The superficial loss rule defines certain circumstances when capital losses are denied. The details of the superficial loss rule are discussed here:

What Is the Superficial Loss Rule?

Here we’ll expand on the superficial loss rule by discussing some cases when a loss can be partially denied instead of being denied in full.

When the quantity of property reacquired (or pre-acquired or remaining) in the superficial loss period is equal to the quantity of property that was sold, the superficial loss rule denies the capital loss in full. However, in some cases where these quantities (i.e., the number of shares or units) are not equal, the superficial loss rule will sometimes allow a portion of the capital loss to be claimed while the remainder is denied. The Canada Revenue Agency describes its position on applying the superficial loss rule to the partial disposition of shares in section 12 of interpretation bulletin IT-456R:

When more items are sold than acquired, an allowable capital loss will occur. For example, if a taxpayer having initially 50 identical properties on hand sells 20 items at a loss and reacquires 15 in the relevant period, thus reducing the properties on hand to 45, the superficial loss will be limited to the 15 properties considered to be reacquired.

The partial application of the superficial loss rule can be explained in different ways, depending on the circumstances. For certain cases, the application of the rule is simpler than in others. The rule will be described below in the context of a couple classes of simpler cases, followed by a general formula that can be applied for more complex cases. The simpler cases are the following:

- When shares are sold at a loss and then partially reacquired within the superficial loss period

- When shares are purchased and then partially sold within the superficial loss period

When Shares are Sold at a Loss and then Partially Reacquired within the Superficial Loss Period

This is the case where you own A or more shares, sell A shares at a loss (more than 30 days after the last acquisition date), and then reacquire B shares (within 30 days after the sale date) where B is less than A. No other sales or acquisitions occur during the superficial loss period.

In cases like this, the superficial loss rule will be applied based on the proportion of shares reacquired compared to the number of shares sold. If more shares are reacquired than sold (B > A) then the entire capital loss would be deemed a superficial loss. Let’s look at the following example (commissions are omitted for simplicity):

Example 1

- Buy 100 shares at a total cost of $300.00 ($3.00/share) on January 2, 2015

- Sell 100 shares with total proceeds of $200.00 ($2.00/share) on April 9, 2015

- Buy 25 shares at a total cost of $55.00 ($2.20/share) on April 10, 2015

- Shares are held for at least 30 more days and no other transactions on identical property occur within the 61-day superficial loss period

From the sale on April 9, 2015 a loss of $100.00 is realized ($200.00 – $300.00). However, since 25 shares are reacquired on the following day and the reacquired shares are held for at least 30 more days, the superficial loss rule applies. According to the CRA’s administration of the rule for the partial disposition of shares, 25% (25 / 100) of the loss would be denied. A capital loss of $75.00 can be claimed, while the remaining $25.00 would be deemed a superficial loss and can be added to the adjusted cost base of the reacquired shares (making the total ACB of the reacquired shares ($25.00 + $55.00) = $80.00).

In cases where the number of shares reacquired (B) is greater than the number of shares sold (A) then the superficial loss rule will deny the entire capital loss. In the example above, if 100 or more shares were reacquired instead of 25 shares, then the loss would be fully denied.

In cases like this where B is less than A then the following formula can be applied to determine the superficial loss:

Superficial Loss = (B / A) x (Total Loss)

= ((Number of Shares Reacquired) / (Number of Shares Sold)) x (Total Loss)

The allowable capital loss can be found by subtracting the superficial loss from the total loss:

Allowable Capital Loss = Total Loss – Superficial Loss

When Shares are Purchased and then Partially Sold within the Superficial Loss Period

This is the case where you purchase A shares, and then sell B shares at a loss within the superficial loss period (within 30 days following the acquisition date) where B is less than A. No other sales or acquisitions occur within the superficial loss period.

In cases like this, the superficial loss rule will be applied based on the proportion of shares remaining compared to the number of shares sold. If more shares are remaining than sold ((A – B) > B) then the entire capital loss would be deemed a superficial loss. Let’s look at another example (commissions are omitted for simplicity):

Example 2:

- Buy 100 shares at a total cost of $300.00 ($3.00/share) on April 9, 2015

- Sell 80 shares with total proceeds of $160.00 ($2.00/share) on April 10, 2015

- The remaining shares are held for at least 30 more days and no other transactions on identical property occur in the 61-day superficial loss period

From the sale on April 10, 2015 a loss of $80.00 is realized ($160.00 – ($300.00 x (80 shares / 100 shares))). However, since the shares were acquired on the previous day (within the superficial loss period) and the remaining shares are held for at least 30 more days, the superficial loss rule applies. According to the rules for partial disposition of shares, 25% (20 / 80) of the loss would be denied. This means that a capital loss of $60.00 can be claimed, while the remaining $20.00 would be deemed a superficial loss and can be added to the adjusted cost base of the remaining shares (making the total ACB of the remaining 20 shares (($300.00 x 20 / 100) + $20.00) = $80.00).

In cases where the number of shares remaining (A – B) is more than the number of shares sold (B) then the superficial loss rule would deny the entire capital loss. In the example above, if 50 or fewer shares were sold instead of 80 shares, the loss would be fully denied. In other words, in cases like this, when less than half the shares are sold then the loss is fully denied. When more than half the shares are sold then the loss is partially denied.

In cases where (A – B) is less than B (more than half the shares are sold) then the following formula can be applied to determine the superficial loss:

Superficial Loss = ((A – B) / B) x (Total Loss)

= ((Number of Shares Remaining) / (Number of Shares Sold)) x (Total Loss)

The allowable capital loss can be found by subtracting the superficial loss from the total loss:

Allowable Capital Loss = Total Loss – Superficial Loss

When Multiple Acquisitions and/or Multiple Dispositions Occur Within the Superficial Loss Period

When the superficial loss period (the time window beginning 30 days before and ending 30 days after the date of disposition) contains multiple sales and/or multiple acquisitions then it can become more complex than the two types of scenarios described above.

In such cases the following general formula for the superficial loss rule for partial dispositions of property can be used:

Superficial Loss = (min(S, P, B) / S) x (Total Loss)

where S is the number of shares sold, P is the total number of shares acquired during the 61-day superficial loss period, and B is the number of shares remaining at the end of the superficial loss period. Note that min(S, P, B) indicates the minimum value among S, P and B.

And once again:

Allowable Capital Loss = Total Loss – Superficial Loss

If we apply the general formula with the two simpler cases above (where only one acquisition and one disposition occur during the superficial loss period) it should yield the same results. But the formula can also be used for more complex cases where there are multiple sales and/or multiple acquisitions during the superficial loss period.

Avoid Headaches by Deferring the Entire Capital Loss for Simplicity

The conditions for partially applying the superficial loss rule for partial dispositions provide an advantage to Canadian investors. Instead of using a strict interpretation of the superficial loss rule in these kinds of cases that denies losses in full, the CRA allows investors to partially claim the loss.

But you’re not obligated to partially claim the loss; you can opt for the entire loss to be denied (and carried forward in most cases). If the loss is relatively small it may not be worth the headache of performing these calculations to determine the partially allowable loss. And remember that when the superficially loss rule denies a capital loss, the amount of the capital loss can usually be added to the ACB of the reacquired shares, so that the loss is effectively carried forward as opposed to being permanently denied.

Applying the Superficial Loss Rule to the Partial Disposition of Shares with AdjustedCostBase.ca

AdjustedCostBase.ca is a web-based application that allows Canadian investors to track ACB and calculate capital gains. AdjustedCostBase.ca supports the superficial loss rule by identifying many cases where the rule may apply and allowing users to apply the rule. It can also be used to partially deny a capital loss.

Let’s take another look at example 1 from above:

- Buy 100 shares at a total cost of $300.00 ($3.00/share) on January 2, 2015

- Sell 100 shares with total proceeds of $200.00 ($2.00/share) on April 9, 2015

- Buy 25 shares at a total cost of $55.00 ($2.20/share) on April 10, 2015

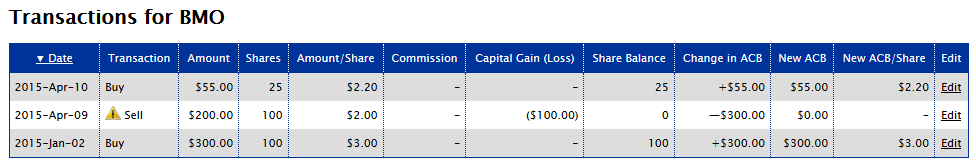

After entering these transactions on AdjustedCostBase.ca you should see the following:

A capital loss of $100.00 is indicated for the sale on April 9, however, you’ll see a warning that the superficial loss rule may apply. Indeed, the rule applies in this case due to the reacquisition of 25 shares on the following day. However, since only a partial amount of shares were reacquired, you’re allowed to claim a loss of $75.00 while $25.00 of the loss is denied, as described above in the original example.

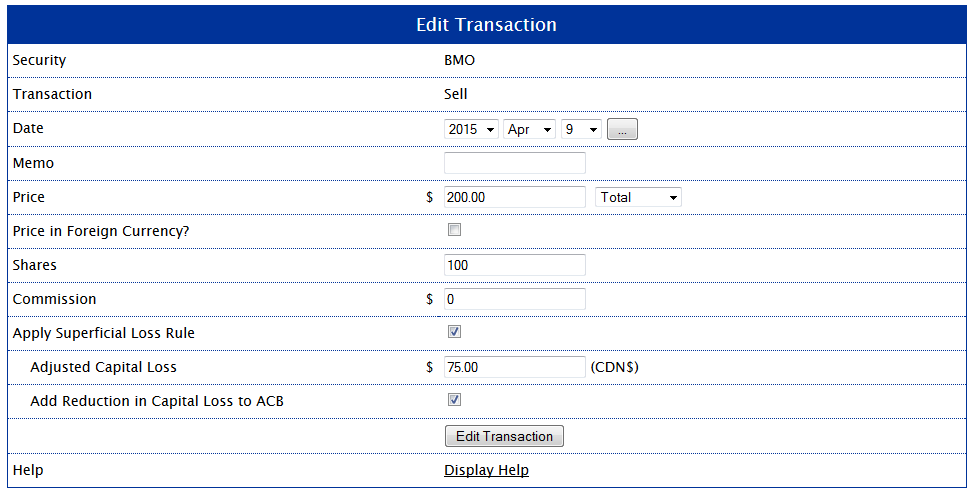

To apply the superficial loss rule, click on the “Edit” link for the April 9 sale to edit the transaction. Then check off the “Apply Superficial Loss Rule” checkbox, set the “Adjusted Capital Loss” to $75.00 and ensure that the “Add Reduction in Capital Loss to ACB” is checked off. The form should appear as follows:

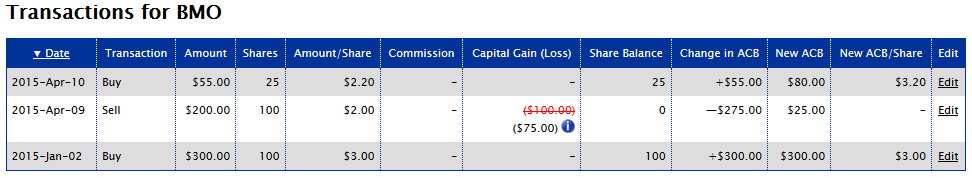

After editing the transaction the list of transactions should appear as follows:

The capital loss has now been reduced from $100.00 to $75.00. Also, the reduction in capital loss has been added back to the ACB.

Note that AdjustedCostBase.ca does not automatically apply the superficial loss rule for you. Although you’ll see superficial loss rule warnings being displayed in many cases, it’s up to you to edit the transaction to apply the superficial loss rule. Also, in cases where you’re partially claiming a loss due to the superficial loss rule, you’ll need to manually calculate the partial capital loss using the methods described above.

Hi, I transferred 100,000 shares of Stock X and contributed it to my RRSP. The superficial loss amount is $4000. I still own shares of Stock X in my regular margin account. Do I need to put anything in the field “Adjusted Capital Loss” or leave it blank.

thanks.

Jas,

In this case the Adjusted Capital Loss field should be set to $0 since the loss is fully deferred. You can also leave the field blank and it will have the same effect.

Hi,

Does the superficial loss rule apply to the following example?

I have owned 500 shares of Company A for more than 60 days with an ACB of $10/share ($5000 in total).

Company B has agreed to purchase Company A for a total of $8 per share consisting of $6 per share in cash and $2 per share of Company B shares.

The cash received for my 500 shares is $3000 and the value in shares of Company B is $1000.

If I wish to keep the shares of Company B can I claim a loss of ($5000(0.75) – $3000) =$750 for the cash portion that I received or is that fully denied as a superficial loss.

Would the ACB of the newly acquired shares with a present value of $1000 be $1250?

Thanks.

Frank,

The tax rules for acquisitions can vary. Your best bet is to look for documentation on the tax implications for this specific merger.

In general, the ACB allocation for Company B would be based on the ratio of the value of shares received and the total compensation, multiplied by your existing ACB for company A. So it would likely be equal to ($2/$8) * $5,000 = $1,250. But again you should look for the documentation that’s specific to this case.

I don’t think that the superficial loss rule would apply because shares of Company A and Company B are not identical properties.

Judging by the general formula, I think I have a partial capital loss I can claim in this situation, but the two basic cases don’t cover this case so I’m not positive.

Shares acquired before 61 day period:

5,457

Shares acquired less than 30 days before sale:

361

Shares Sold:

1393

(No activity less than 30 days after sale)

By my calculations, 361/1393 is a superficial loss (25.9%). The rest I could claim as a capital loss. This seems to go along with the rules in the CRA bulletin, but doesn’t seem to align with your blog post. Comments?

CG,

Your case does apply for either of the two simplified cases above (after making a purchase you sold more shares than were purchased) so you need to use the general formula:

Superficial Loss = (min(S, P, B) / S) x (Total Loss)

= (min(1393, 361, (5457 + 361 – 1393)) / 1393) x (Total Loss)

= 0.2592 x (Total Loss)

which matches what you calculated.

how can these losses be filed correctly to reflect superficial tax loss rule? THX

[redacted]

Ralph,

You can enter your transactions on AdjustedCostBase.ca and you’ll see warnings when the superficial loss rule may apply, as described here:

http://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-with-adjusted-cost-base-ca/

If one were to sell all shares of a security in a non-registered account at a loss, but still hold some shares of it (purchased prior to the superficial loss period) in a registered account, would this result in a partial superficial loss? Based on this formula:

Superficial Loss = (min(S, P, B) / S) x (Total Loss)

Would B be non-zero, since there are still shares held in the registered account?

Leslie,

Yes, shares held in registered accounts need to be factored in. However, for the superficial loss rule to be triggered you would need to purchase some shares (in any of your accounts) within the superficial loss period.

I am having difficulty following all the examples. Here is my situation:

I have a nonregistered account and I have let’s say 1000 shares of XXX.

I move 30-60% of the shares to registered accounts ( or sell in source account and buy back in those registered accounts) . I have a small capital loss on the shares transferred. I am not very interested in claiming the loss. Can I carry those losses forward in the ACB?

Stef,

When transferring shares from a registered account to a non-registered account, the superficial loss rule will apply when you incur a capital loss. This loss will be permanently denied as you cannot add the loss back to the ACB of any shares in your non-registered account.

Note also that the superficial loss rules for a partial disposition of shares would not apply in that case because the number of shares deemed to have been disposed of and the number of shares deemed to have been reacquired are equal.

Thanks for the fast answer. It seem that I actually sold in the source account ( that is a company account that I control) and bought back after 2 days in the registered personal account. What happens if I reacquire the same number of shares in the source account within the 30 days. Would that save the capital gain loss for the source account?

Stef,

The superficial loss would apply in that case, and you would not be able to claim the loss. You would need to wait at least 30 days to repurchase the shares in order to avoid the superficial loss rule.

It seems my question was not clear. What I really care is to be able to carry forward the superficial loss in he ACB. So in my case here is the sequence of events:

-have 1000 shares in a company account

– I sold 200 shares with a loss

-after 2 days in a registered account I bought 500 shares of the same stock

I still have 20 days or so to make a trade within the 30 days window in the original account. My goal is to “save the superficial loss” in the ACB.

Isn’t enough that I still owe 800 shares in the original account to adjust its ACB with the superficial loss?

Would buying 200 shares in the original account achieve that?

Stef,

The only certain way I’m aware of to avoid the loss being classified as a superficial loss would be to sell all of your shares of this type – both in your registered account and non-registered account. Then the loss would be allowable, as long as you avoid repurchasing the shares for at least 30 days.

As an example:

– I purchase 100 shares of XYZ in 2016

– I sell 50 shares of XYZ on May 1, 2018 at a capital loss in my non-registered account.

The very next day, on May 2, 2018, I make the following two purchases:

– 50 shares of XYZ in my separate registered account

– 50 shares of XYZ in my non-registered account

According to the formula in this blog post, this should be a superficial loss with the entire amount being denied.

My question is: can I add the loss to my adjusted cost base in my non-registered account, or is the loss permanently denied because I also purchased the same shares in my registered account?

Jacob,

Yes, the entire capital loss would be a superficial loss in that case.

In cases with the repurchase of shares occurs in a registered account, the capital loss is permanently denied and cannot be added back to the ACB of any remaining shares in a non-registered account. I’m not sure what would happen in the case where shares are repurchased in both non-registered and registered accounts. In this particular case it would seem fair to allow half of the loss to be added back to the ACB of the shares in the non-registered account, but I’m not entirely sure.

I have a question regarding the following:

Date Qty Price Cost Adj Total Qty Total Cost “Average Cost” Gain/Loss

2018-11-03 300 35 10,500.00 300 10,500.00 35.00

2018-11-05 100 28 2,800.00 400 13,300.00 33.25

2018-11-07 300 25 7,500.00 700 20,800.00 29.71

2019-01-03 100 22 2,200.00 800 23,000.00 28.75

2019-02-01 -100 25 -2,500.00 700 20,125.00 28.75 -375.00

Within the 61 day period:

Superficial Loss = (min(S, P, B) / S) x (Total Loss)

Where S = sold, P = purchased, B = remaining (balance)

Applying the above formula to the sell on 2019-2-1:

Sold 100

Bought 100

Balance 0

Superficial Loss = (min(100, 100, 0) /100) x (375) = 0

This means the total capital loss of 375.00 can be claimed. Does this make sense or did I miss something somewhere?

TS,

Your share balance at the end of the superficial loss period appears to be 700 shares. In that case the entire capital loss would be considered superficial.

Thanks for the informative post. I was hoping you could clarify something for me. Would the same sale be used to create a capital loss multiple times beyond its initial number of shares?

ie: If I made the following transactions:

2016-01-01: Buy 500 XYZ at $100/share

2018-02-01: Buy 100 XYZ at $100/share

2018-02-05: Sell 100 XYZ at $50/share (loss)

2018-02-08: Sell 100 XYZ at $50/share (another loss)

Would all 200 share be denied the capital loss or would the first superficial loss use-up the buy and a capital loss be allowed on the second 100 shares?

Jon,

Based on my interpretation of the general formula:

Superficial Loss = (min(S, P, B) / S) x (Total Loss)

For the Feb. 5th sale, S would be 100, P would be 100 and B would be 400. Therefore 100% of the loss would be denied (but could be added back to the ACB). For the Feb. 8th sale, the values would be the same: S would be 100, P would be 100 and B would be 400. Again 100% of the loss would be denied.

Arguably, the two sales could be combined, resulting in S = 200, P = 100 and B = 400, in which case 50% of the loss would be allowable. However, I’m not clear on which method should be used.

I have the following pattern of sells and buys of pennyshare stock of ABC corp. (I am not a day trader and normally do not trade often).

Begin with holding of 1,912,650 shares of ABC,

May 14, sell 550,000 shares,

May 22, buy 200,440 shares,

May 22, sell 107,358 shares, (different broker account)

May 24, sell 225,750 shares,

May 24, sell 993,000 shares, (different broker account)

May 24, buy 92,200 shares,

May 24, buy 890,000 shares, (different broker account)

May 28, sell 200,440 shares,

May 28, sell 95,200 shares, (different broker account)

May 28, sell 890,000 shares (different broker account)

June 19, buy 4,008,800 shares.

all of these sales were made at a capital loss. How do I calculate the superficial loss for this series of transactions and what percent of the cap loss is left for the allowed part of the capital loss for each sale?

Thanks for the informative help but the previous examples were to simple for me to figure out how to handle this and if I can somehow sum the sales and the buys to simplify these transactions? I have resisted adding the transactions of the same day in order to report each broker account seperately.

Thanks for your help.

Please clarify for me: Is it the case the the 30 day count pre the sale in question starts on the transaction date, but the 30 day count post the sale in question ends on the settlement date?

sounds off to me, but is that the case?

Another thing that confuses me in the more complex cases that have multiple sales (at a loss) that are just several days apart how that stretches the the overall time frame to consider superficial loss? Does that change the time frame for the earlier sale just before this one? How do you determine the applicability of the second condition in these cases where we are out of the time frame of the earlier sale but still within the time frame of the latter sale and so on when there are more sales. And when there are buys inbetween them, how does that change things?

Hank,

You can use the formula above for each sell transaction:

Superficial Loss = (min(S, P, B) / S) x (Total Loss)

For example, for the sale on May 14, S would be 550,000, P would be (200,440 + 92,200 + 890,000) = 1,182,640 and B would be (1,912,650 – 550,000 + 200,440 – 107,358 – 225,750 – 993,000 + 92,200 + 890,000 – 200,440 – 95,200 – 890,000) = 33,542. This would give a percentage of (min(550,000, 1,182,640, 33,542)/550,000) = 6.1%. Therefore 6.1% of the loss would be superficial and 93.9% of the loss would be allowable.

This would need to be repeated for each sale. For each sale, the time frame is +/- 30 days from the settlement date of the sale.

Another option to simplify the calculations would be to cancel the entire loss and add it to your ACB. This would result in deferring your capital losses rather than them being permanently denied. This is especially worthwhile if you close out your position before the end of the year, as it will not impact the net capital gain or loss reported for the year.

The superficial loss period should be the period that starts/end 30 days before/after the settlement date.

For shares of “X”:

Nov. 4, 2019: Buy 200 shares for $2000 in Registered Account “A”

Nov. 5, 2019: Buy 400 shares for $4000 in Non-Registered Account “B”

Nov. 6, 2019: Sell 200 shares for $1000 in Non-Registered Account “B”

No other transactions within the 61-day period.

Can a Superficial Loss be applied to adjust the ACB of “X” in Non-Registered Account “B”? If yes, how would it be calculated?

I think I understand the formula for computing the superficial loss amount when multiple *transactions* are involved, but I don’t think it addresses the question of where the ACB adjustment is made when multiple *accounts* are involved.

For example, suppose I own 1000 shares, and sell 100 shares at a loss on March 1. I have two purchases within the 61 day period totalling more than 100 shares, lets say one is 40 shares, one is 70 shares. Then I believe the entire loss will count as superficial, because S = 100, P = 110, and B = 1010.

But if one of those two purchases (say the 40 share one) was to a TFSA, how is the ACB adjustment split between the two accounts? I assume I can’t assign it all to the taxable account (which only purchased 70 shares), but can I assign 70/100 parts of it? Does it matter what order the two purchases happened in?

DJM,

I am not entirely sure, but it seems reasonable to allocate the adjustment based on the proportion of shares repurchases. Using your example, 40/110 of the superficial loss would be added to the ACB of the shares in the TFSA and 70/100 added elsewhere.

Why do I get a superficial loss warning when I add a sell transaction that is not followed by a buy transaction?

Ben,

If a buy transaction is within 30 days before or 30 days after then the superficial loss rule may apply. Therefore a buy transaction occurring before the sell transaction may trigger the superficial loss rule. The other requirement is that you must still own shares 30 days after the sale.

By “buy transaction”, are we including shares acquired under a re-investment plan?

Thank you.

TS,

I’m not aware of any rule that exempts shares acquired via a DRIP from the superficial loss rule.

I recently sold BNS shares at a loss, subsequently received a drip in the form of more shares within the 30 day window. is there any way to correct this and avoid a superficial loss? also would all my loss be denied? thanks for your help

Steve K,

Yes, the superficial loss rule would apply in that situation. However, only part of loss corresponding to the amount of shares purchased through the DRIP would be considered superficial. For example, if you sold 100 shares at a loss and purchased 1 share through the DRIP then only 1% of the capital loss would be considered superficial (and that amount could be re-added to the ACB of the shares).

If I sell all the shares in a taxable account, then buy some in a registered account, will the superficial loss rule be triggered? If so, what happens to the unclaimed losses? Will I have to track it and add it to the ACB when the same stock is bought in the taxable account? What if I never buy any more shares as I have given up on the stock?

Thank you.

TS,

Assuming that the purchase in your registered account occurs within the superficial loss period then the superficial loss rule will apply. Normally the denied loss can be re-added to the ACB of the repurchased shares, but in the case of a repurchase that occurs in a registered account, this does not apply. The superficial loss will be permanently denied, and you will not be able to add it to your ACB even if you purchase more shares in your non-registered account at a later time.

If the number of shares repurchased isn’t equal to the number of shares sold, then it’s possible that only part of the loss will be deemed superficial:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

Hello,

Are you able to help determine if the rule applies here? I am thinking that I can claim a Capital loss, since no shares were repurchased within 30 days. The “remaining” portion of shares were purchased more than 30 days before the sale.

Buy 125 shares in TFSA on January 7, 2020

Buy 195 shares in non-registered account on January 24, 2020

Sell 195 shares in non-registered account on February 13, 2020

Buy 2 shares in TFSA on April 1, 2020

Thanks

Brad,

The superficial loss rule would apply in this case because you’ve purchased shares during the superficial loss period and you still own some shares at the end of the period. You cannot associate the remaining shares with a particular purchase as all shared are in the same pool.

Based on the formula above, only part of the loss would be considered superficial:

Superficial Loss = (min(S, P, B) / S) x (Total Loss)

= (min(195, 195, 125) / 195) x (Total Loss)

= 125 / 195 x (Total Loss)

= 64.1% x (Total Loss)

Therefore 35.9% of the loss would be allowable.

Hey there,

Just wanted to start by saying thank you so much for the article and all the time spent answering questions in the comments. It’s super helpful and super appreciated.

I’ve been doing a lot of research on this subject lately and I’ve come across a fundamental split in opinion on how a certain superficial loss scenario should be interpreted, and I’m having a hard time finding definitive evidence to support one interpretation over the other. I was hoping you could help me.

I’ve found this differing opinion in a few places, but the best example is https://canadiancouchpotato.com/2020/10/22/how-to-avoid-superficial-losses/ . If you look in the comments for a question by a poster named Frank, a scenario similar to my own is brought up, and it seems the author has a different interpretation of superficial loss than this blog does.

The scenario is simple. Say I own 200 shares of XIC in my RRSP and 100 shares in an unregistered account. The shares in the RRSP were acquired before the 61-day period. I buy an additional 50 shares in my unregistered account, then sell all 150 unregistered shares the day after, leaving me with 0 shares of XIC in my unregistered account and 200 in my RRSP.

If I understand your interpretation correctly, this should result in a 33% superficial loss, because I’m still “holding” 200 shares of XIC and I purchased 50 shares in the 61-day period (and 50 shares is 1/3 of the 150 I sold).

However, the author of the article I linked seems to interpret things differently. He believes that there is no superficial loss here because the 200 shares in my RRSP were purchased prior to the 61-day period, which means they are disregarded in the superficial loss calculations. According to him, only shares which are purchased during the 61-day period are considered when determining whether or not any shares are “held” at the end of that period; and since I sold the 50 shares I purchased during that period, there’s no superficial loss.

I find the arguments made here to be compelling, but I would obviously prefer to avoid a superficial loss if possible. Is this just a matter of different opinions and I should consult a tax professional for a definitive answer? Or is there any further reading you suggest I do on the subject?

Thanks again for taking the time to help so many people here!

Ryan,

In your example of owning 200 shares in your registered account and 100 shares in your non-registered account, followed by a purchase of 50 shares in your non-registered account, and finally a sale of 150 shares in your non-registered account the next day, I can confirm that my opinion is that 1/3 of the loss would be considered superficial.

I’m not sure I see a difference of opinion on the comments of that blog post though.

In the example Frank provides, 400 shares are held in registered accounts and another 400 shares in a non-registered account. Then 50 shares are purchased in a registered account followed by a sale within 30 days of 400 shares in the non-registered account. Dan concludes that 1/8 of the loss is superficial, which I would agree with. This seems very similar to your example, except for the specific numbers and the fact that the purchase that triggers the superficial los is in a registered account instead of a non-registered account. I don’t think the latter difference has any impact.

Perhaps some of your confusion relates to the comments about how holdings in your registered accounts do not need to be sold for tax-loss harvesting. I agree with this as well. When you successfully harvest a loss, you would avoid purchasing any identical shares within the 61-day window in any of your accounts. As a reminder, both of the following conditions need to be met for the superficial loss rule to apply:

1) During the period that begins 30 days before and ends 30 days after the disposition, the taxpayer or a person affiliated with the taxpayer acquires a property (in this definition referred to as the “substituted property”) that is, or is identical to, the particular property.

AND

2) At the end of that period, the taxpayer or a person affiliated with the taxpayer owns or had a right to acquire the substituted property.

If the first condition isn’t met (no purchases of identical property in any of your accounts in the 61-day window) then it is irrelevant whether you own shares in any of your accounts at the end of the superficial loss period.

Thanks a lot for that! I guess the part that’s tripping me up is this comment:

“I think this is confusing because you’re thinking of the original RRSP and TFSA shares as being “still held” 30 days after the loss is realized. But that’s only half of the two-part rule. To cause a superficial loss, those shares have to also be purchased within the 61-day window.”

“Those shares have to also be purchased within the 61-day window” seems to imply to me that Dan thinks only shares purchased within the 61-day window count as being “still held”. So shares purchased before that window would not be considered “still held”.

This is similar to the response to a comment I received by a colleague of his who he wrote a tax-loss harvesting whitepaper with, who seems to believe the situation would not result in a superficial loss: https://www.canadianportfoliomanagerblog.com/part-i-introducing-tax-loss-selling/#comment-39007

I tend to agree with your view on this, and I really appreciate you taking the time to spell it out in even more detail! I’ve asked Dan for clarification as well, I’m curious what he thinks. Perhaps I’m just misinterpreting things.

Ryan,

In the Canadian tax system there aren’t any rules about identification of specific shares as far as I know (unlike some other jurisdictions such as the US). In general it’s not always feasible to identify specific shares out of a pool, although in your example there is an obvious separation since some of the shares are in a registered account.

So I think I would disagree with Justin’s response.

However, in these examples, it could be argued that the spirit of the superficial loss rule isn’t violated. Generally speaking, the reasoning behind the rule is seemingly to prevent the claiming a capital loss on shares without a meaningful change in your overall position. In the case where shares are held in a registered account and your non-registered position is fully liquidated, then you could argue that claiming the full capital loss is fair because the shares in the registered account haven’t contributed to the ACB of the shares.

You could also argue with the wording of the superficial loss definition, which requires that “the taxpayer owns or had a right to acquire the substituted property.” The shares held in your registered account are obviously not the substituted property.

I’m not sure how worthwhile it would be to pursue these argument with the CRA though.

Ryan,

On second thought, I think I’m on the fence about this. Perhaps the definition of the superficial loss rule does intend for shares that are obviously not the “substituted property” to be excluded from being captured by the latter half of the rule. Otherwise, it would be impossible to fully claim a loss if you own identical shares in a registered account or your spouse owns identical shares, etc. unless you always ensure that purchases occur outside the 61-day window. And you wouldn’t be able to add the denied loss back to your ACB in some scenarios.

Definitely an interesting question!

Thanks a lot for the discussion! I agree, the wording of the text of the statute is just vague enough to make both sides of the argument fairly persuasive. I appreciate you taking the time to share your opinion! Thanks for all the work you do on this and the ACB tool, it’s extremely helpful!

Do you know the effective date at which the superficial loss would be added back to the ACB of the remaining stocks? I could think of three choices, but each has a problem, as I will explain below:

1. The date at which the shares are sold.

This leads to an intriguing singularity. Let’s say if you buy 100 XYZ at $100 on March 1, sell them all at $90 on March 2, and repurchase 100 shares or more before March 31, then the loss of $1000 would be entirely superficial, and you would have 0 shares in the account with an ACB of $1000 from March 2 until you repurchase the shares. Which would mean an infinite cost per share.

2. The date at which the shares are repurchased,

The problem with this is that the date of purchase can precede the date of sale, as in your Example 2. This leads to some weird recursion, in that on the date of selling, your ACB, and with it the superficial loss, is now higher than originally calculated.

3. The end of the superficial loss period, i.e. 30 days after the sale.

This avoids the two problems above, but it means that for a period of 30 days, the ACB is lower than it should be. Let’s say you purchased 120 shares at $100 on March 1 and sold 40 shares at $90 on March 2 (triggering $400 superficial loss). Then your ACB on the remaining 80 shares will become $8,400, or $105 per share, but only on March 31. If you sell another 40 shares at $105 before that, you would trigger a capital gain that you shouldn’t.

Hi,

Does the below transactions make sense?

Mar 1: Buy 5k shares @ $0.495 + $9.99 commision. New ACB $2,484.99

Mar 2: Buy 10k shares @ $0.89 + $9.99 commision. New ACB $11,394.98

Mar 2: Sell 5k shares @ $0.6 + $9.99 commision. New ACB $8,404.97 ($808.32 capital loss is superficial)

Mar 3: Sell 10k shares @ $1.29 + $9.99 commision. Capital gain $4,485.04 with no shares left.

Ray,

The superficial loss rule would not apply to either sale because there are no shares remaining at the end of the superficial loss periods.

Jens,

For the case where the repurchase precedes the sale then I would suggest adding the denied loss to the ACB immediately after the sale. This is how it is handled on AdjustedCostBase.ca – there can be a non-zero ACB for a zero share balance in some cases, but this is temporary until the repurchase. For the case where the repurchase follows the sale then you can add the denied loss either immediately after the sale or at the time of the purchase of the repurchased shares.

Hi! I am a new investor and got the superficial loss by accident… I don’t want to claim the loss at all, but don’t know how to do it correctly on a tax form. I got T5008 form with the list of the transactions. Should I simply not to report that particular transaction at all? Your advice will be really appreciated!

Alexandra,

The schedule 3 form (and consequently most tax software) is not well suited to handle inputting dispositions involving superficial losses. In such cases I suggest modifying the adjusted cost base in column 3 in order to achieve the desired capital loss (setting it equal to the ACB in the case where the loss is fully denied). The Annual Capital Gains reports provided by AdjustedCostBase.ca will do this automatically when you select the “Include all superficial loss transactions” option. It is probably also acceptable to omit inputting transactions where the entire loss is denied by the superficial loss rule.

I believe that all tax software only submits amounts from numbered cells to the CRA. For schedule 3, this only includes the total proceeds of disposition and the total gain or loss from all sales (lines 13199 and 13200) and not individual disposition entries.

Here’s another edge case:

Suppose my spouse holds 100 XYZ at an ACB of $100/share.

On March 1, she sells them all at $90/share for a capital loss of $1000.

On March 2, I buy 100 XYZ at $90/share into my own non-registered account.

So the entire $1000 are considered a superficial loss.

My question is: Whose ACB are the $1000 being added to? My spouse no longer holds any shares, so if she adds it to hers, the ACB/share will be infinity, possibly forever.

Is it permissible to add the $1000 to the ACB of my 100 shares in this case?

Jens,

The superficial loss is added to the ACB of the repurchased shares. So in this case it can be added to the ACB of your shares.

Thanks for another very informative post!

I’m wondering how to handle the following scenario involving a spouse’s account, where the following steps happen in this order within a 30-day window, and both myself and my spouse start with 0 share:

1. I acquire 100 shares at FMV 100 CAD/share

2. I sell them all at 90 CAD/share (capital loss 100 * 10 = 1000 CAD)

3. My spouse acquires 100 shares at 90 CAD/share

4. My spouse sells them all at 90 CAD/share (no loss/gain)

With a strict application of the superficial loss rule, in step 2 my capital loss would be superficial and transfered to the ACB of my spouse’s shares in step 3, who would then claim the 1000$ capital loss in step 4.

However, if I apply the generic partial disposition formula described here, can I argue that for step 2 I have:

– S = 100 (I sold 100 shares)

– P = 200 (the shares I acquired + the shares my spouse acquired)

– B = 0 (neither myself nor my spouse holds any share by the end of the superficial loss period)

=> min(S, P, B) = 0 and there is actually no superficial loss, allowing me to claim the full 1000$ of capital loss in step 2?

Olivier,

Assuming that there are no other relevant transactions, the superficial loss rule would not apply at all because no shares are owned at the end of the superficial loss period.

Sorry, you are entirely right, I was trying to simplify my real situation and I over-simplified it to the point where there is actually no superficial loss at all.

Instead, consider the situation where in step 4 my spouse sells only 99 of the 100 shares, so there is one share left at the end of the 30-day period, but in my spouse’s account and not mine.

I wanted to confirm that I could still use 99% of my capital loss, with the other 1% being transferred to the ACB of the one share that’s left in my spouse’s account. Or, in other words, that the formula for partial disposition is still valid in such a situation by cumulating data for both accounts for P and B.

Olivier,

Yes, I believe B would be 1 in that scenario, so 99% of the loss would be denied and 1% would be superficial.

does the partial disposition of shares formula work the same way for foreign currency denominated shares or do additional considerations need to be accounted for? For example, let’s say we are dealing with foreign currency where each share would be a single unit of foreign currency, does the formula still work or does everything need to be converted first to CAD and instead of share count it would be CAD amounts?

How does the Superficial Loss Rule affect foreign property gains/losses reported on your T1135?

Case 1: Suppose I sell shares at a loss in late Dec 2020 and repurchase them in early Jan 2021. Should I increase the reported capital gains by the superficial loss amount, the same I would on my Schedule 3?

Case 2: Suppose I sell property held in a foreign country (e.g. USD cash, bitcoin or bullion) and repurchase identical property in Canada. Should I still increase the reported capital gains by the superficial loss amount? One could argue that the superficial loss amount was not incurred on foreign property because the repurchase happened in Canada.

Jens,

I believe that the gain/loss on foreign property on form T1135 should be reported based on Canadian rules for calculating capital gains, and thus should be adjusted according to the superficial loss rule.

Your ACB and application of the superficial loss rule is based on your pool of identical property across all accounts and countries. A repurchase in a Canadian account could trigger a superficial loss for a sale of identical property in a foreign account.

Thank you for explaining (in the comments) how to handle Schedule 3! I was having trouble inputting partial superficial losses. I called the CRA and after being transferred 3 times, they were still unable to answer how to handle this 🙂

Hi – I’m finding your website very helpful. I’m wondering if my calculations below are correct for an example I have. I purchased stocks (all same company) in both my Margin and TFSA accounts then sold all from my Margin account. There were no other transactions within 30 days of the stock sale. I came up with an allowable loss of $824.59 and fingers crossed have this right.

Margin November 11, 2021, Buy 3026 $77,549

TFSA November 24, 2021, Buy 2631 $63,661

Margin December 21, 2021, Sell 3026 $71,232

Total Loss (TL)= $77,549 – $71,232 = $6,317

Superficial Loss = Min (S, P, B)/S x TL = (2631/3026) x $6,317 = $5,492.41

Allowable Loss = Total_Loss – Superficial_Loss = $824.59

Thanks again,

Conrad

Conrad,

Your calculations look correct to me.

Hi there,

If I sell 100 shares, buy 10 over the 61-day period and hold 500 after then S=100, P=10 and B=500 so the superficial loss is min(100,10,500)/100 x loss which in this case is 10%

If I decide to sell 100 shares but 10 shares at a time, is S the instantaneous amount sold or the amount sold over a 61-day period.

In the instantaneous case, SL = min(10,10,510)/10 = 100%. In the other case, it’s 10%.

To me, it seems that the S should be the amount sold over a period of time, otherwise the taxpayer is penalized for selling in small lots which doesn’t make sense to me.

Thanks for your help,

Hi

I have what is perhaps a straightforward question, but I’m getting confused by all the reading.

If me and affiliated partners accounts ( spouse , partner etc) own a total 5000 shares in total of a stock we purchased in March 2022 and then we sell 3000 shares in September 2022 for a loss , do any type of superficial losses apply since we have 2000 shares left ? We are well outside the superficial loss period and zero transactions of this stock in between in any of the accounts during March and September?

I keep thinking that somehow the formula for partial dispositions applies but I think its only for that relevant period ?

Thank you for such a great website

Rick

Rick,

If you or an affiliated account did not purchase the same shares from the period starting 30 days before the September, 2022 sale until 30 days after, then the superficial loss rule would not apply at all, and a capital loss would be fully allowed.

Thank you for clarifying this.

I have another question about writing puts on a stock that is written outside the 60-day superficial period and expires beyond the superficial period. Still, the stock option involuntarily gets involuntarily assigned to me in the superficial period where I have sold shares of the same company and I receive the shares at the put write price.

Does this now affect my calculation of capital losses. ? Would this count as an acquisition of shares and need to apply the partial disposition formula ?

Thanks

Rick,

A sale resulting from the expiry of options is exempt from the superficial loss rule per the Income Tax Act:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-12700-capital-gains/capital-losses-deductions/what-a-superficial-loss/non-superficial-losses.html

However, it is not clear to me that this treatment extends to the case where the superficial loss rule is triggered by the purchase of shares resulting from the expiry of options.

Does the superficial loss rule apply to mutual fund units? Thank you.

TS,

Yes the superficial loss rule can apply to mutual fund units.

I can’t really see a true example of how the superficial loss rule applies to DRIP programs. Please advise on the scenario where the shares in a stock you own are enrolled in a DRIP program which provides a monthly reinvested dividend spaced at regular 30 day intervals. To me it seems that selling even only part of one’s total numbers will always trigger the superficial loss rule because there will never be a time when a reinvested distribution DOESN’T occur 30 days before or after the sale of the shares.. As such, it seems the only way around this is to plan ahead. I.e. 1) ask one’s brokerage to turn off the DRIP immediately after a monthly reinvestment occurs and then 2) wait 31 days after the last reinvested dividend before selling. Please advise?

Elvio,

If you sell all your shares (and don’t repurchase for 30 days) then the superficial loss rule will not apply.

Otherwise, if the number of shares sold is larger than the number of shares purchased via the DRIP, then part of capital loss will be allowable:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/