The superficial loss rule prohibits claiming a capital loss when you (or your spouse or other entity affiliated with you) repurchase identical property within the period beginning 30 days before the sale and ending 30 days afterwards, and the property is still owned at the end of this period.

The onus is on the taxpayer to determine when the superficial loss rule applies. AdjustedCostBase.ca is a free web-based application that allows Canadian investors to calculate their adjusted cost base and capital gains. The service provides some features to assist you with identifying when the superficial loss rule may apply and for applying the rule. The methodology for using these features is described below through some examples.

Example #1

Let’s start with the following example (this happens to be the same as Example #1 in What Is the Superficial Loss Rule?):

- January 6th, 2014: Buy 100 shares for $50 per share

- November 3rd, 2014: Sell 100 shares for $30 per share

- November 4th, 2014: Buy 100 shares for $30 per share

- December 2nd, 2015: Sell 100 shares for $80 per share

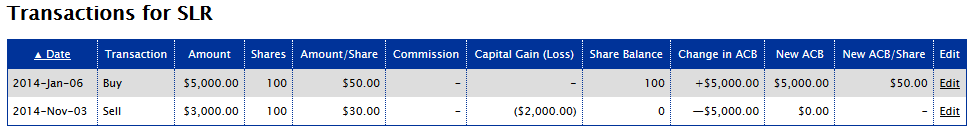

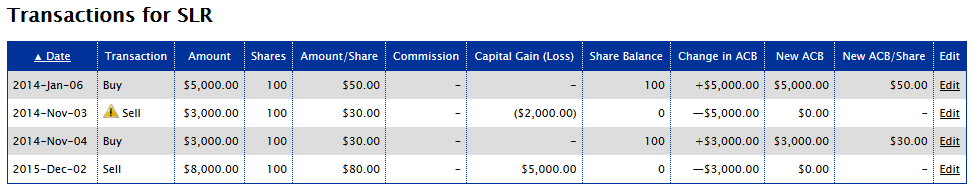

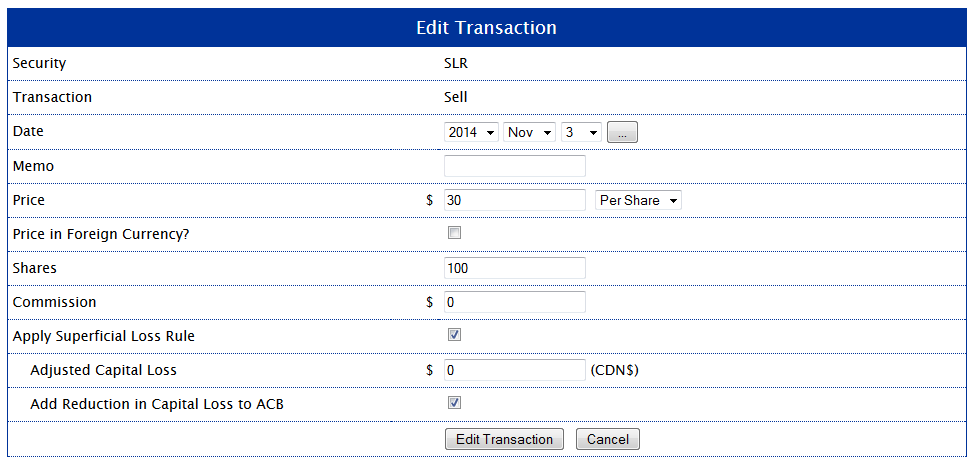

For simplicity we assume that no transaction fees are applicable. First, let’s enter these transactions into AdjustedCostBase.ca. After doing so, you should see the following list of transactions:

Note that the superficial loss rule should apply for the sale transaction on November 3rd, 2014 because the shares have been repurchased the very next day. The capital loss of $2,000 cannot be claimed according to the superficial loss rule. AdjustedCostBase.ca does not automatically apply the superficial loss rule — it’s up to you to do so.

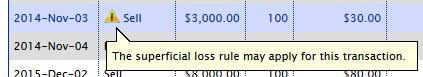

You’ll see a warning icon for the “Sell” transaction and when you move your mouse over it a message pops up indicating that the superficial loss rule may apply to this transaction:

In general, AdjustedCostBase.ca will not always correctly inform you when the superficial loss rule applies. The are many scenarios where the rule may apply, but AdjustedCostBase.ca does not have all the information that’s necessary to determine this (more on this below). But in simple cases where all the transactions are entered into AdjustedCostBase.ca in the same account and portfolio, AdjustedCostBase.ca will present you with the warning above.

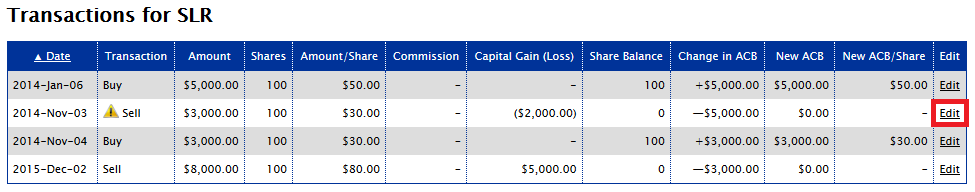

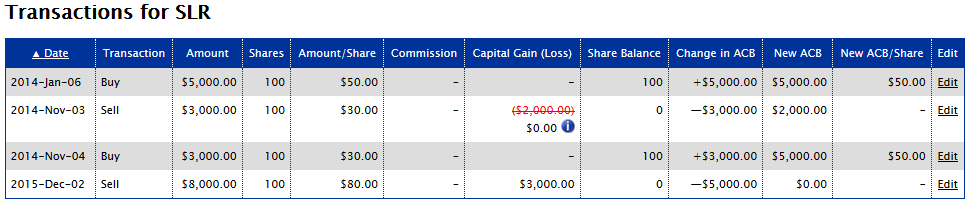

Once you’ve determined that the superficial loss rule should apply, you need to instruct AdjustedCostBase.ca to apply the rule. AdjustedCostBase.ca will not automatically apply the rule even if the warning message appears. To apply the superficial loss rule, you need to edit the “Sell” transaction:

In the form for editing the transaction you’ll see a checkbox labeled “” This checkbox should be checked off in order to apply the superficial loss rule. Then two new fields will appear:

- Adjusted Capital Loss

- Add Reduction in Capital Loss to ACB

The “Adjusted Capital Loss” is the dollar amount to which the capital loss is reduced. In the majority of cases, the superficial loss rule completely denies the loss, and you should enter $0.

The “Add Reduction in Capital Loss to ACB” checkbox indicates whether or not the reduction in capital loss should be added back into the ACB for this security. In this example, you’ll this box should be checked off because the denied capital loss should indeed to added back to the ACB.

In some circumstances, such as when the repurchase occurs in a registered account or in your spouse’s account, this box should be unchecked. This is because the ACB adjustment should occur in the account where the repurchase occurs.

For this example, you should enter $0 as the “Adjusted Capital Loss” (the loss is fully denied) and the “Add Reduction in Capital Loss to ACB” checkbox should be checked (the reduction in capital loss should be added back to the ACB). The form should appear as follows:

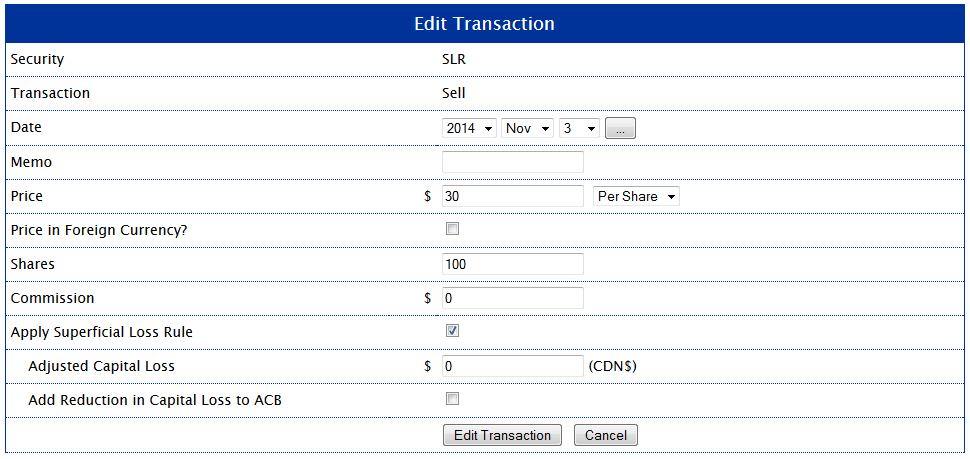

After successfully editing the transaction, the list of transactions should be as follows:

You’ll notice that the $2,000 is crossed off and replaced with $0. Instead of the ACB on 2014-Nov-03 being reduced to $0, it’s now $2,000 (because the $2,000 denied capital loss is added back to the ACB). The capital gain on 2015-Dec-02 is now reduced to $3,000 from $5,000.

Example #2

Let’s now modify Example #1 slightly:

- January 6th, 2014: Buy 100 shares for $50 per share

- November 3rd, 2014: Sell 100 shares for $30 per share

- November 4th, 2014: Buy 100 shares for $30 per share in your RRSP account

- December 2nd, 2015: Sell 100 shares for $80 per share in your RRSP account

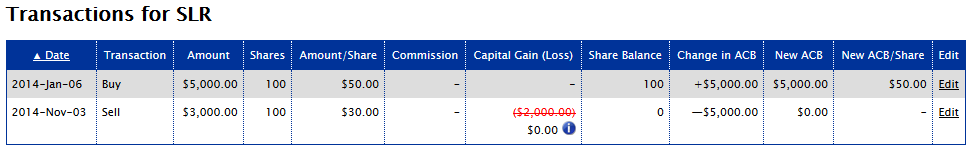

The buy transaction on 2014-Nov-04 and the sell transaction on 2015-Dec-02 now occur in your RRSP account instead of your non-registered account. First let’s enter the first 2 transactions into AdjustedCostBase.ca (the last two transactions should not be entered because ACB need not be tracked for registered accounts):

No warning about the superficial loss rule is present because the repurchase transaction isn’t included. But the superficial loss rule does nonetheless apply. To apply the rule, you’ll need to click on the “Edit” link for the “Sell” transaction.

Again, you should enter $0 as the “Adjusted Capital Loss” (the loss is fully denied). But this time, the “Add Reduction in Capital Loss to ACB” checkbox should be unchecked because the denied capital loss should not be added back to the ACB of the security in your non-registered account. The form should appear as follows:

After applying the superficial loss rule, the list of transactions is now:

The capital loss is denied and reduced from $2,000 to $0 (as was the case in Example #1). But the reduction in the capital loss is not added to the ACB here, because the repurchase occurred in a registered account. The ACB is $0 following the “Sell” transaction.

A similar situation would apply when the repurchase occurs in a spouse’s account or a corporate, trust, or partnership account controlled by you or your spouse. But in these cases, the ACB of the security in the account where the repurchase occurs should be increased by the amount of the denied capital loss.

Can I Always Rely on AdjustedCostBase.ca to Tell Me When to Apply the Superficial Loss Rule?

No. AdjustedCostBase.ca does not have all the necessary information to do so in all cases. The following cases are examples of when it’s necessary for you to determine if the superficial loss rule should apply:

- A repurchase triggering the superficial loss rule that occurs in your spouse’s account or an account of a trust, corporation, or partnership controlled by you or your spouse.

- When you repurchase another ETF within the superficial loss period that tracks the same index of an ETF you’ve sold at a loss. AdjustedCostBase.ca does not know that the two securities are ETF’s tracking the same index. It’s up to you to identify when this situation applies.

- When you repurchase identical property in a registered account. Transactions in registered accounts do not need to be entered into AdjustedCostBase.ca (and you should not be entering them in the same portfolio you use for non-registered accounts).

- When you still own the right to purchase the identical security at the end of the superficial loss period. For example, if you still own call options at the end of the superficial loss period, the superficial loss rule may apply. AdjustedCostBase.ca will not inform you about this.

In general, AdjustedCostBase.ca will only warn you about the superficial loss rule when “Buy” and “Sell” transactions occur within the same portfolio (and even when a warning occurs, it’s up to you to apply the superficial loss rule). In the situations mentioned above (and possibly some others) you’ll need to figure out when the superficial loss rule should be applied.

In this situation would the superficial loss rule apply? Or since the the initial buy was closed out with a sell already that had a gain does it not apply to the second sell which had a loss?

October 25th, 2014: Buy 100 shares for $50 per share

November 3rd, 2014: Sell 100 shares for $60 per share

November 4th, 2014: Buy 100 shares for $50 per share

November 8th, 2014: Sell 100 shares for $40 per share

Thank you,

Jeff

Jeff,

Assuming that there are no other transactions for the same security within 30 days following November 8th, 2014, then the superficial loss rule would not apply.

One condition for the superficial loss rule is that shares need to be held 30 days after a sale that results in a capital loss. This is not the case in the example above because the share balance is zero after November 8th, 2014.

What about scenarios where the number of shares sold and repurchased is not the same, and the superficial loss only partially applies? For example, I sold some shares at a loss as I needed funds to help finance a house purchase, needed less of the money than I thought and so put the unneeded amount back into the same fund a week or so later (the share price had increased a little in the interim). So using round numbers for simplicity lets say I sold 10000 shares at a loss and then bought back 2500. When I edit the transaction and select Apply Superficial Loss Rule it’s left to me to enter the actual Adjusted Capital Loss, but what would it be? Would it be simply 2500/10000 multiplied by the actual loss, with the denied portion of 7500/10000 automatically added back to the ACB? Or is the math for partial superficial losses more complicated than just breaking it down by number of shares, especially when the share price changed between the sale and repurchase as it did in my case?

Thanks

Dave,

This case is covered here:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

I have two “managed” portfolios containing assorted funds offered by a major bank’s financial services in non registered accounts. The managed funds in the portfolios have lots of withdrawals (it’s my income!) and regular fund rebalancing purchase sale transactions, and monthly dividend reinvestments. I have noticed that the “Suspect superficial loss rule applies” warning rarely applies when the funds that may have been sold have had more shares bought as a part of the reinvestments.

I presume this means I must go through ALL the transactions manually and alter the SL rule application.

This became more pronounced when I merged funds between the two portfolios.

Can you confirm this ? Entering so many years of data has already been crazy arduous, the thought of going through all this again is scary. As suspected … it looks like for many years there will be no difference in my taxes as I go to correct this error.

Fred,

The superficial loss rule still applies when the number of units bought during the superficial loss period exceeds the number of units sold (provided all requirements for the superficial loss rule are met).

However, if the number of units bought in the superficial loss rule is greater than the number of units sold, then the loss may only be partially denied:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

The superficial loss rule is never applied automatically on AdjustedCostBase.ca, even when the warning appears. You must edit each transaction in order to apply the superficial loss rule, as described here:

https://www.adjustedcostbase.ca/blog/applying-the-superficial-loss-rule-for-a-partial-disposition-of-shares/

What would the correct way to calculate the ACB in this scenario and how would the superficial loss rule apply?

A. I purchase a security within my RIF.

B. I make an in kind transfer of that security from my RIF to my unregistered trading account.

C. I make an in kind transfer of the same security from my unregistered trading account to my TFSA at a lower market value than when transferred from the RIF

D. same as C. but within the 30 day window for superficial loss.

E. same as C but with a higher market value than when transferred from the RIF.

F. same as C but with a higher market value than when transferred from the RIF and within the 30 day window.

Ed,

The in-kind transfer from your RRIF to your non-registered account would not trigger any gain or loss. This would be equivalent to a purchase of the shares in your non-registered account, and your ACB for those shares would increase by the fair market value of the shares at the time of the transfer. When you transfer the shares in-kind into your TFSA, a deemed disposition occurs. Any capital loss would be permanently denied (this is the case regardless of the timing between the transfer out of your RRIF compared with the transfer into your TFSA). If a capital gain occurs, you will pay taxes on the gain. For further information, please see the following:

https://www.adjustedcostbase.ca/blog/capital-gains-and-losses-for-in-kind-contributions-to-registered-accounts/

I would like to change which accounts in which I hold certain funds (XBAL & VBAL). How will this affect the ACB of the security in each account?

I have an RESP and a Non-registered account. The RESP holds only XBAL, the non-registered account does non hold either XBAL or VBAL.

If I sell XBAL in the RESP and immediately purchase VBAL in the RESP then on same day I buy XBAL in my Non-registered account, do superficial loss rules apply? If XBAL is sold for a gain is any adjustment to ACB required?

Are these completely independent for ACB Tracking?

Thanks

Mike,

The CRA has stated that they consider index funds tracking the same index to be identical properties, thus switching between two different funds that track the same index could trigger the superficial loss rule.

XBAL and VBAL, while similar, due not track all the same indices and don’t have identical asset allocations. For example, XBAL holds an ETF that tracks the S&P/TSX Capped Composite for its Canadian equities, while VBAL holds at ETF that tracks the FTSE Canada All Cap Index. So I think that XBAL and VBAL can be swapped without triggering the superficial loss rule.

Your blog post is very helpful but does not seem to cover the following case.

I sell X shares of a certain security in my portfolio at a loss

Within the 31 days afterwards my wife, who already holds some of the same security, buys Y shares of it where Y is less than X. She subsequently, still within the 31 day period, sells Y shares of that security (either at a loss or a profit).

How do I account for this in the ACB system?

Hugh,

In the case where you’ve sold all your shares then you should leave the option to “Add Reduction in Capital Loss to ACB” unchecked. Then in your wife’s portfolio or account you can add a “Buy” transaction for 0 shares with a total amount equal to the amount of the denied loss. This will have the effect of disallowing the loss in your account/portfolio and adding the same amount to your wife’s ACB for those same shares.

Thank you. I was wondering how I would add that superficial loss to her ACB – this does resolve that question.

I assume also that subsequent sales in HER account relating to that security, assuming I have none in my account as well, would then be recorded in the normal way with any superficial loss rules being applied to HER account should it be necessary based on the date of HER transactions, with MY original sale and its date no longer playing any role. However any subsequent additional purchases within the 31 days of my sale would need to be treated in the same way as you describe here. Is this correct?

Hugh,

Yes, that’s correct.

Hi,

What is the rule for superficial loss in the case of purchasing stock options with different expiry dates?

Let’s say I purchase calls expiring December 1st, and then purchase calls expiring December 31st. What happens if, when I decide to sell, one of the calls is making money and the other loses money? Can I still claim the loss for one of them? What happens if both are at a loss?

Thanks,

Caleb,

I don’t think that options with different expiry dates would be considered identical property. Therefore the sale of one instance should not be impacted by transactions/ownership of the other instance.

Not that holding the right to acquire shares (i.e., call options) can cause the superficial loss rule to apply to the sale of the underlying shares.

In the case of ETFs that track the same index, but one ETF tracks the upside (long) and another tracks the downside (short), such as HQU and HQD, would the superficial loss apply when switching from one of these ETFs to the other, assuming there was a loss incurred.

Hi. Thanks for the handy online tool. My question is: When filing my personal income taxes is there a worksheet that needs to be completed in order to report the calculations for ACB due to the Superficial loss rule or ROC? Or do I simply adjust the appropriate figures (eg. Box 20 Book Value and Box 21 Proceeds of Disposition) on my Autofilled T5008 slips, and keep my calculations should CRA request them? Thanks!

Mike,

Neither Schedule 3 nor T5008 slips seem well designed to accommodate scenarios involving superficial losses. Adjusting the book value or proceeds of disposition so that you end up with the correct capital loss value seems reasonable to me. Note that when submitting your tax return electronically, only numbered boxes are transmitted to the CRA. For Schedule 3 in particular, this includes only the sum of all proceeds of dispositions for all shares (box 13199) and the total gain or loss for all shares (box 13200) (though keeping more detailed records as you’ve suggested is a good idea).

Hi,

If all purchases and sales occur within the same account (no purchases in registered accounts) and the superficial loss rule applies, is the capital loss add back to ACB allowed?

Ty,

Yes, a denied capital loss can be added back to the ACB of the repurchased shares in that case.

Hi! Would the superficial loss rule apply in a case where your shares get called away at a capital loss resulting from of a covered call being exercised and then you get the shares assigned to you within 30 days as a result of a cash secured put being exercised? So for example, consider the scenario below.

Lets assume I own 100 shares of ABC at a cost basis of $1000 ($10/share).

Jan 9: Sell one ABC call option with a strike price of $9 to collect $50 in premium expiring Jan 13.

Jan 13: Call option exercised and 100 ABC shares called away at a total capital loss of $50.

Jan 16: Sell one ABC put option with a strike price of $8 to collect $50 in premium expiring Jan 20.

Jan 20: Put option exercised and 100 ABC shares assigned at a cost basis of $750.

So in this scenario, would the $50 capital loss generated from the shares being called away on Jan 13 be considered a superficial loss? Thank you for your time and advice on this.

In example 2: https://www.adjustedcostbase.ca/blog/wp-content/uploads/superficial_loss_rule_applied_SLR_RRSP.png

“The capital loss is denied and reduced from $2,000 to $0 (as was the case in Example #1). But the reduction in the capital loss is not added to the ACB here, because the repurchase occurred in a registered account. The ACB is $0 following the “Sell” transaction.”

Does that mean the capital loss is lost forever?

H,

Yes, since the shares were repurchased in a registered account in this example, the capital loss is permanently denied and cannot be used to offset or reduce future capital gains.