Patient Home Monitoring (trading under symbol PHM on the TSX Venture exchange) recently completed a spin-off where each shareholder of PHM received 1 new share of PHM and 1/10th of a share of VieMed (trading under symbol VMD on the TSX Venture exchange) for every common share owned, effective December 22, 2017.

PHM released a “Management Information Circular” document that describes the tax consequences of this event, published on November 20, 2017. This document can be found by visiting SEDAR and search for “Patient Home Monitoring.” The section that describes the tax treatment for Canadian common share holders can be found on page 55:

PHM Shareholders Resident in Canada

The following portion of this summary is generally applicable to Holders who, for purposes of the Tax Act and any applicable income tax convention, and at all relevant times, are resident or deemed to be resident solely in Canada (each, a “Resident Holder”).

Exchange of PHM Shares for New PHM Shares and Viemed Shares

Based on past CRA administrative policy and the Ruling, the renaming of the existing PHM Shares, and the amendment of the terms of the PHM Shares to increase the number of votes that may be cast at meetings in respect of each existing PHM Share, as contemplated by the Plan or Arrangement, should not, in and of itself, result in PHM Shareholders being deemed to have disposed of their PHM Shares for the purposes of the Tax Act. PHM has obtained the Ruling confirming that PHM Shareholders should not be considered to have disposed of their PHM Shares for the purposes of the Tax Act upon the amendment of the terms of the PHM Shares contemplated by the Plan of Arrangement.

PHM has advised that the aggregate fair market value of all Viemed Shares when they are distributed to PHM Shareholders under the Arrangement is not expected to exceed the “paid-up capital”, as defined for the purposes of the Tax Act, in respect of all PHM Shares immediately before the distribution of Viemed Shares and the issuance of New PHM Shares in exchange for PHM Shares under the Arrangement (the “Share Exchange”). Accordingly, PHM is not expected to be deemed to pay, nor is a Resident Holder expected to be deemed to receive, a dividend as a result of the distribution of Viemed Shares under the Arrangement. If the fair market value of all Viemed Shares at the time of their distribution under the Arrangement were to exceed the “paid-up capital” in respect of all PHM Shares immediately before that time, PHM would be deemed to have paid a dividend on the PHM Shares equal to the amount of the excess, and each Resident Holder would be deemed to have received a pro rata portion of the dividend, based on the proportion of the total PHM Shares held by the Resident Holder at the time. See “Taxation of Dividends” below for a general description of the taxation of dividends under the Tax Act.

Assuming that the fair market value of all Viemed Shares at the time of their distribution under the Arrangement does not exceed the “paid-up capital” in respect of all PHM Shares immediately before that time, a Resident Holder whose PHM Shares are exchanged for New PHM Shares and Viemed Shares under the Arrangement should be considered to have disposed of the PHM Shares for proceeds of disposition equal to the greater of: (i) the Resident Holder’s adjusted cost base of the PHM Shares immediately before the exchange; and (ii) the fair market value, at the time of the exchange, of the Viemed Shares received by the Resident Holder. Consequently, a Resident Holder will realize a capital gain to the extent that the fair market value of the Viemed Shares received on the Share Exchange exceeds the adjusted cost base of the Resident Holder’s PHM Shares at the time of the exchange. If the fair market value of all Viemed Shares at the time of the Share Exchange were to exceed the “paid-up capital” in respect of all PHM Shares immediately before the exchange, the proceeds of disposition of the Resident Holder’s PHM Shares would be reduced by the amount of the dividend referred to in the previous paragraph that the Resident Holder would be deemed to have received. PHM has obtained the Ruling from the CRA confirming that the Share Exchange should be considered to occur “in the course of a reorganization of the capital” of PHM such that section 86 of the Tax Act should apply to subject Resident Holders to the Canadian federal tax treatment described above in respect of the Share Exchange. See “PHM Shareholders Resident in Canada – Taxation of Capital Gains and Capital Losses” below for a general description of the treatment of capital gains and losses under the Tax Act.

The cost amount to a Resident Holder of New PHM Shares acquired on the Share Exchange for the purposes of the Tax Act will be equal to the amount, if any, by which the adjusted cost base of the Resident Holder’s PHM Shares immediately before the Share Exchange exceeds the fair market value, at the time of their distribution, of the Viemed Shares received by the Resident Holder. The cost amount for the purposes of the Tax Act to a Resident Holder of the Viemed Shares acquired on the Share Exchange for the purposes of the Tax Act will be equal to the fair market value of the Viemed Shares at the time of the Share Exchange.

This means the following:

- PHM believes that there will be no immediate taxable dividend resulting from the spin-off (the rest of this discussion assumes this to be true, but you may want to wait for a confirmation from PHM).

- There is no deemed disposition on the PHM shares resulting from the issuance of the new PHM shares.

- If the total fair market value of the VMD shares received is less than your total adjusted cost base of PHM immediately prior to the spin-off then the ACB for PHM will be reduced by the fair market value of the VMD shares received. No immediate capital gain or loss will occur.

- If the total fair market value of the VMD shareds received exceeds your total adjusted cost base of PHM immediately prior to the spin-off then the ACB for PHM will be reduced to zero. A capital gain equal to the difference between the fair market value of the VMD shares and your ACB will apply for the 2017 tax year.

- The ACB of the VMD shares received becomes equal to the fair market value of those shares.

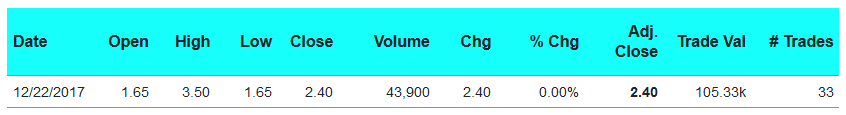

The Income Tax Act does not include a precise method for determining fair market value of publicly traded shares. However, a common approach is to take the average of the day high and the day low. Here is the data for VMD on December 22, 2017:

Using this method the fair market value would be:

FMV = ($1.65 + $3.50) / 2

= $2.575

This value will be assumed to be the fair market value in the examples below, however, you may want to check with PHM to see if they can provide an official fair market value (especially since the price has been quite volatile).

Reallocating the ACB and calculating the possible capital gain on AdjustedCostBase.ca related to this event involves inputting two transactions:

- Return of capital for PHM on December 22, 2017 equal to the fair market value of the VMD shares received (or $0.2575 per share of PHM owned).

- Buy shares of VMD on December 22, 2017. The number of shares is equal to 1/10th of the number of shares of PHM owned and the total amount is equal to the fair market value of the VMD shares received.

You will also need to first add the securities PHM and VMD on AdjustedCostBase.ca as well as input all the prior buy and sell transactions for PHM.

Below are examples showing the resulting calculations on AdjustedCostBase.ca where the ACB is either below or above the fair market value of the PHM shares received.

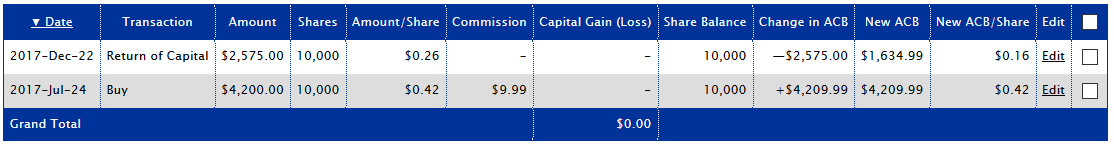

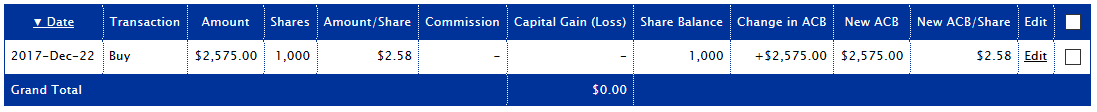

Example 1: Fair market value of VMD shares is lower than the ACB of PHM

This assumes that 10,000 shares of PHM are purchased for $0.42 per share on July 24, 2017 with a commission of $9.99. No capital gain occurs but the ACB of PHM is reduced by the total fair market value of the VMD shares received of $2,575 ((10,000 shares of PHM) x (0.1 shares of VMD/share of PHM) x $2.575/share of VMD). The ACB for the VMD shares received is equal to the fair market value of $2,575.

ACB calculations for PHM:

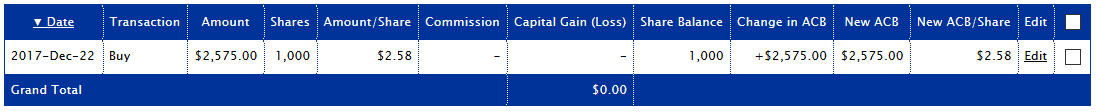

ACB calculations for VMD:

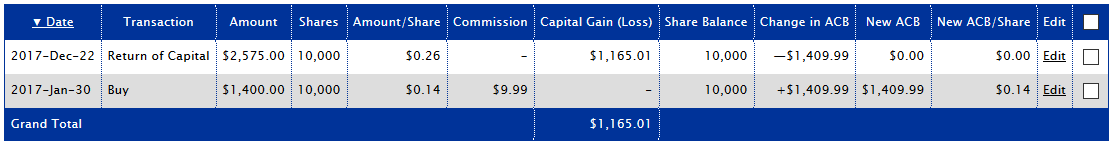

Example 2: Fair market value of VMD shares exceeds the ACB of PHM

This assumes that 10,000 shares of PHM are purchased for $0.14 per share on January 30, 2017 with a commission of $9.99, for an ACB of $1,409.99 prior to the spin-off. The fair market value of the VMD shares received is the same as in Example 1: $2,575 ((10,000 shares of PHM) x (0.1 shares of VMD/share of PHM) x $2.575/share of VMD). The ACB for the VMD shares received is once again equal to the fair market value of $2,575.

But since the fair market value of the VMD shares exceeds the ACB of PHM, a capital gain occurs. This capital gain is equal to $1,165.01 ($2,575.00 – $1,409.99). The ACB of the PHM shares is reduced to $0.

ACB calculations for PHM:

ACB calculations for VMD:

Thanks for this write-up! I was a PHM shareholder and received VMD shares on this transaction. This is the only place on the web that I could find a specific example like this. But I have a question regarding the following paragraph:

“2. Buy shares of PHM on December 22, 2017. The number of shares is equal to 1/10th of the number of shares of PHM owned and the total amount is equal to the fair market value of the VMD shares received.”

Shouldn’t this read:

“Buy shares of VMD on December 22, 2017. The number of shares is equal to 1/10th of the number of shares of PHM owned and the total amount is equal to the fair market value of the VMD shares received.”

Thanks for your help!

kc,

Thanks for pointing this out! I’ve corrected the error.

Can you give any guidance for the effect on ACB from the Primaris spin-off from H&R REIT?

Dale,

Information on the tax treatment of the Primaris spin-off from H&R REIT is available in the following document:

https://www.hr-reit.com/wp-content/uploads/2021/11/HR-Primaris-Spin-Off-Final-Circular.pdf

From page 41:

“Immediately after the Qualifying Disposition, and in accordance with the detailed rules in the Tax Act applicable to qualifying dispositions, the adjusted cost base of a Resident Holder’s REIT Units will be decreased by an amount equal to the REIT Transfer Percentage multiplied by the adjusted cost base of the Resident Holder’s REIT Units immediately before the Qualifying Disposition.

The adjusted cost base of a Resident Holder’s Primaris REIT Units, Series A will be increased by the same amount immediately after the Qualifying Disposition, except to the extent that the Resident Holder’s loss, if any, from a disposition of the REIT Units immediately before the Qualifying Disposition would have been denied under the “dividend stop-loss rules” in the Tax Act. Management expects that the adjusted cost base of Primaris REIT Units, Series A will not be materially reduced for any Resident Holders as a result of the dividend stop-loss rules.”

From page 43:

“The REIT currently anticipates that the REIT Transfer Percentage will be approximately 27%, though such estimate may be revised to reflect any material changes arising between the date of this Circular and the completion of the Plan of Arrangement or as the REIT otherwise determines is appropriate.”

Assuming that the 27% figure holds true, the spin-off can be represented by the following transactions:

1. Return of Capital for H&R REIT for a total amount equal to 27% of the ACB of H&R REIT immediately prior to the spin-off.

2. Buy units of Primaris REIT for the same total amount as above.

Thank you!