On March 31, 2020 Brookfield Infrastructure Partners L.P. (BIP.UN) announced the completion of a unit split corporate event resulting in each unitholder of BIP.UN on record as of March 20, 2020 receiving 1 shares of Brookfield Infrastructure Corporation (BIPC) for every 9 units of BIP.UN. In addition, a cash payment was made in lieu of fractional shares.

https://bip.brookfield.com/bipc/press-releases/2020/03-31-2020-120202244

Each unitholder of record on March 20, 2020 received one (1) class A exchangeable subordinate voting share (the “Share”) of BIPC for every nine (9) BIP units held, or approximately 0.11 Shares for each BIP unit…BIP unitholders will receive a cash payment in lieu of any fractional interests in the Shares. Brookfield Infrastructure will use the volume-weighted average trading price of the Shares for the five trading days immediately following the special distribution (March 31 through April 6) to determine the value of the Shares for the purpose of calculating the cash payable in lieu of any fractional interests.

Brookfield has provided some details on the tax treatment of this corporate event for Canadian investors on their web site:

https://bip.brookfield.com/bipc/stock-and-dividends/tax-information

I owned units of Brookfield Infrastructure Partners L.P. prior to the formation of Brookfield Infrastructure Corporation. As a result of the special distribution from Brookfield Infrastructure Partners L.P. in 2020, I received class A shares of Brookfield Infrastructure Corporation. Is this special distribution taxable for Canadian federal income tax purposes

The special distribution should not be taxable to a Canadian resident shareholder for Canadian income tax purposes provided the adjusted cost base of the Brookfield Infrastructure Partners L.P units held by the Canadian resident holder is positive after the special distribution.

In general, this special distribution will reduce the adjusted cost base of your interest in the partnership units of Brookfield Infrastructure Partners L.P. by an amount equal to the fair market value at the time of the special distribution of the class A shares you have received. The same fair market value at the time of the special distribution of the class A shares received is your adjusted cost basis. The 5-day volume weighted average price (VWAP) ending April 6, 2020 of a share of Brookfield Infrastructure Corporation on the Toronto Stock Exchange was $50.12.

This information is somewhat misleading because the entire value of the special distribution is not allocated as return of capital. Rather only a portion of the value reduces the ACB because it is offset by an allocation of partnership income.

The ACB of a limited partnership such as BIP.UN needs to be adjusted by reducing the ACB by an amount equal to the distributions received. Normally this would involve cash distributions, but in the case of the special distribution of BIPC shares, the fair market value of the shares received should be used. Next, the ACB should be increased by net tax allocation corresponding to the distribution. The process should be performed for each distribution.

Brookfield has provided the following spreadsheet as a guide for calculating the ACB for BIP.UN:

On a per share basis the value of the BIPC special distribution is equal to US$3.972. This is based on an exchange rate CAD$1.402036/US$, corresponding to CAD$5.5689/share. Since each unit of BIP.UN distributed 1/9 shares of BIPC, this corresponds to the market value above of CAD$50.12 (CAD$5.5689/share x 9 shares).

Based on data posted on the CDS Innovations web site, Brookfield has reported a net return of capital amount of CAD$3.59726/share. The ACB should therefore be reduced by a net value of CAD$3.59726/share after factoring both the value of the special distribution and the net tax allocation associated with this distribution.

This is the case regardless of whether or not cash was received in lieu of fractional shares.

There is also a capital gain value equal to -$0.00061 associated with the special distribution. This does not impact ACB but results in an immediate capital loss for the 2020 tax year.

Based on the above, the tax treatment of the BIPC unit split in terms of the impact on ACB is as follows:

- The ACB of BIP.UN will be reduced by CAD$3.59726/share.

- The initial ACB of the BIPC shares is equal to $50.12 per share multiplied by the number of shares received. The total amount of the initial ACB for BIPC excludes any cash received in lieu of fractional shares.

Let’s look at the following example:

- You purchase 500 shares of BIP.UN on January 4, 2019 for $43.00 per share with a commission of $9.99.

- Based on the record date of March 20, 2020 you receive 1 share of BIPC for every 9 shares of BIP.UN. In this case you would be entitled to 55.55 shares of BIPC.

- Since cash is issued in lieu of fractional shares, you would receive 55 shares of BIPC plus $27.57 in cash (0.55 shares of BIPC x $50.12 per share).

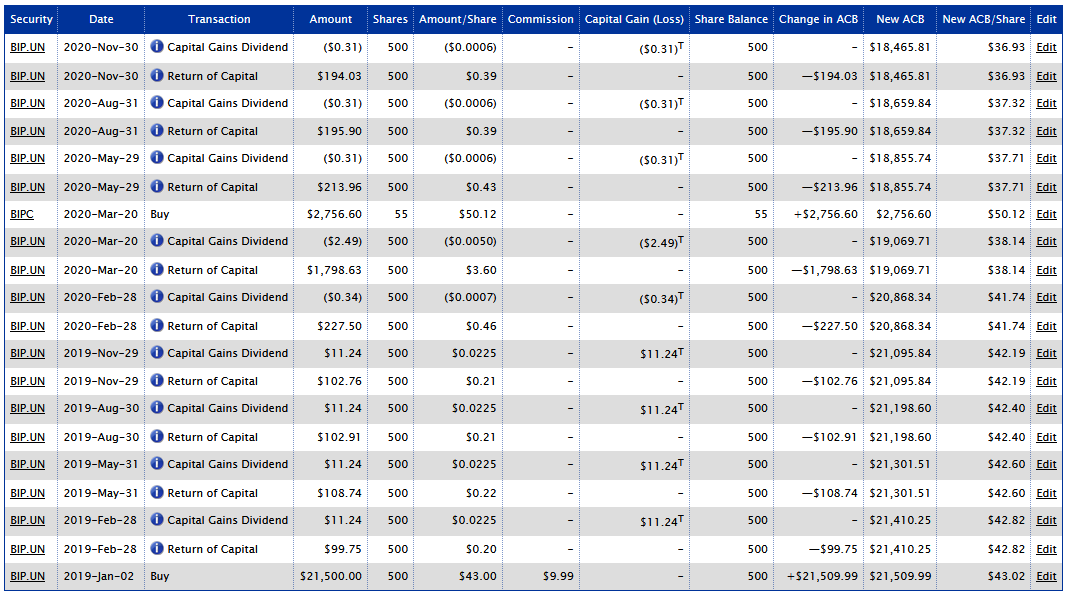

The ACB can be calculated on AdjustedCostBase.ca using the following transactions:

- Buy 500 shares of BIP.UN on January 2, 2019 for $43.00 per share with a commission of $9.99.

- Buy 55 shares of BIPC on March 20, 2020 for $50.12 per share (with no commission) (for a total amount of $2,756.60).

- Return of Capital for BIP.UN on March 20, 2020 of $3.59726/share.

There are also additional return of capital transactions for 2020 that need to be factored in as a result of the 4 regular cash distributions for BIP.UN for 2020. In particular the values are:

- $0.455/share for Feb. 28, 2020

- $0.42793/share for May 29, 2020

- $0.3918/share for Aug. 31, 2020

- $0.38806/share for Nov. 30, 2020

In addition there were capital gains (with negative values) allocated for each distribution (including the special distribution) that do not impact ACB but result in immediate capital losses for the 2020 tax year:

- -$0.00067/share for Feb. 28, 2020

- -$0.00498/share for May 29, 2020

- -$0.00061/share for Aug. 31, 2020

- -$0.00061/share for Nov. 30, 2020

In addition, there would be return of capital and capital gains dividend transactions for 2019 (and any prior years that the units were owned).

The ACBs of BIP.UN and BIPC are calculated as follows:

All of the return of capital and capital gains dividend transactions (including the one associated with the special distribution) were imported using the Streamlined Import of Tax Information feature available to AdjustedCostBase.ca Premium subscribers. The initial purchase of the BIPC shares must be specified manually.

If the market value of the share received as larger than the ACB of BIP.UN just immediately prior to March 31, 2020 then your ACB will be reduced to $0 and you will incur an immediate capital gain on the residual amount. Your adjusted cost base cannot be negative.

Thank you for the detailed information

What a great summary, thanks for this!

Would BIP.un and BIPC be identical properties for purposes of the superficial loss rules?

Stephen,

The CRA provides the following definition for identical properties:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-127-capital-gains/shares-funds-other-units/identical-properties.html

“Properties of a group are considered to be identical if each property in the group is the same as all the others. The most common examples of identical properties are shares of the same class of the capital stock of a corporation or units of a mutual fund trust.”

Based on this, I do not believe that BIP.UN and BIPC would be considered identical properties.

Hello, just found this great site! Would the BEPC share issuance in summer 2020 for BEP.UN unit holders be treated in the same manner? I believe so, just wanted to confirm

JF,

It seems that the tax treatment would be similar:

https://bep.brookfield.com/bepc/stock-and-dividends/tax-information

“I owned units of Brookfield Renewable Partners L.P. prior to the formation of Brookfield Renewable Corporation. As a result of the special distribution from Brookfield Renewable Partners L.P. in 2020, I received class A shares of Brookfield Renewable Corporation. Is this special distribution taxable for Canadian federal income tax purposes?

The special distribution should not be taxable to a Canadian resident shareholder for Canadian income tax purposes provided the adjusted cost base of the Brookfield Renewable Partners L.P. units held by the Canadian resident holder is positive after the special distribution.

In general, this special distribution will reduce the adjusted cost base of your interest in the partnership units of Brookfield Renewable Partners L.P. by an amount equal to the fair market value at the time of the special distribution of the class A shares of Brookfield Renewable Corporation (“BEPC Shares”) you have received. The same fair market value at the time of the special distribution of the BEPC Shares is your adjusted cost basis in your BEPC Shares. The closing price of a share of Brookfield Renewable Corporation on the New York Stock Exchange on July 30, 2020 (the date of the special distribution) was US$40.72. The Bank of Canada daily exchange rate for July 30th, 2020 for USD/CAD was 1.3432.”

Hi,

I just saw this now and thank you very much for the detailed explanation, it really helps.

I am still uncertain with regards to the cash in lieu received with the BIPC shares. If they do not affect the ACB of BIPC shares then how do we account for them? Income?

Thanks,

FV

FV,

Your ACB of BIP.UN should be reduced by the total value of the special distribution (fair market value of the BIPC shares + cash in lieu of fractional shares). Your ACB should then be increased by the total tax allocation associated with the distribution.

You can think of this case as two different events:

1. A distribution from BIP.UN (accounted for as described above)

2. A reinvestment of a portion of the distribution in BIPC shares.

The ACB of the BIPC shares is established based on the fair market value of the shares at the time of the distribution. The cash received in lieu of fractional shares is not added to the ACB of the BIPC shares.

Wow! I am a premium member but didn’t realize Streamline Import of Tax Information was available till I read it here. Thank you.

Thank you for this whole explanation. I was about to tear my hair out.

Now to face BEP.UN. Wish I held these stocks in a registered account!

Can I just say however in your example you say “you purchase 500 shares for $31.50” but when you calculate the ACB you say “500 shares for $43.00”. A detail but I was already struggling to follow.

Jane,

Thanks, the error has been corrected!

Here is my situation:

On 20 March 2020 I held 35 shares of BIP.UN.

My monthly statement for April 2020 shows

– 1 April 2020 sale of one share

– 2 April 2020 distribution, receiving the Brookfield Infrastructure Corporation (BIPC) shares.

The details describe a spinoff on 34 shares from Brookfield Infrastructure with a Record Date of 1 April 2020 and a Payment Date of 2 April 2020.

The T5013 for BIP.UN had the following note in the “Other information” section:

“SPECIAL DISTRIBUTION WITH RECORD DATE 31MAR2020 HAS BEEN REPORTED ON THIS SLIP AS INSTRUCTED BY THE ISSUER”

The amounts on the T5013 correspond to 35 shares for the special distribution.

I recently received transaction details for trades made in 2020 and an amended T5013.

The transaction details show a trade date of 30 March 2020 for the sale of the one share of BIP.UN (the 1 April 2020 sale from above).

The amounts on the amended T5013 correspond to 34 shares for the special distribution.

How do I record the above for correct reporting?

Do I enter the sale of one share on 1 April 2020 (reducing shares from 35 to 34) and then enter the return of capital and capital gains dividend with a 1 April 2020 date?

Thank you.

I can’t answer the above question, however I was disappointed to learn that Brookfield’s own press release as quoted above has an inaccurate date.

It says shareholders of BIP.UN on March 20th are eligible for the special dividend, but actually in corresponding with Brookfield it’s March 30. I sold half my shares on March 25, and did not receive the special distribution for all the shares held on March 20. From Brookfield “If you held BIP units at March 30th, you would have been eligible for the special distribution of BIPC shares.” TD told me the same thing.

I trust there’s nothing to be done. I protested and heard nothing further. But I don’t understand. It’s pretty important to get the date right Brookfield.

Jane,

Hopefully you’ll get to the bottom of this. Brookfield reported the record date of the special distribution as being March 20 on CDS. You may want to also check whether your T5008 slip has the correct income reported based on the income allocation:

https://bip.brookfield.com/~/media/Files/B/Brookfield-BIP-IR-V2/2020%20tax/2020%20Canadian%20Taxable%20Income%20Calculation%20Common.pdf

If in fact you aren’t entitled to the special distribution then the $1.97 per unit of income allocated to this distribution should not be taxable to you.

My question relates to the Brookfield offer to purchase shares of Inter Pipeline Ltd. (IPL) One of the options is to receive 0.25 shares of Brookfield Infrastructure Corporation (BIPC) for each share of IPL (no cash involved). The Offers to Purchase (including the Original and the 1st, 2nd, 3rd and 4th Variations) are available here: https://www.ipl-offer.com. The 1st Notice of Variation contains the updated tax section which says that a Resident Holder who disposes of an IPL common share will realize a capital gain (loss) equal to the cash (if the cash option is chosen) or fair market value of BIPC shares (if the BIPC option is chosen) received, net of reasonable costs of disposition, less the adjusted cost base of the IPL shares. There is no mention of a rollover. Why doesn’t subsection 85.1(1) apply to provide a rollover if the taxpayer chooses to avail of it? Instead they are providing the rollover via the option to receive exchangeable LP units. Thank you.

Diane,

It seems that you’re correct and a capital gain or loss will be realized when IPL shares are exchanged for cash and/or BIPC shares. However, the capital gain (or loss) will be equal to the fair market value of the cash and/or BIPC shares received less your ACB for the IPL shares. I’m not sure why a tax-deferred rollover is not an option in this case.

Hello

Im trying to figure out how my ACB changes for the unit split of BBU to BBUC.

Each holder of BBU’s limited partnership units (“BBU units”) of record on March 7, 2022 received one (1) class A exchangeable subordinate voting share (each a “Share”) of BBUC for every two (2) BBU units held.

I originally purchased 200 shares of BBU for $39.40 per share (no commission)

On March 17, 2022 I received a return of capital of $3265.74 from BBU. I see that this ROC was used to provide me with 100 shares of the new BBUC. Therefore the per share ACB for my new shares of BBUC is $32.6574.

What I am struggling to understand is how my brokerage calculated the per share ACB of BBU which is now $22.9683 from the original ACB of $39.40.

I love this site, it has really helped me better understand this world of finance.

Thank you for all you do and any help you can provide in explaining my situation will be greatly appreciated.

Regards

Joe,

The tax treatment for the special distribution of BBUC shares is described here:

https://bbu.brookfield.com/bbuc/stock-dividends/tax-information

“I owned units of Brookfield Business Partners L.P. prior to the formation of Brookfield Business Corporation. As a result of the special distribution from Brookfield Business Partners L.P, I received class A shares of Brookfield Business Corporation. Is this special distribution taxable for Canadian federal income tax purposes?

The special distribution should not be taxable to a Canadian resident shareholder for Canadian income tax purposes provided the adjusted cost base of the Brookfield Business Partners L.P units held by the Canadian resident holder is positive after the special distribution.

In general, this special distribution will reduce the adjusted cost base of your interest in the partnership units of Brookfield Business Partners L.P. by an amount equal to the fair market value at the time of the special distribution of the Class A shares you have received. The same fair market value at the time of the special distribution of the Class A shares received is your adjusted cost basis. The opening price of a share of Brookfield Business Corporation on the New York Stock Exchange on March 15, 2022 was $27.75.”

Your ACB of your BBU units should be reduced by the fair market value of the shares received in the special distribution, and the ACB of your BBUC shares should be established based on this same fair market value.

With an initial ACB per unit of $39.40, the BBU units would have an initial total ACB of $7,880 (200 units x $39.40/unit). With a total fair market value of $3,265.74 for the special distribution, your ACB of the BBU units would decrease to $4,614.26. This is equivalent to $23.07/unit.

Note that the ACB of your BBU units should also be adjusted every year based on the difference between distribution and net tax allocation amounts, as described here:

https://bbu.brookfield.com/sites/bbu-brookfield-ir/files/brookfield/bbu/tax-information/2021-bbu-adj-cost-base_0.pdf

If you purchased the BBU units before 2022, this could potentially explain the discrepancy, but there are also many reasons why the value reported by your brokerage could be incorrect.

Finally, note that while there are many ways that the fair market value of the special distribution could be calculated, BBUC never traded as low as $32.66/share (in Canadian dollars) in March, 2022.

Thank you for your explanation. I think I understand it a bit better but still a complex concept to grasp.

Appreciate the time you took.

Regards

Joe

I was in a similar issue as Diane, regarding the InterPipeline (IPL) to BIPC conversion. If I could have done things over again, I would have elected to just take cash deal, instead of this complex conversion. I do remember there was quite a heated battle during the hostile takeover, with me getting bombarded by letters from both sides. Unfortunately, I don’t recall getting much on how to brake this down for tax records.

It’s been a while since this happened, and I’m trying to backtrack again to see if I can fix this mess up and file any possible corrections on my taxes for that year.

After some searching, here’s something I found on the Brookfield site:

***

Disposition of IPL common shares for cash and BIPC shares

A Resident Holder that disposes of Common Shares to Brookfield Infrastructure for cash and/or BIPC Shares will be considered to have disposed of such Common Shares for proceeds of disposition equal to the aggregate fair market value of the cash and/or the BIPC Shares received. Such a Resident Holder will realize a capital gain (or a capital loss) equal to the amount by which such proceeds of disposition, net of any reasonable costs of disposition, exceed (or are less than) the aggregate adjusted cost base to the Resident Holder of the Common Shares disposed of. A Resident Holder that receives only cash and/or BIPC Shares for its Common Shares is not eligible to make a tax deferral election as noted below. A Resident Holder should consult its own tax advisor on the determination of the fair market value of any BIPC Shares received on the disposition of its Common Shares and the computation of its capital gain (or capital loss), if any.

***

All I know is, I had 300 IPL shares, that vanished (no record of sales by IBKR). I was given 103 shares of BIPC instead. Actually, it was 103 (and a fractional share). Now, the fractional share was automatically sold, as I see THAT in the trading records, but no selling of my IPL or purchasing of the 103 BIPC.

I reported the ‘realized’ gains in my tax from the fractional sale. However, I am confused on how to go about the rest. A look during that tax year showed many people with the same questions regarding IPL to BIPC, but no one knew any real answers. And everyone was calculating things different on their tax forms (and some stated they were not going to report it at all since they didn’t physically sell a thing).

I don’t understand lawyer talk much, but I will assume that I should (pretend) I sold all the 300 IPL shares, then declare any capital gains? Luckily for me IBKR shows me an adjusted cost base of my 103 BIPC shares on my dashboard, I will just assume they did that correctly, so if I sell those in the future I know where to start.

It looks like on September 1st, 2021 the fractional share of BIPC was automatically sold. Am I correct in assuming that would be the same date I was awarded the 103 full shares, and also the date I should assume my IPL shares were sold?

Even still, who knows what IPL shares should have been sold at. This is so confusing! Maybe I’ll have to wait another year again and try to take another stab at this…