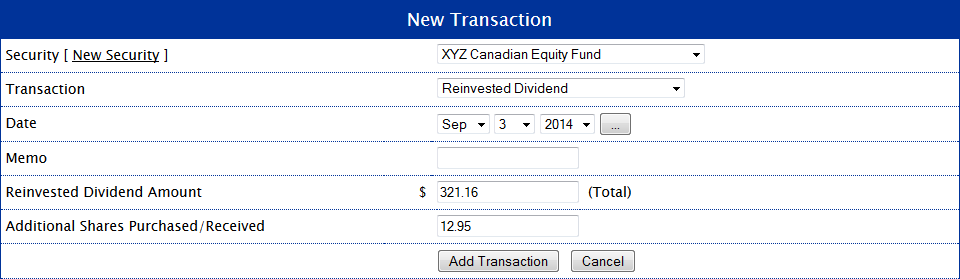

For Example 1 from above, you would add a new “Reinvested Dividend” transaction, setting the appropriate amounts for the reinvested amount and additional shares received:

You could also use a “Buy Transaction” type with a total amount of $321.16 for 12.95 shares and the effect will be exactly the same. Using a “Reinvested Dividend” transaction, however, makes it easy to see which transactions are related the DRIPs and which are normal purchases.

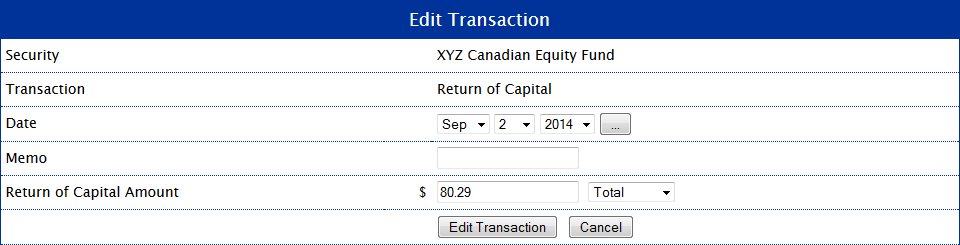

Next, you would need to create another transaction for the return of capital:

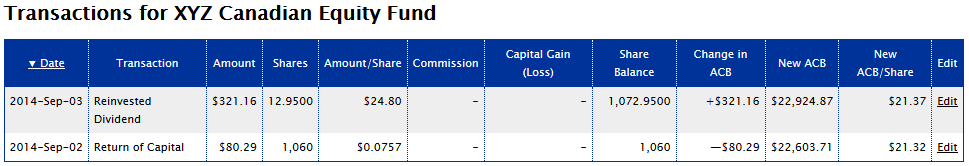

The transactions and resulting ACB after entering these transactions are shown below:

For Example 2 the transactions would be entered in much the same way, except the “Reinvested Dividend” transaction would be for only 12 shares with a total amount of $297.60.

You may notice the subtle detail that the transaction date for the “Return of Capital” transaction is set the 2014-Sep-02 while the date of the “Reinvsted Dividend” transaction is set to 2014-Sep-03. This is done to ensure that the return of capital is applied first. This will not be an issue if the return of capital amount is inputted as a “Total” amount, as opposed to a “Per Share” amount. But if a “Per Share” amount is used, the number of shares associated with the calculation of total return of capital is 1,060 (not 1,072.95). Moving the “Reinvested Dividend” transaction a day after the “Return of Capital” transactions ensures that the correct total return of capital will be calculated if you enter if as a “Per Share” amount. The total return of capital is equal to the return of capital per share multiplied by 1,060 shares. This also reflects the correct transaction order: first, a distribution occurs, and second, the distribution is reinvested.

Reviewing an old tax year in which I purchased $30,000 mutual fund, 980.2030 units at $30.61 and at year end I received a note from the broker saying there was a Reinvested Dividend of $3.692 units for an amount of $0.00.

CRA is assessing a capital gain of $142.16 which I will have to pay tax on.

However I notice when I make the Reinvested Dividend entry of $0.00 with 3.692 units, my ACB drops from $30.61 to $30.49. Shouldn’t a reinvested dividend on which I have to pay capital gains tax increase my ACB, not lower it, since I will pay paying the capital gain tax as assessed?

Or should I alter the Reinvested Dividend entry to include the amount $142.16 based on the historical unit value of $38.50?

The $0.00 amount likely means that you didn’t invest additional cash into the fund, not that the amount of the reinvested dividend is zero. Your brokerage should be able to tell you the amount reinvested, but most likely it’s equal to the fund’s NAV at the time of the reinvestment multiplied by the number of additional units received.

When a reinvested dividend occurs your total ACB should always increase, however, the ACB per share could either increase or decrease.

I am going to calculate the ACB for my parents’ BCE account. Their investing was limited to BCE’s DRP program.

However, i do not know how they originally entered the program i.e. I don’t have a record of when they purchased the “first” share in order to get started with the DRP, the year it occurred or the value of the initial purchase. Can i still work out the ACB without that information provided i get their first account statement?

Your options would include the following:

1. Use an ACB of zero. This will result in a potentially much higher capital gain than the true value.

2. Donate the shares. You won’t need to report any capital gains and you’ll be able to report a charitable tax credit equal to the full value of the shares.

3. Look up the dividend history and use the data in a spreadsheet to backwards calculate the number of shares owned on each distribution date (being careful to account for stock splits). However, if you have no information at all (not even the date of the original purchase or the number of shares originally purchased) it will probably not be possible to reconstruct the necessary information.

Also, in your case you may want to look at BCE’s online ACB calculator:

http://www.bce.ca/investors/shareholder-info/transactions-and-cost-base

Hi . I recently sold shares which I had had in a drip program for many years( maybe 20). There was at least one -1 for 3 stock split, name changes over time, etc. I have record of what I paid initially and most statements of new shares added due to the drip monthly or later quarterly. To get my ACB, would I just add up all the money that went into buying the new shares in the drip over the years(from these statements), plus the original cost, and divide that by the total number of shares I have at the end, regardless of splits ? thanks, Rick

Rick,

Yes, you should be able to do that, as long as:

– There were no sales up until this point

and

– The distributions did not include any return of capital and there were no non-cash distributions

Under Dec. 2015 distribution information for the BOM ZWB ETF there was a (presumably re-investment) of 0.130 per unit in addition to the 0.073 paid in cash). The respective amount shows up as a higher than actual received payment on the monthly Tax information I received with the T3 for the Jan 7/16 distribution but is not segregated between the actual cash payment of 0.073 for Dec/15 and this “phantom” amount. Reading the DRIP info above, where there are additional shares issued without an actual payment as proof of distributed value, here there is however no correspondent increase to the amount of UNITS held. So do I just increase the ACB by the respective amount for which my only documentation is the T3 slip which doesn’t provide any information to support that amount of revenue I did not receive, yet have to pay taxes on it. So how can I prove to the Tax people my action of increasing the ACB to reduce my Capital Gains/increase Capitital Loss when selling the units, which did not change in amounts? In other words how can I prove that I only received 0.073 per unit and that the rest was re-invested without increase in Units.

Looking at it from the customers side, there also is no specific sudden change in the unit price to support such a re-investment by the fund to prove there was an actual re-investment made (without issuing corresponding units!!!!!

On very important point to consider: Were is the proof that unit owners actually did received value????

Willi,

ACB in general cannot be calculated from your T-slips. It needs to be backed up by your transaction records. The same goes here, and the non-cash distribution should be equal to the difference between all the taxable income and return of capital reported on your T-slip, and the amount of cash distributions received. I would think this alone would be sufficient proof, but also, the CRA can refer to the distribution tax breakdown that each ETF must report.

Further information about phantom distributions can be found here:

http://www.adjustedcostbase.ca/blog/phantom-distributions-and-their-effect-on-adjusted-cost-base/

http://www.adjustedcostbase.ca/blog/streamlined-import-of-return-of-capital-and-phantom-distributions-and-for-exchange-traded-funds-etfs-publicly-traded-mutual-funds-and-trusts/

The examples you gave were for Canadian stocks and mutual funds.

What about $US stocks, mutual funds and $US Investment Savings Accounts (ISA’s) held in a $US margin account?

Do you do you enter the DRIP distribution as “Reinvestment Income” (and/or “Return as Capital” if applicable) into adjustedcostbase.ca?

Or do you have to do something different to take into account the $US/$Cdn exchange rate applicable at the time the DRIP distribution was made?

I have a $US ISA held in a $US Margin Account. Trying to figure out how to calculate its ACB.

Any insight would be most welcome/

Rob,

AdjustedCostBase.ca has been updated to allow you to enter reinvested dividend transactions in a foreign currency. Thank you for your suggestion.

You can enter the reinvested dividend in the same way as described here (a reinvested dividend is equivalent to a purchase for the purpose of calculating ACB):

http://www.adjustedcostbase.ca/blog/calculating-adjusted-cost-base-with-foreign-currency-transactions/

Note that a distribution considered to be return of capital in a foreign country is generally considered to be fully taxable in Canada.

Many thanks for the update. That was fast1

I have already used it to calculate my ACB for my $US ISA held in a $US Margin Account. It appears to work great.

P.S. You may want to write a post explaining how to use it for others. (Or add to your original post above).

Hi,

I’ve had BMO full drip shares for quite some time now and have never tracked ACB. I’d like to get back and start investing again. To track ACB, I’ve been going through computershare to look at past divident and payment transactions. When I first owned the share, I didn’t select to reinvest the divident and so I used to get cheques in the mail. Do I account for these cheques (paymnet) in ACB? Pardon if I sound confused…I am!

Thanks

Velle,

Dividends paid in cash should not affect ACB, unless a portion is in the form of return of capital. Assuming all the BMO distributions are in the form of eligible dividends, only any reinvested portion will factor into determining ACB.

Thanks much for your article AdjustedCostBase.ca

Here are my questions.

Back in 1996 I invested 3K in a drip which had continued to this year. The company has been bought out this year and my only option is to receive a disbursement check which will amount to approximately 36K.

I’ve declared and re-invested the dividend income yearly and I don’t think I bought any additional shares on my own (although possible).

The other issue is the management company changed 5 years ago so they don’t have anything prior. I know I have many of the 1099’s but doubtful that I’d have them all the way back to 1996.

The new management firm said I could pay them for a “Prior agent statement”.

So here are my questions.

1. If I have the same taxman is it likely he’d have that info? I’d buy the statement if needed.

2. How can I figure out the cost basis and what type of tax hit should I be prepared for.

Hi, guys, i hope some of you can help me out with my REITs ACB calculation. Much appreciated!

My REITs situation is a bit different, because not all the dividend goes to buy the share and i have some leftover cash, and I don’t know how to calculate the cash part.

Fort instance,

I had 100 units of one REIT, i bought it 100 X 8(per share), plus commission of 10 dollars, my ACB is 100 X 8+10 = 810

then came the dividend, 0.1 dollars per share, so the dividend is 10 dollars, with this 10 dollars, 9 was used to buy 1 share and 1 dollars left in the balance. How do i calculate the ACB now? it would be easy if all of the dividend goes to buy share.

Also in my T3, for that dividend of 10 dollars, they broke it down to 3 (21), 5(26) and 2 (42 also meant ROC). I just got so confused with all these number. If any of you can tell me how the cash goes, and how to use ROC in T3, I would be much appreciated.

Sorry, i didn’t read this article carefully enough. thanks for this awesome article.

now i know how to calculate my ACB, so my scenario above is:

New ACB is: 100 X 8 + commission + 9 – 2

If the commission is 10 dollars, the total is: 810+9-2= 817. And my ACB per share is 817/11= 74.27

Correct me if i am wrong. Thanks again everyone!

Richard,

Please refer to Example #2 above, which shows a case where only some of the cash from a distribution is reinvested. In cases like this only the reinvested portion increases ACB and only that amount should be inputted for a Reinvested Dividend transaction on AdjustedCostBase.ca. In your example your total ACB would increase by $9 as a result in the reinvestment.

If a portion of the distribution is ROC then that amount would decrease ACB. When a distribution is fully ROC and fully reinvested then the effect on ACB cancels out, however, in your example only part reinvested and only part is ROC. In addition to the $9 increase in ACB as a result of the reinvestment, there would be a decrease in ACB of $2, for a net increase of $7.

This example can be inputted into AdjustedCostBase.ca as follows:

1. Return of Capital: $2 total

2. Capital Gains Dividend: $3 total

3. Reinvested Dividend: $9 total for 1 share

If inputting the return of capital amount as a per share value, you’ll need to ensure that this transaction is ordered before the reinvested dividend transaction.

Richard,

That’s correct, the ACB following the distribution and reinvestment would be $817 in total or $74.27 per share.

Thank you very much AdjustedCostBase.ca for the detailed explanation and quick response!

Pingback: Ask the Spud: Can I Make Taxable Investing Easier? | Canadian Couch Potato

Sorry to ask a dumb question, but what date would you pick for the “buy” date of a dividend which is reinvested in a mutual fund (when does the “transaction” happen)? I am new to investing and new to mutual funds and never new that just selling some losing mutual funds would involve me in all this. FYI my T5 is describing Capital Gains Dividends.

Sam,

I would use the distribution payment date for a reinvested distribution. Note that the exact date probably won’t make any difference in your calculations as long as there are no sales around that time.

Thanks very much for your reply. Would you add up all the reinvested dividends from the time you owned the funds till you sold them? I’m surprised that the mutual fund co. doesn’t keep track of the ACB of such funds for us. My mom’s accountant seems to be using the book cost as the ACB for her mutual funds but I thought this was a different thing.

Sam,

Adding up all reinvested dividends to calculate ACB may work in some cases, such as when there are no sales over that period of time, but in general, ACB needs to be calculated incrementally.

Sam,

In my experience, most mutual find companies do keep track of the ACB taking into account reinvested dividends for its customers. Considering the cost of most mutual funds that is the least they can do. Just phone them.

If you bought your mutual find through a broker etc, you broker can also provide you with the most up to date ACB.

Or you can calculate the ACB yourself using this website.

From my experience as of late that is correct (relating to relatively recent new investments). Unfortunately not every party has done so many years ago. Trouble is when you move your account from one party to another, for example even from one subsidiary of, say, a Bank to another as I have done twice. All the receiving party has on file are the present units and and the current price. So they have no way to provide you with the correct ACB, the reason, at least my Bank states that ACB qouted by them is not guaranteed.

From my first investment ever and for any security: I created a relatively simply spreadsheet and entered every transaction as it occurred, making appropriate changes when I receive T3 slips as during the year all I received were funds in cash or re-invested including applicable number of shares or units without any breakdown between, say Dividends and Capital Gains, Foreign Revenue, Foreign Tax paid, etc. and particularly Return of Capital, as the latter can for some funds be quite a high percentage, all of which affects the ACB. Another method is investing into some software. i.e. I also use Quicken from Intuit where I also enter the data and make appropriate changes after I receive my T3 (Canada). And comparing Quicken so far it always concurs with my one calculation but for quite a few securities I hold the info I receive from my Bank as to ACB is incorrect – in some cases by quite a lot – new securities purchased via my latest brokerage party I use are dead on. Yes keeping your info up-to-date yourself is work intensive, but a lot easier than trying to determine the correct ACB after holding a security for a long, long time with lots of monthly re-investments including sales &/or purchases during that time.

If this is a reinvested dividend, wouldn’t I also need to have a third line recording Capital Gains Dividends in either example, in order to keep track of Capital gain or loss?

Hi,

I have had shares in a DRIP for many years and have traced the ACB. In Jan 2016, I removed 73 shares from the DRIPand put them in my brokerage account. I then sold these 73 shares in Oct 2016.

Do I need to make an entry in ACB and if so, what kind of entry?

Many thanks for this tool, it has been a godsend.

I forgot to mention that these 73 shares were my original investment. Not sure if that matters.

Tom

Roberto,

If a reinvested distribution consists entirely of capital gains, it can be inputted into AdjustedCostBase.ca as a Reinvested Capital Gains Distribution transaction. Or, if only a part of it consists of capital gains, you can use a combination of a Buy transactions along with a Capital Gains Dividend transaction. Also note that a capital gains distribution doesn’t affect ACB, but rather results in an immediate capital gain. As such, you don’t necessarily need to input this into AdjustedCostBase.ca as it will appear on your T-slips, however, you can choose to do so in order to get an accurate picture of your total capital gains for the year.

Tom,

You would need to account for the original purchase, the increases in ACB resulting from each of the dividend reinvestments and the sale when calculating your capital gain. However, the transfer of your shares to another account belonging to you should not result in a deemed disposition and as such no ACB accounting for the transfer should be needed.

Thanks. Another question…When I fill out my Schedule 3 and enter the ACB, would that be the ACB immediately prior to the sale or the ACB shown after the sale? This is probably a stupid question but I’m a bit frazzled.

Tom,

On Schedule 3 the ACB should be the ACB for the shares that were sold immediately prior to the sale (number of shares sold x ACB per share).

My husband and I own DRIP of BNS together. In addition I own the DRIP of BNS myself. Could you please let me know how to keep track of ACB for my husband and also for myself using adjustedcostbase.ca.

Thank you

Ala

Hi, if I have a small position on a stock paying a small dividend quarterly, but not enough cash to buy any new share (for example, the stock pays a $25 distribution yet it is currently priced at $50.00/share and thus not additional shares can be purchased), in order to accurately maintain my ACB, should I be making an entry for the $25 distribution? Or is the ACB only adjusted and entries made when actual additional shares are purchased? Thank you

Joe M

Joe,

Your ACB will only change based on the amount reinvested in additional shares, not on any cash amounts received (provided that the distribution does not consist of any return of capital). So there should be no change in ACB if a dividend is received entire in cash.

Hi – If you receive a stock distribution of a different company in which you had 0 shares prior to this distribution, what is the ACB of those shares? Is it presumed to be $0 or FMV?

Thanks

Natacha,

The tax treatment for a spin-off can vary on a case by case basis so it’s best to check this by looking on the company’s web site, searching for press releases, checking sedar.ca, or contacting the company’s investor relations department.

If the distribution of the new shares is done on a tax-deferred basis, then typically your ACB would be reallocated between the original company and the spin-off company based on the relative fair market values of the two (your ACB would not equal the FMV of the shares in this case).

If the new shares are taxable as a distribution, then your ACB would likely be equal to the FMV of the shares received, which should also be equal to the taxable amount of the distribution.

If ROC is 100% reinvested, no effect in ACB right? Thanks!

Kashmoth,

Normally the decrease in ACB from the ROC should be offset by the increase in ACB resulting from the reinvestment, resulting in no net change in ACB.

However, in the special case where your ACB has reached zero, the ROC will be taxable as a capital gain in the year of the distribution (and the reinvestment would subsequently increase the ACB).

Pingback: Why we're going to sell all our mutual funds - RodyWord

Lately I’ve noticed that many dividend payments are supposedly reinvested in a DRIP but there is a clear indication that the dividends purchase 0 shares. I was told that the dividends go to adjust the purchase price but, here again, I have not noticed any change in the price I paid for the shares. What i’m I missing?

Julio,

This sounds like it may be a phantom distribution:

https://www.adjustedcostbase.ca/blog/phantom-distributions-and-their-effect-on-adjusted-cost-base/

All else being equal, in theory a distribution will cause the market value to decrease by the amount of the distribution. If the distribution is a phantom distribution, then in theory the market value will then increase by the same amount, resulting in zero net change. But in reality, market prices fluctuate for many reasons, so it can be difficult to see this effect.

(1) re: Example 1: I couldn’t figure out how did you arrive 12.95 additional units of the fund. The received distribution amount is $321.16. Total owned 1060 units with a total original ACB of $22,684.00, to my calculation the cost of per unit is $21.40 ($22,684.00/1060), therefor $321.16/$21.40 = 15.01 units. Now, a total of units are owned should be: 1060 + 15.01=1075.01 instead of 1072.95 (1060+12.95). Correct me if I am wrong, am I missing something here?

(2) How do I calculate the ACB for the DRIP shares which accumulated for many years?

(3) Does the DRIP shares need to be added on to the original shares were purchased when you calculate the ACB? I know how much I paid for the original shares which I purchased in different years.

Thanks!

Angi,

The number of units you receive from a reinvested distribution is a known value that you would get from your brokerage statement. Generally it should be approximately the market value at the time of the reinvestment, which is unrelated to your ACB.

The process outlined above needs to be repeated for all reinvestments that occur over many years.

Your ACB will increase by the amount reinvested.

I thought I made a post yesterday wrt to no warnings of Superficial loss rule application when multiple portfolios are merged and the result is multiple reinvestments and sales all occuring within the +/- 30 day window. I can’t find it now. Is there some special treatment regarding buys which are reinvestments (and technically out of my control) or is the program simply missing these?

Stuart,

I’m not aware of any exemptions to the superficial loss rule for reinvestments. In such cases, it’s likely that the capital loss could be only partially denied:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

After reading the examples, I am not sure I fully understand how to enter my DRIPs into adjust cost base, so hopefully someone can help.

My brokers’ transaction history reports:

Dividend/Interest: 258.44$

Reinvest: 16 shares, total -256.32$.

To enter this properly into adjust cost base, am I supposed to make two transactions like this (call this case A)

Transaction 1) Reinvested dividend, 16 shares, value 256.32$

Transaction 2) Return of capital: 258.44$

Or perhaps I am supposed to enter two transactions as follows (case B)?

Transaction 1) Reinvested dividend, 16 shares, value 256.32$ (there are no commissions for DRIPs with this broker)

Transaction 2) Return of capital: 2.12$

Perhaps neither of these are correct, after all my brokers do not report a return of capital, so maybe I am supposed to do case C:

Transaction 1) Reinvested dividend, 16 shares, value 256.32$

In scenario C, I assume I ignore all interest paid that is not reinvested when entered the transaction details in Adjust cost base.

Thanks for anyone willing to help.

Adonis,

In general you would only need to input a transaction for the reinvested amount – a Reinvested Dividend transaction for 16 shares for a total of $256.32 in your example.

If any portion of the distribution consists of return of capital, you would need to add a Return of Capital transaction. This is based on any portion of the full dividend (the reinvested amount plus the amount received as cash) that is deemed to be return of capital. Similarly, any portion of the distribution that consists of capital gains can be inputted as a Capital Gains Dividend transaction.

If the dividend consists entirely of other forms of income such as eligible/non-eligible dividends, interest income or other income, then only the Reinvested Dividend transaction is necessary. These other forms of income do not impact ACB (but result in taxable income for the year of the distribution that should be reported on your T-slips).

We have read the information about incomplete records but don’t know how to proceed in the following situation. We have recently sold CIBC shares as executors for a relative who passed away. The original share certificate of 100 shares was purchased in 1989 and we have the original purchase receipt. She joined the dividend reinvestment plan right away but we have no records from 1989 to 1993. Can we enter the original purchase information from 1989 in the adjustedcostbase database and then start entering quarterly data starting in 1994? How should we proceed with this? Thanks.

Terry,

If you only input the transactions for the reinvested dividends starting in 1994, your final share balance will be too low. At the very least I would suggest inputted an extra Reinvested Dividend transaction in 1994 for the number of shares missing (the difference between the final share balance and 100 shares plus the number of shares obtained from 1994 onward) for an amount of $0. This will give you the correct final share balance, and will guarantee that your capital gain is not under-reported (it will be greater than it should be, however).

Another suggestion I have is to contact CIBC’s investor relations department to see if they can provide information on historical dividends and DRIP purchase prices:

https://www.cibc.com/en/about-cibc/investor-relations/contact-us.html

I’ve been with the BMO DRIP since 2007 and sold most of it in 2019.

Luckily the Computershare website keeps an online history record of every transaction that was made by me.

The question I have is on 2 occasions I have had 1 share certified ,mailed to me which I then signed over to family members to get them started on DRIP plans. This method skips the steps of buying 1 share and then certifying in the person’s name by a brokerage.

How does this effect my ACB? I am now 1 share shorter but I did not sell it.

What I thought I should do is just readjust the ACB/share by dividing the existing number of shares by the ACB at the time of that the 1 share was certified.

Thanks for the great amount of knowledge on your site!

Frank,

The effect will depend on whether you are deemed to have acquired and immediately sold the share, or the share is immediately passed on without acquiring and selling it. In the latter case there are no consequences to your ACB. In the former case this is equivalent to a purchase of the share followed by a sale.

I have recently just found out I have gotten a dividend pay from MGM of 0.10 CENTS! I did not do any drips or whatever unless its by default? Bet not. Anyways I supposed adding it on transaction would be just doing:

Security: MGM

Transaction: Capital Gains Dividend

Date: The Settlement Date

Capital Gains Dividend Amount: 0.10 TOTAL (right? NOT Per Share)

CHESS,

The distribution from MGM is likely taxable to you as foreign income. Therefore you should not input any transaction for this distribution into AdjustedCostBase.ca as it should not impact your ACB.

Only distributions that consist of return of capital, capital gains and/or phantom distributions will impact capital gains and ACB. Or, if the distribution is reinvestment this will impact ACB. Distributions consisting of other types of income including eligible or non-eligible dividends, interest income and foreign impact have no impact on ACB and therefore do not need to be accounted for (unless the distribution is reinvested).

Hi,

The brokerage I am using does not have an option to automatically reinvest dividends (DRIP) so I will be receiving the dividends in cash and likely reinvesting manually after the divident has been received in cash. How do I go about inputting this into the ABC software would it be the following:

Transaction 1: Capital Gains Dividend for the amount of cash dividend received

Transaction 2: Buy transaction for the amount of cash dividends received and used to purchase additional units

Thanks!

Dylan,

In most instances you would only need Transaction 2.

In the case of ETF’s / funds that distribute return of capital or incur phantom distributions, then further accounting is necessary (this is the case regardless of whether the cash received is reinvested).

Thanks!

Does this mean that the initial dividend received in cash is technically not taxed then as long as it is at some point reinvested back into more shares? If it is not reinvested and I just leave it as cash are there any tax implications?

Dylan,

No, the dividend is taxed (unless it consists of return of capital). The taxation of a distribution is the same regardless of whether it is received in cash or reinvested.

Gotcha, but how would I input this using the ABC tool? For example say a stock I hold just paid out dividends and I received it in cash today would I need to input a transaction?

Sorry for all the questions appreciate everything you do here!

Dylan,

There’s no need to input any transactions in that case. If a distribution doesn’t consists of return of capital, phantom distribution and is not reinvested then there will be no impact on ACB. The distribution may be taxable but the taxable amounts should be accurately reported on your T-slips.

Hi,

We buy company shares at about 50% of their market value. This advantage is added as revenu on our T4 slips. Since the tax has already been paid on 50% of the purchased shares, how do I account for this in the ACB when calculating our capital gain. Should I be entering the BUY as [purchase price + 50% purchase price] to account for the revenu already taxed.

Natasha,

This can be inputted as a Buy with a total amount equal to the amount you paid plus the amount of the taxable benefit you received (this total amount should equal the approximate fair market value of the shares).

After reading the examples, I am not sure I fully understand how to enter my Synthetic DRIPs properly for my RIOCAN REIT purchased from Questrade.

Example Scenario:

Let’s take RIOCAN for example. I own 1000 shares purchased at $17 ($17000) and the company pays a yearly dividend of 5.41% ($.0541 x 17000 = $919.70). The monthly dividend would be $919.70/12 = $76.64 dividend payment per month.

The stock currently trades at $17.50 so the synthetic DRIP will automatically purchase 4x full shares ($17.50 x 4 = $70) with $6.64 remaining and added as cash to my account.

What kind of Transaction(s) would I enter in this exact scenario?

Would it simply be:

Transaction 1) Reinvested dividend, 4 shares, value $70 (there are no commissions for DRIPs with this broker)

Transaction 2) Return of Capital: $6.64 (Im not sure of the cash remaining in this scenario would be considered a “Return of Capital”)

Im starting to wonder if Transaction 2 is even required for this left over money for a Synthetic DRIP, thus leaving me with entering only 1 transaction:

Transaction 1) Reinvested dividend, 4 shares, value $70 (there are no commissions for DRIPs with this broker)

Peter,

You should input the first transaction only.

It’s possible that an additional Return of Capital transaction would be required for REITs such as RioCan, however, the amount would be totally unrelated to the amount you receive as cash vs. the amount reinvested (it could be anywhere between $0 and $76.64 depending on how the distribution is deemed to be taxed).

Hi there,

If the mutual fund that I am holding pays out a monthly distribution (a portion of which is ROC), that I am reinvesting in more shares, how would my ACB be impacted?

Would I:

1. Simply add the amount of the reinvested distributions paid monthly to my ACB and back out the ROC component as indicated on my T3 at year end (downward adjustment to ACB)?

2. Not include a downward adjustment to my ACB (based on the ROC component indicated on my T3) because the distributions are being reinvested?

Dino,

I would suggest thinking about the ROC and reinvestment as two separate events. The ROC will decrease your ACB by the amount of ROC and the reinvestment will increase your ACB by the amount reinvested.

In the case where the distribution is composed entirely of ROC and the entire amount is reinvested, then there will be zero net change in your total ACB. However:

– Often a distribution consists of various components and isn’t entirely ROC.

– Only a portion of the distribution may get reinvested if you can only receive whole shares.

– When using AdjustedCostBase.ca you’ll need to keep track of your total share balance, which would be impacted by the reinvestment in additional shares.

Note that your T3 slip generally only contains the total amount of ROC received throughout the year. If the fund made multiple distributions throughout the year consisting of return of capital and you sold units throughout the year, you would need to factor in the ROC separately for each distribution in order to accurately calculate the gain or loss.

Hello everyone :),

I opened a margin account last year and I’m trying to use the excel files from the cds website to get distribution data.

Getting the ROC is straightforward enough.

1/ I have a case (ZDB.TO 2020) where there is a “non-cash distribution” (0.63 per share), which equals the capital gain row and there is no ROC (at least, not in the same column). I added it all (0.63) as “Reinvested Capital Gains Distribution”. Is that correct?

2/ Are there any other rows other than ROC and Non-Cash distribution to take into account to calculate the ACB/Capital gains?

3/ Are Eligible/Non-Eligible Dividend rows could be useful to double-check the T3 that the broker will send me?

4/ Does Foreign/Other Income count as incomes (100% taxable) which I guess will be also in the T3 if any?

5/ Does the rest of the rows have any useful purpose to have a correct ACB or declaration to the CRA?

Thanks 🙂

Thomas,

Yes, ZDB incurred a $0.63 “Reinvested Capital Gains Distribution” for December 30, 2020. The cash distributions throughout the year included capital gains and return of capital.

The only rows relevant in terms of calculating ACB and capital gains are:

– Total Non-Cash Distribution ($) Per Unit

– Capital gain

– Return of Capital

However, if you’ve reinvested any of the cash distributions then that is an additional consideration.

Any other rows such as eligible/non-eligible dividends, foreign income, other income, etc. do not impact ACB (unless the cash is reinvested) but could be useful for cross-checking your T3 slip.

Hi, I received a T3 today showing capital gain dividends as a composition of the distributions from my ETFs. These were not re-invested. Am I right to assume that I will not need to input these transactions into adjustedcostbase? One of the possible options is “Capital Gains Dividend”, hence I would like to make sure.

Thank you.

Henry,

Capital gains distributions are taxable immediately in the year of the distribution and do not impact your ACB (unless they correspond to a phantom distribution). It is therefore not absolutely necessary to input these transactions into AdjustedCostBase.ca, however, you may wish to do so for completeness to see all of your capital gains.

Hi,

I received DRS shares (US company) as part of my compensation. How would I account for them in the ACB calculation?

Silvia,

While I don’t know the full details of this arrangement, it seems likely that if you received shares as part of your compensation then the fair market value would be taxable as employment income. The ACB would increase by the fair market value of the shares received.

Would that be the FMV at the time of receipt or today? Also, in calculating cost would I include US and/or Canadian taxes paid (to revenue agencies)?

Thanks

Silvia,

The fair market value should be based on the time the shares were received. Taxes paid on the benefit of receiving the shares should not be added to the ACB.

Hi,

I am new to ABC calculation and to this website.

I am in a situation similar to example 2 above. I don’t understand what should be the input in the application of this website the “$23.56 in cash received in cash” from example 2.

Thanks

Guillaume,

For this case you would only need to input a “Reinvested Dividend” transaction for 12 shares for a total amount of $297.60. If the distribution doesn’t consist of any return of capital then there is no impact on ACB from the amount received in cash.

Hello,

In my investment account I have Telus dividends automatically reinvested. In the account’s transaction history the date column has 2 dates that are the same (“T: Oct. 06, 2021” and “S: Oct. 06, 2021”). The description column shows “TELUS CORPORATION REINV@C$27.6242 REC 09/10/21 PAY 10/01/21”.

My first question is which is the correct date to enter in my ACB transaction? Most of the reinvested dividends in this account for other stocks and ETFs have matching dates for T, S, and PAY. I don’t understand why in this case T and S are 3 trading days later than PAY date. In another case (ALGONQUIN POWER & UTILITIES CORP), PAY is 07/15/21 while T and S are Jul. 21, 2021 (4 trading days later).

Second question is how can T and S be the same date? Isn’t settlement supposed to be T+2?

Thank you.

Karim,

It sounds like you should use October 6, 2021. The timing and rules for settlement of purchases and sales may not be the same for DRIP.

Also, the exact date won’t have any impact in the calculations if there aren’t any sales at around the same time.

Hi,

Here is an example I created to try calculating Adjusted Cost Base with Reinvested Distributions / Dividend Reinvestment Plans (DRIPs) IN FOREIGN CURRENCY SECURITY.

Example made by myself :

*** For this example, I am reusing the same numbers as Example2 in “Calculating Adjusted Cost Base with Reinvested Distributions / Dividend Reinvestment Plans (DRIPs)” with the modification of the 12 shares with a total amount of $297.6. However, I replaced the security from XYZ to PepsiCo stock (PEP) since it is in $US. Also, the dates, the year and the exchange rate are changed and the following transactions have been added/modified:

– On January 1 1971, conversion of 2 268.40$US at a rate of 1.00 $CAD = 0.10 $US. No commission fee.

– On January 2 1971, addition of US $ 1.00 as transaction fees for the purchase of the title

– On October 1 1971, sale of 1070 shares of PepsiCo at a price of US $ 2.14 at an exchange rate of US $ 1.00 = CAD $ 10.00, with a charge of US $ 1.00 for the sale of the stock

– On October 10, 1971, conversion of US $ 23,342.2500 to CAD $ at a rate of US $ 1.00 = CAD $ 20.00

I am therefore trying to calculate the ACB on the PepsiCo stock for the year 1971

Also, since PepsiCo trades in US $, we also need to calculate the ACB on the US currency. To do this, it is necessary to use all transactions for the year 1971 on all securities and transactions made in US $. In this example, only the transactions in this example were made on a unique US currency, and therefore having no other transaction in this currency, in order to facilitate understanding. Thus, the ABC for PepsiCo and for the US currency for 1971 would be calculated as follows:

At the beginning of 1971, the ABC for the PepsiCo is 0.00$ and the ABC for US$ Currency is 0.00$. Both ABC would be:

PepsiCo’s ACB = 0.00 $CAD

ACB of $US currency = 0.00 $CAD

On January 1 1971, conversion of 2 268.40$US at a rate of 1.00 $CAD = 0.10 $US. No commission fee. Both ABC would become:

PepsiCo ACB = 0.00 $CAD (No change on PepsiCo ABC since no transaction on PepsiCo Security. Conversion of Currency doesn’t affect ABC of a security)

ACB of $US currency = 22,684.00 $CAD (For input: Buy 2268.40$US. Shares = 1. Commission = 0.00$)

On January 2 1971, purchase of 1,060 shares of PepsiCo stock at a price of US $ 2.14 per share and a transaction fee of 1.00$US at an exchange rate of 1.00 $CAD = 0.10 $US. Both ABC would become:

PepsiCo ACB = 22 694.00 $CAD (For input: Buy 2.14$US. Shares = 1060. Commission = 1.00$US)

ACB of $US currency = 0.00 $CAD (For input: Sell 2268.40$US. Shares = 1. Commission = 0.00$US)

On September 2 1971, Return of the Capital of 8,029 $US at an exchange rate of 1.00 $CAD = 0.10 $US. Both ABC would become:

PepsiCo ACB = 22 613.71 $CAD (For input: Return Of Capital 80.29$CAD total)

ACB of $US currency = 0.00 $CAD (No transaction on Foreign Currency. Return of Capital doesn’t affect ABC of foreign currency)

On September 3 1971, receive a distribution of 12 shares at a price of US $ 2.48 per share at an exchange rate of 1.00 $CAD = 0.10 $US. Both ABC would become:

PepsiCo ACB = 22 911.31 $CAD (For input: Buy 2.48$US. Shares = 12. Commission = 0.00$US)

ACB of $US currency = 297.60 $CAD – 297.60 $CAD = 0.00 $CAD (For input: Buy then Sell 29.76$US. Shares = 1. Commission = 0.00$)

On September 5 1971, receive a distribution of US $ 2,356 in cash at an exchange rate of 1.00 $CAD = 0.10 $US. Both ABC would become:

PepsiCo ACB = 22 911.31 $CAD (No change on PepsiCo ABC since no transaction on PepsiCo Security. Distribution in cash doesn’t affect ABC of a security)

ACB of $US currency = 23.56 $CAD (For input: Buy 2.356$US. Shares = 1. Commission = 0.00$)

On October 1 1971, sale of 1,070 shares of PepsiCo stock at a price of US $ 2.14 per share and a transaction fee of 1.00$US at an exchange rate of 1.00 $CAD = 0.10 $US. Both ABC would become:

PepsiCo ACB = 42.74 $CAD (For input: Sell 2.14$US. Shares = 1070. Commission = 1.00$US)

ACB of $US currency = 22 921.56 $CAD (For input: Buy 2289.80$US. Shares = 1. Commission = 0.00$)

On October 10 1971, conversion of 2 289.80$US to CAD $ at an exchange rate of 1.00 $CAD = 0.10 $US. Both ABC would become:

PepsiCo ACB = 42.74 $CAD (No change on PepsiCo ABC since no transaction on PepsiCo Security. Conversion of Currency doesn’t affect ABC of a security)ACB of $US currency = 0.00 $CAD (For input: Sell 2289.80$US. Shares = 1. Commission = 0.00$)

=========

For the PepsiCo security, this example gives a Capital Gain of 19.43 $CAD on the transaction of October 01 1971, which make sense to me. (1070*2.14$US*10$CAD/$US – 1070*21.3725 $CAD – 1.00 $US*10$CAD/$US = 19.425 $CAD)

However, what I don’t understand by doing this example in adjustedcostbase.ca is that I get a capital lost on the transaction of October 10 1971 of 23.56$ CAD. This is unexpected since the exchange rate used in this example doesn’t vary and is always 1.00 $CAD = 0.10 $US. In this example, I was expecting that the foreign currency wouldn’t have any effect and therefore a capital gain of 0.00$ on the foreign currency, since the exchange rate doesn’t vary in this example.

Could you tell me what I am doing wrong please.

Guillaume,

A corporation’s dividends would not consist of return of capital. And in this case, a foreign entity’s distributions would likely be classified as foreign income, regardless of the classification in the foreign jurisdiction.

But assuming there was a cash distribution of US$8.029 then your ACB of US$ would increase by CAD$80.29 and your share balance of US$ would increase by 8.029 (this is the case regardless of whether the distribution is classified as return of capital, or otherwise).

In the case where you are enrolled in a DRIP, I would not suggest considering this as a purchase of US$ followed immediately by a sale of US$. Since you never hold a cash balance of US$, I don’t think this is necessary.

Finally, capital gains were introduced in Canada in 1972 so you would not have incurred any capital gains in 1971.

Dividends do not affect my ACB and for tax purpose get grossed up then the tax credit applied, Dorel is paying a “special dividend” will that be treated the same please? Thank you

Joe,

According to this document filed on SEDAR:

https://www.sedar.com/GetFile.do?lang=EN&docClass=14&issuerNo=00003790&issuerType=03&projectNo=03323937&docId=5113500

The US$12 special dividend will be designated as an eligible dividend:

Therefore there should be no impact on the ACB of your Dorel shares resulting from the special dividend.

thank you

Question regarding DRIPS and how to enter transaction fees charged to be included in the ACB.

It is mentioned earlier on this page to include a transaction fee if it is charged, but how does one properly enter it on the data entry screen?

When selecting Dividend Reinvestment from the Transaction Drop down box, the Commission box is not available to enter the transaction fee so where would one enter it so that it is included in the ACB?

USD Example (let’s ignore the Currency exchange to simplify)

Dividend paid: 31.00

Tax withheld: 5.00

Net Dividend: 26.00

Div to Reinvest: 26.00

Transaction fee: 1.50

Net Amount: 24.50

Share Price: 40.00

Fractional Shares Bought: .6125 (24.50/40.00)

In the Price (Total) field, would I enter?

A. 26.00 (ie 24.50 + 1.50)

B. 24.50

C. 27.50 (ie 26.00 + 1.50)

Thanks in advance.

Geo

Geo,

You should include the fee in the total amount if there is one in a Reinvested Dividend transaction. For your example you would input $26.00 as the total amount. Alternatively, you could use a Buy transaction and input the commission ($1.50) and net amount ($24.50) separately.

When a distribution that is 100% return of capital is re-invested, is there an increase in the amount of units held based on the dollar value of the ROC payment? Ie. NAV is $10 and 100% ROC distribution of $5 is re-invested. Would you shares increase by 0.5 shares?

Ronshow,

The number of units purchased as a result of the reinvestment should correspond to what your brokerage reports.

If it’s a phantom distribution, then there would generally not be an increase in the number of units owned.

Hi, my questions relate to a Manulife financial drip. Since the inception of the manulife drip all of my dividends have been set up to automatically be re invested through their program and I have paid annual taxes accordingly. Over the years I have accumulated approx 1000 shares through this program.. In July of this year I cashed in 150 shares. In calculating the adjusted cost base do I use the adjusted cost of the first 150 shares accumulated through the drip or do I use the adjusted cost base for the full 1000 shares accumulated from the inception of the program through to present day.

Also I received approx 1375 shares when MFC demutualize (adjusted for stock split) when these are cashed in would the adjusted cost base be the current market value at the time they are cashed in. Thanks,

Steve,

Your ACB immediately before the first sale would be based on the cost of the shares originally purchased, plus the cost of the approximately 1,000 shares accumulated through the DRIP. Your ACB is calculated among all your shares owned of the same kind throughout all your personal non-registered accounts. In Canada there is no option to pool shares into groups (except in some instances for employee stock options).

Thanks ,and , when I eventually redeem the 1375 shares I initially received at the time of demutualization of Manulife and for which I did not pay anything would the adjusted cost base be zero. These demutualized

shares along with the shares obtained and accumulated through the DRIP are separated on the AST statement of the Manulife stocks that I receive quarterly.

Hi,

While filing my taxes I used AdjustedCostBase.ca’s premium service ( it’s REALLY helpful)! I found that one of the funds I own, has issued a reinvested dividend for which I was taxed a capital gains tx of $421. However, upon checking transaction history, I see, I did not receive any additional shares… I contacted my broker and they told me, since I have not turned on DRIP, I’ve received a cash payment for this reinvested dividend ( which I could not located in my statement for Dec 21). Do I talk to my broker about this? Who issues the funds or the shares? Do I receive the shares from the broker or the fund itself?

Sid,

Is it possible this was a phantom distribution? See the following:

https://www.adjustedcostbase.ca/blog/phantom-distributions-and-their-effect-on-adjusted-cost-base/

Thank you for your reply.

I checked the financial statement of the fund and it shows:

“Reinvestment of distribution to holders of redeemable units” …

does that indicate they gave our shares to unitholders? or is that regarded as phantom? My broker is still to get back to me regarding this issue

Sid,

I can’t tell based on that information, but please feel free to share the name of the fund.

You can also check the fund’s web site or reach out to them. If it’s a publicly traded fund you can also lookup the information as described here:

https://www.adjustedcostbase.ca/blog/tax-breakdown-service-for-etfs-and-trusts-from-cdsinnovations-ca/

I have a BCE Drip that I sold in 2021 and I hold conventional BCE shares in another account. Do I have to pool these two together to get my acb for tax purposes for the sale of the DRIP?

Mary,

All personal holdings in non-registered accounts should usually be tracked jointly for the purposes of calculating ACB, even if the same shares are held in different brokerage accounts (the only exception I’m aware of is for certain cases involving employee stock options).

I have a few thousand shares of XAW, and I’m a little confused after doing the “Streamlined Import of Tax Information” function on adjustedcostbase.ca for the 2022 tax year.

The import of the 2022 data worked fine for XAW, and I see three new transactions in my transactions list for XAW. The one that I’m not understanding is an end-of-year “Reinvested Cap. Gain Dist.”, showing an amount per share of $0.32441, with an associated capital gain of $2,047 based on my holding of 6,310 shares.

What’s confusing to me is that when I compare this against my 2021 tax import, the only similar end-of-year transaction is a “Capital Gains Dividend” (NOT a “Reinvested Cap. Gain Dist.”), showing an amount per share of $0.06069 resulting in a capital gain of $380.77 on 6,274 shares.

This 2022 capital gain of $2,047 is of course fairly significant, so I’m just trying to understand how come it’s so high this year, and how come this “Reinvested Cap. Gain Dist.” transaction is here for 2022, when there was a different type of transaction for 2021 that resulted in a much lower capital gain.

Dave,

XAW incurred a phantom distribution at the end of 2022. There was no phantom distribution for 2021. In 2022, XAW had cash distributions with a return of capital component but no capital gains component. In 2021, XAW had cash distributions which included both return of capital and capital gains.

Hmmm…I guess I’m still not understanding. In your reply, you said that in 2022, XAW had cash distributions “with no capital gains component.” But when I imported the 2022 XAW transactions to adjustedcostbase, it shows a $2,000 capital gain in the “Capital Gain (Loss)” column…?

Dave,

The cash distributions for 2022 had no capital gains component. But the non-cash (phantom) distribution for 2022 was entirely comprised of capital gains. So to summarize:

2022:

– Cash distributions consisting of return of capital and other allocations (but not capital gains)

– Non-cash distribution consisting of capital gains

2021:

– Cash distributions consisting return of capital, capital gains and other allocations

– No non-cash distribution

Thank you for the reply. So, when I run the capital gains report from adjustedcostbase.ca, the PDF shows a $125 capital gain under column 5 (Gain or Loss); and under the capital gains table, there’s a comment that says: “1. Total capital gains from T-slips: $2,047.46.” When reporting my capital gains on my tax return, what should I be putting: $125, or $2,047.46?

Dave,

The capital gains reported on T-slips should end up on liens 17400 and 17600 on Schedule 3. But if filing using tax software then you shouldn’t need to worry about this beyond inputting your T-slip information.

The details of each row shown on the capital gains report should be reported on Schedule 3. Tax software should provide a means for reporting gains in a similar format.

Yes, that’s what I’m asking. So you’re saying in Schedule 3, I should just report the capital gains shown in column 5 in the table from the adjustedcostbase PDF Capital Gains Report? i.e. for me it would be $125, not the $2,047.46 shown as a comment below the table on your report? My tax software is Wealthsimple Tax, so it just offers one line where I enter the capital gains information. Of course, I’ll enter the T3 slip info I receive from my brokers as well….but for the capital gains info, I just want to be absolutely clear that I should just be entering the info from the adjustedcostbase TABLE itself, not the COMMENT below the table, correct?

Dave,

The total capital gains from T-slips value ($2,047.46) does not need to inputted into the Capital Gains (Schedule 3) section on Wealthsimple Tax. This will be accounted for after inputting your T3 slips. Only the data from the table should be inputted into the Capital Gains section.

Hello, in the cases of monthly distributing ETFs (eg. XEI, XDV), how should I properly book the year-end distributions when there are: i) ROC, ii) a non-cash component (entirely cap gains distr), and iii) a reinvested dividend transaction into additional shares? As of now, I currently do the following:

1/ Dec 30, ROC (reducing ACB)

2/ Dec 30, reinvested cap gains distr (increasing ACB)

3/ Dec 31, reinvested dividends into new shares (further increasing ACB)

Would this be accurate or am I anyhow double counting the ACB increased from steps 2 and 3?

Thanks!

Henry,

Using the December, 2022 distribution for XEI as an example, it has the following components:

– Cash distribution of $0.13571/share

– Non-cash distribution of $1.93810/share

– Capital gains distribution of $1.93810/share

– Return of capital of $0.00018/share

– Other income allocations are not relevant

This can be represented with the following transactions on AdjustedCostBase.ca:

– “Reinvested Capital Gains Distribution” of $1.9381/share

– “Return of Capital” of $0.00018/share

– “Reinvested Dividend” with the actual amount of cash reinvested and number of shares received

Note that the “Reinvested Dividend” transaction may or may not correspond to the full amount of the cash distribution. In cases where cash is received in lieu of fractional shares, only the actual reinvested amount should be included.

In the case where capital gains are less than the non-cash distribution amount, the “Reinvested Capital Gains Distribution” should only correspond with the capital gains amount. A “Reinvested Dividend” transaction should be added for the difference (for 0 shares). In the case where the non-cash distribution amount is less than the capital gains amount (as is the case for XDV in 2022), the “Reinvested Capital Gains Distribution” amount should only correspond with the non-cash distribution amount. A “Capital Gains Dividend” transaction should be added for the difference.

I’m afraid I’ve confused myself regarding entering dividends, specifically in regards to CAD vs USD securities.

I understand that I need to enter into ACB the purchase of any new shares as a result of my brokerage’s synthetic DRIP program, whether they are USD or CAD.

I also understand that I need to track ACB for any foreign currencies, in this case USD.

My question is, do I need to make an entry for the total amount of cash dividends received in either currency, prior to making an entry for the purchase of additional shares via the DRIP? Or is this only necessary for dividends received in USD?

Susan,

Although I’m not aware of any specific guidance on this, I would recommend not considering reinvested US$ dividends as a deemed purchase and sale of US$ cash. This will simplify things. For any residual cash received (in the case where only a whole number of shares is acquired), you can input a “Buy” transaction for US$ cash for the residual amount based on the fair market value of US$.

Hi, for monthly dividend ETFs (eg XEI), should reinvested Dec 2023 distributions (record date of the dividends was Dec 29 per Blackrock’s website) be recorded as of 2023 – even if additional shares were only received in early Jan 2024? Or should the additional shares be recorded on the date of share receipt in 2024? TIA!

Henry,

I would suggest recording this based on the payment date of the distribution (i.e., early January 2024 in this case). However, the exact date of the reinvestment is less relevant than the relative order between the reinvestment and any sales of the same units (or return of capital/phantom distributions if they are recorded on a per-unit basis).

Hello,

I understand that if dividends are paid in cash (i.e. because it’s not enough to purchase a share) it doesn’t effect the ACB and I don’t need to enter the transaction. But I’m just curious what type of transaction it is? Dividend?

Jocelyn,

You do not need to input any transaction into AdjustedCostBase.ca for a dividend from a corporation that’s received in cash. For distributions received in cash from ETFs and funds, you may need to include a “Return of Capital” transaction.

I received a t5008 for an American mutual fund which i purchased from an American savings account, i don’t have all the statements, just the first year 2014 and last seven years with a gap of two years. I have to convert the American cost to Canadian but have a question. Do i have to convert each purchase transaction and income reinvested to Canadian? With a two year gap of statement info I don’t know the # of shares, dates or invested income transactions. So how do i get a correct cost value in Canadian?

Rebecca,

Yes, the ACB should be determined by converting the costs into CAD$ based on the exchange rates at the time of each purchase (rather than converting the aggregate cost in US$ into CAD$ based on the exchange rate at the time of the sale). If you don’t have your transaction history then the best you can do is make an estimation.

I have a relative that has a DRIP for one of the big banks for over 20 years.

She wants to liquidate this portfolio now.

I don’t think she calculated the ACB for any of those over 80 (20 years x 4 quarters) reinvested shares.

Was is the best way to calculate the proper ACB for all those periods, so that the capital gains calculation can be made?

Does the DRIP have all the history of share prices for those 20+ years?

John,

There is some information on this topic available here:

https://www.adjustedcostbase.ca/blog/calculating-capital-gains-with-incomplete-records/

Note that some of the big banks have online tools for calculating historical investment returns on there shares, for example:

http://www.research.cibc.com/investorRelations/InvestmentCalculator.asp

https://www.rbc.com/investor-relations/share-information.html

https://www.td.com/ca/en/about-td/for-investors/investor-relations/share-information/share-price-tools/investment-calculator

These won’t necessarily directly provide you with the information you need, however, you could work backwards by trial and error to figure out the original investment required that gives you the share balance/market value for today.

It should also be possible (though not simple) to calculate the ACB yourself based on historical dividend and price information.

Hi.

I recently closed out the full position of a non-registered Canadian listed stock in order to harvest some capital loss. The stock had been in a synthetic drip with my brokerage.

The sale was made 5 days after the ex-dividend date and 25 days before the dividend was paid.

I forgot to ask my broker to remove the stock from the DRIP so I wound up with new shares.

Do I have a synthetic loss?

Thanks,

Steve

Steve,

If the DRIP occurred within 30 days of the capital loss and you still owned those shares 30 days following the sale, then the superficial loss rule would apply.

However, the superficial loss rule would likely only need to be applied to a small portion of the loss. Please see the following:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

In particular, the superficial loss would be equal to:

Superficial Loss = (B / A) x (Total Loss)

where A is the number of shares sold and B is the number of shares reacquired.

If, for example, you sold 1,000 shares at a loss and acquired 10 shares via the DRIP, then only 1% of the loss would be considered a superficial loss (and could be re-added to the ACB of the acquired shares.