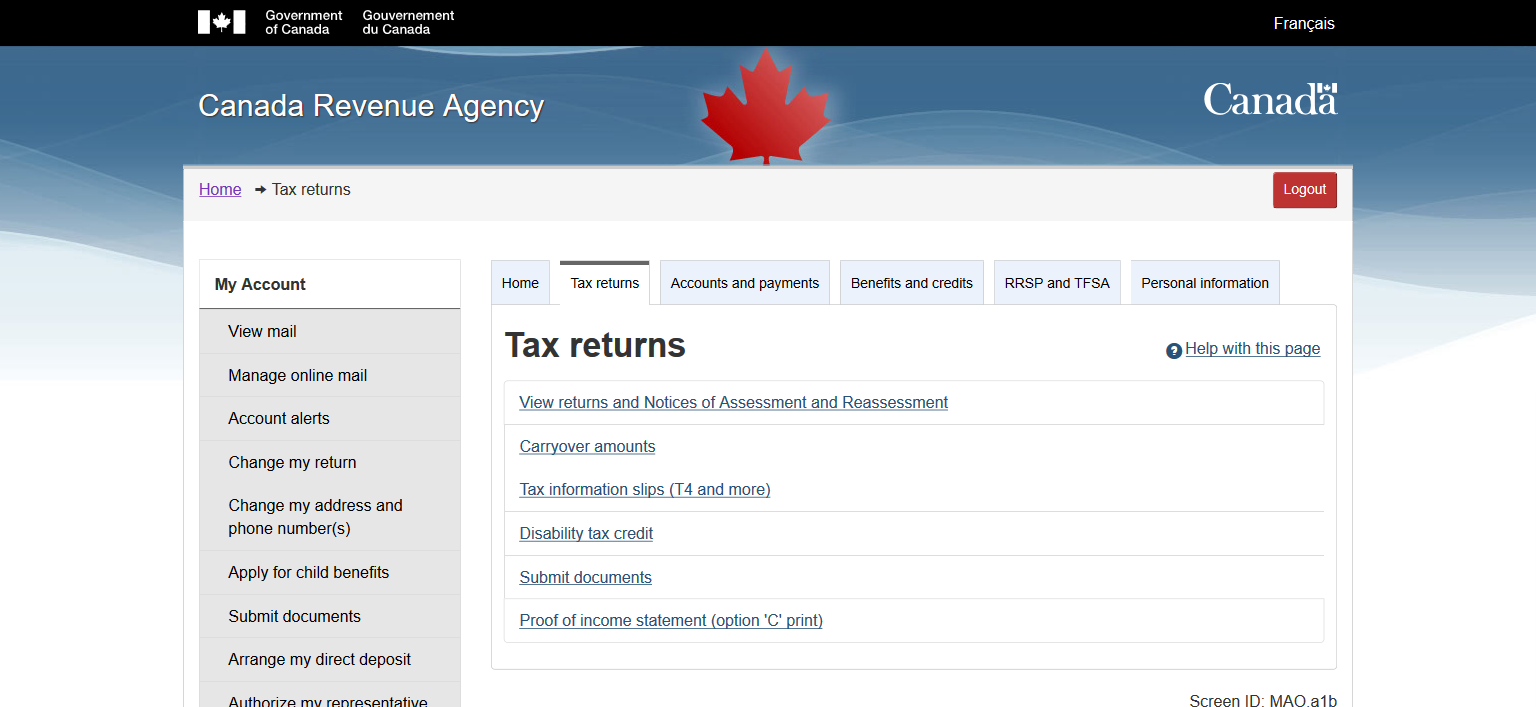

The Canada Revenue Agency provides individual taxpayers with online access to certain tax information slips. This can be helpful for reconciling your own records. The tax information slips are not complete as only a limited subset of tax slips are provided. To access your available tax slips online, first log in to the CRA web site as an individual. Then, click on the “Tax returns” tab and you should see the following:

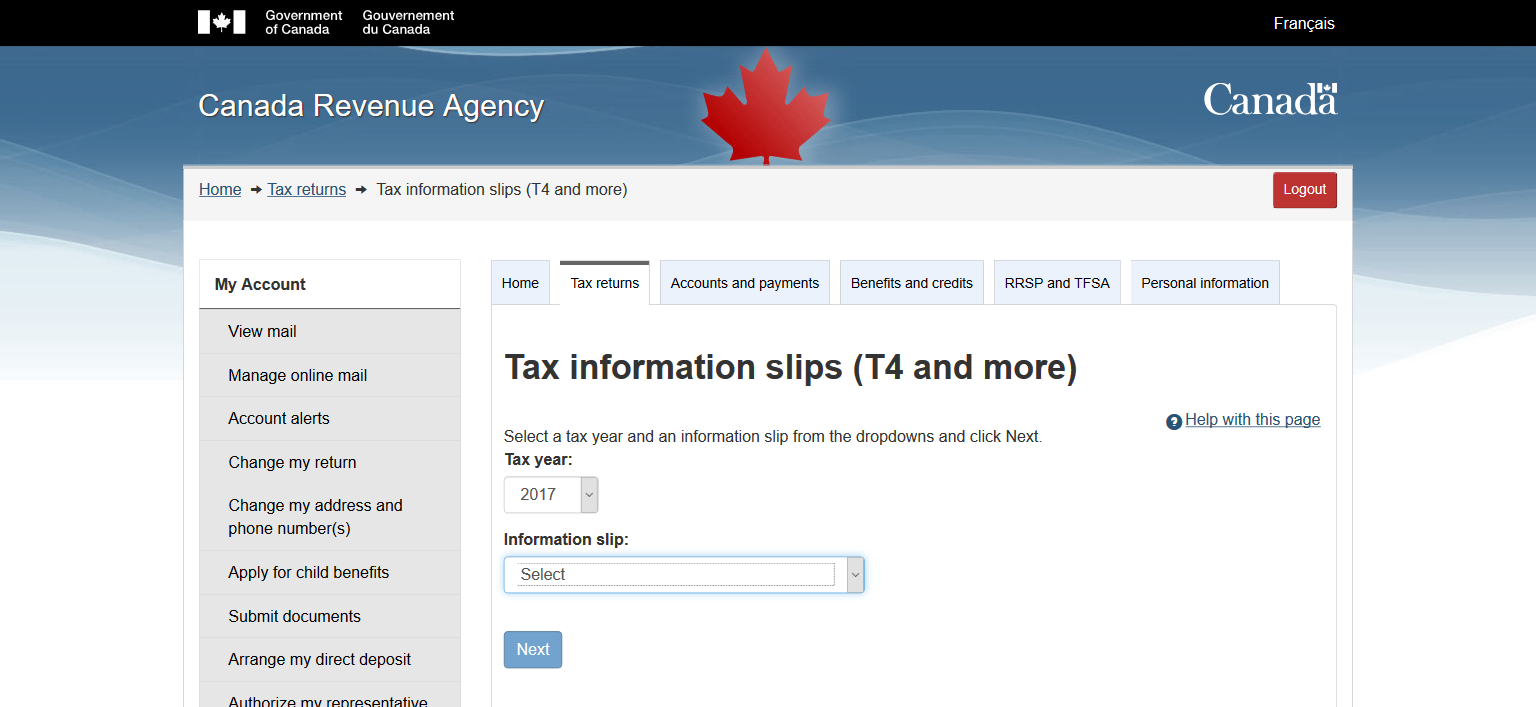

Next, click on the “Tax information slips (T4 and more)” link and you’ll be brought to the following page:

Here you’ll be able to select from different tax years and several types of tax slips including the following:

- T4 – Statement of remuneration paid

- T4A – Statement of pension, retirement, annuity, and other income

- T4A(P) – Statement of Canada Pension Plan Benefits

- T4A(OAS) – Statement of Old Age Security

- T4E – Statement of Employment Insurance and Other Benefits

- T5 – Statement of Investment Income

- T3 – Statement of Trust Income Allocations and Designations

- T5008 – Statement of Securities Transactions

- RRSP Contribution Receipt

After selecting one of the options, you’ll be able to view a list of slips available. For each slip, you’ll be able to see the amounts on record, line by line.